Contents

Share this article

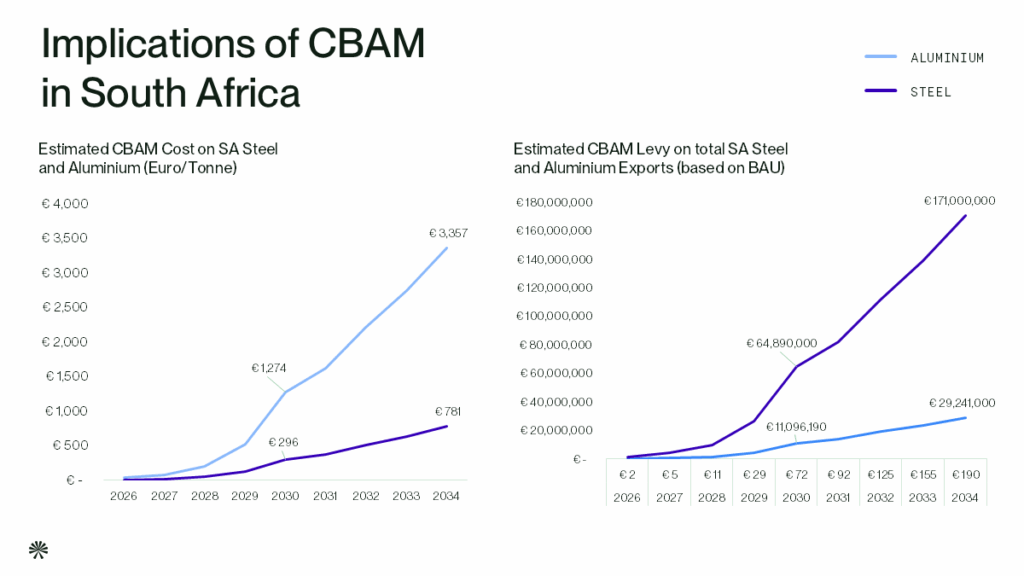

South Africa is among the countries most exposed to the EU’s Carbon Border Adjustment Mechanism (CBAM), with iron, steel, and aluminium exports particularly at risk. These sectors face heightened vulnerability due to high Scope 2 emissions from the country’s coal-heavy power grid and a relatively low domestic carbon price—factors that together raise the risk of revenue leakage. In 2023 alone, CBAM-covered exports to the EU were worth €1.1 billion, accounting for 5% of South Africa’s total exports.

Here, we explore how exposed South Africa’s metals sectors are, why carbon intensity matters, and what companies must do to remain competitive under CBAM.

Steel exports

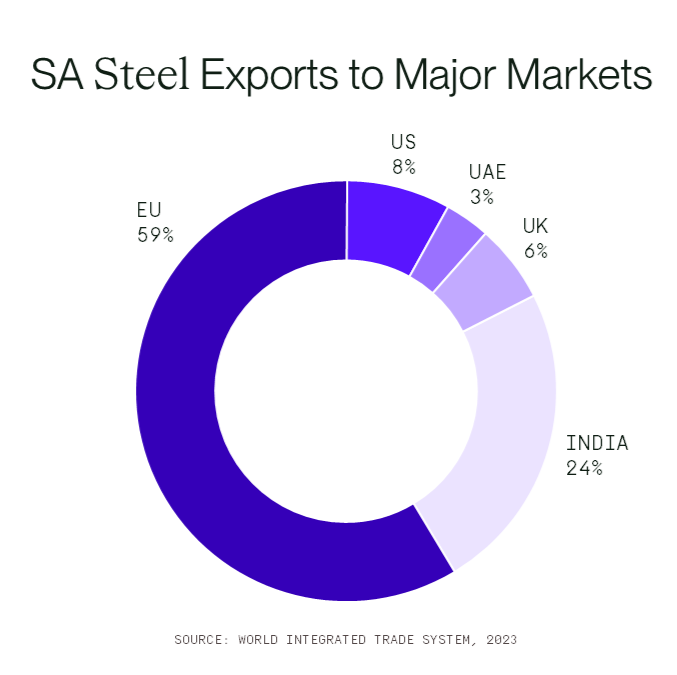

The EU is a critical destination for South Africa’s iron and steel exports, making the sector especially vulnerable under CBAM. In 2023, South Africa produced 4.9 million tonnes of crude steel, ranking 32nd in the world. While the country is not a major producer globally, it plays a significant role in EU supply chains. In 2018, South Africa exported 0.9 million tonnes of CBAM-covered steel products to the EU—2% of total EU imports—making it the 16th largest supplier to the region.

Recent figures reinforce this trend. According to the South African Iron and Steel Institute, nearly 140,000 tonnes of primary steel products were exported in March 2023 alone, with 59% of those exports destined for EU member states and an additional 6% going to the UK. This heavy dependence on EU markets places the steel sector at significant risk from rising CBAM costs.

Steel’s carbon challenge

South Africa’s steel production is dominated by the Blast Furnace–Basic Oxygen Furnace (BF–BOF) process, which is one of the most carbon-intensive methods globally. While the Electric Arc Furnace (EAF) route offers significantly lower emissions, its benefits are limited in South Africa due to the country’s coal-based electricity grid. Even EAF production here remains more emissions-intensive than in many other countries.

This structural challenge means that South Africa’s steel sector generally carries a higher carbon footprint than its global competitors, making exports more costly under CBAM and reducing their attractiveness in the EU market unless mitigation efforts are introduced.

