Share this article

The latest yearly Safeguard Mechanism results have just been released – this tells us who Australia’s largest emitters are, how many of them there are, and how many tonnes of emissions they released last year.

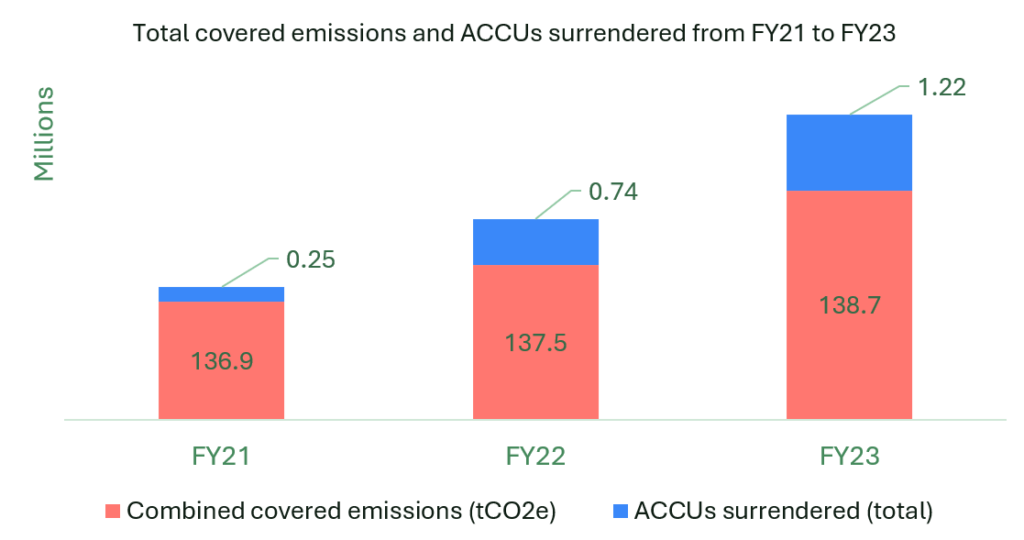

Combined, they reported a total of 138.7 million tonnes of scope 1 CO2-e emissions, this is nearly 30% of Australia’s total emissions.

Why is the Safeguard Mechanism data particularly important this year?

From this year, everything changes, as all Safeguard facilities enter the new reformed mechanism, when they are expected to reduce emissions annually by roughly 4.9%. So results from the FY22-23 update give us an indication of the starting point – the last year before liability will be faced.

What the new data tells us

There are no new entrants to the top list – it remains at 219, like the previous year. We can also see that, overall, emissions have increased slightly from last year – from 137.5 mt in FY22 to 138.7mt CO2e in FY23. This is to be expected with a normal business as usual trend, and before the new imperative to decarbonise hits the organisations bottom line budget.

What is interesting, is an increase in Australian Carbon Credit Units (ACCUs) surrendered between FY22 and FY23. ACCUs are historically used to net out exceedance positions of safeguard facilities (excess emissions over the facility’s baseline).

One reason why the FY23 exceedance might be higher, in addition to a slight increase in total emissions, is the changes in the way baselines are calculated – incrementally over the past few years facilities have moved from reported baselines (typically with the highest headroom) to baselines that float with production – the latter which are closer to actual emissions, resulting in more exceedance.

What is the impact for those organisations who are not reducing emissions?

While there are on-site decarbonisation levers that large facilities can implement, it is unlikely many of them will have been implemented in time for FY24. Some quick wins may be implemented, but Safeguard facilities will have to turn to procuring units to offset the majority of their emissions.

Facilities will have two main choices for offsetting purchasing and surrendering ACCUs -or safeguard mechanism credits (SMCs), generated and sold by other facilities that have decarbonised below their baseline.

As rapid decarbonisation won’t have happened in these initial years, it’s unlikely there will be many SMCs generated and therefore facilities will need to acquire ACCUs. In fact, many facilities will be preempting their emissions exceedance now, and procuring ACCUs early, before the Oct-March rush.

With the majority of the 219 facilities seeking ACCUs to offset their FY24 emissions we could expect the demand for ACCUs or SMCs from safeguard facilities to reach 3.5 to 6.7 million for FY24.

While the average cost to procure units is still yet to be determined by the market, indications can be gleaned from the ACCU spot price of $33.75 and the government’s provided price cap of $75.

What can we expect from next year’s reporting data?

We can expect next year’s update to include significantly more ACCUs surrendered, increased ACCU prices, and hopefully a reduction in emissions as decarbonisation starts to ramp up.

What steps organisations should take now to reduce liability?

It’s critical that facilities track and understand their emissions to track their anticipated liability. Historically many facilities estimate their emissions at the end of the financial year in line with the NGER reporting deadline in October. Now, with liability dependent upon these numbers, it’s critical that estimates of emissions be calculated throughout the year.

What’s yet to be seen is how many facilities will opt for trade-exposed baseline adjusted (TEBA) status and bid for a differentiated decline rate. Large facilities are turning their attention to their eligibility as TEBA facilities and determining the impact on their bottom line – and what decline rates they may be eligible for.

Some facilities will also be opting for multi-year monitoring periods (MYMP). This is when they know they will decarbonise in the coming years but are facing liability in the first years. A MYMP allows them to net out current liability with future abatement at the end of the MYMP of 2-5 years. This should be approached with caution however, as it represents a liability being carried.

Critical steps for facilities covered by the Safeguard Mechanism:

1. Improve tracking of emissions throughout the year to firm up estimates of the FY liability

2. Assess TEBA and MYMP eligibility, and what combinations of measures are best for you and

3. Undertake decarbonisation modelling to understand the cost-benefit and savings of implementing decarbonisation initiatives on site

Our team are Safeguard Mechanism experts, for a no cost, no obligation discovery session to discuss the developments, opportunities, and risks for your business under the Safeguard Mechanism or NGERS contact our team.