Aluminium exports

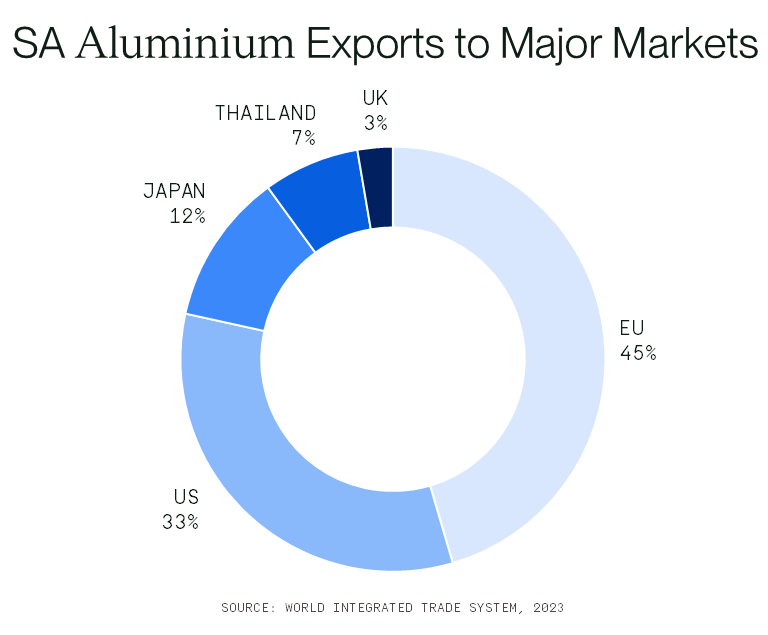

Aluminium is another key export for South Africa, particularly to the EU. The country produces approximately 700,000 tonnes of primary aluminium annually—roughly 1% of global output. Despite this modest share, South Africa ranks as the 8th largest aluminium exporter to the EU.

The aluminium industry is also economically significant at home, contributing around 1% to South Africa’s GDP. It supports roughly 11,000 direct jobs and an estimated 29,000 indirect jobs across the value chain. In 2022, South Africa exported 189,000 tonnes of unwrought aluminium to the EU, representing 35% of total aluminium exports. This close trade relationship exposes the sector to significant CBAM-related cost pressures.

Aluminium’s emissions footprint

The emissions intensity of South Africa’s aluminium sector is among the highest in the EU’s import base. Hillside Aluminium, the largest producer in Africa, reports a carbon intensity of 18 tonnes of CO₂ equivalent per tonne of aluminium, well above the global average of 10 tCO₂e. The country’s reliance on coal-fired power significantly drives up the carbon footprint of its aluminium production.

Many global competitors are already operating at much lower emissions intensities, thanks to the use of cleaner electricity sources or more efficient technologies. This puts South African producers at a competitive disadvantage as CBAM costs begin to reflect emissions differences more directly in pricing.

What this means for South African metals

South Africa is emerging as a carbon outlier in the EU’s metals supply chain. Without meaningful decarbonisation efforts, both the steel and aluminium sectors will face increasing CBAM charges that could squeeze margins, reduce demand, and erode long-term market access.

To stay competitive, South African companies must act now. This means assessing their emissions exposure, re-evaluating supply chains, and investing in lower-carbon production methods. The CBAM is not just a compliance issue—it’s a catalyst for change and a clear signal that carbon performance will increasingly shape global trade relationships.

Assess and mitigate your CBAM risk

As CBAM costs rise over the coming decade, South African exporters must act now to protect EU market access.

Start by assessing your CBAM footprint—the emissions linked to your materials, suppliers, and products—and calculating your effective carbon price (ECP) to understand what’s already been paid before import. This will give you a clear picture of your exposure and where the risks lie.

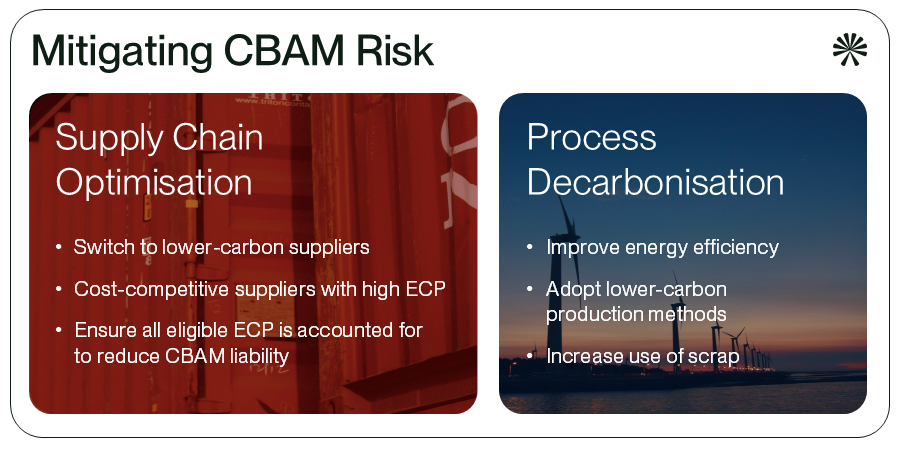

Mitigation strategies fall into two main buckets:

- Supply chain optimisation – shifting to lower-carbon suppliers to reduce CBAM exposure without major internal changes.

- Process decarbonisation – cutting emissions through electrification, fuel switching, scrap use, and other efficiency gains.

Early action matters. Even small sourcing changes can drive major cost savings as CBAM charges grow.

Anthesis CBAM experts are already helping South African companies assess their exposure, optimise supply chains, and unlock competitive advantage in the EU.