The Australian Treasury has just released the draft legislative framework that will introduce mandatory requirements for large listed and unlisted entities as well as financial institutions to disclose their climate-related risks and opportunities.

In this article we take a closer look at the exposure draft legislation on climate-related financial disclosures.

Context – Current climate-related reporting standards and legislation

Inline with international momentum towards standardised and compulsory climate disclosures, the Australian Government took a significant step forward last year by pledging to enforce mandatory reporting with the draft legislation on climate-related financial disclosures. This commitment will involve a collaborative effort between reporting standards and legislation to effectively implement the disclosure requirements.

ISSB and AASB Reporting standards

Building upon the foundations of previous frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and Sustainability Accounting Standards Board (SASB), in June 2023 the International Sustainability Standards Board (ISSB) published the new global best practice standards on sustainability and climate-related disclosures.

To ensure they are appropriate for the Australian context, in October 2023 the Australian Accounting Standards Board (AASB) released the Exposure Draft of the Australian Sustainability Reporting Standards (ASRS), open for consultation until 1 March 2024. In relation to climate disclosures, these are materially aligned with the ISSB standards.

Mandatory Climate Reporting Legislation

Following two rounds of consultation in 2023, in early 2024 the Australian Treasury released the Exposure Draft of the legislative framework. This will implement disclosure requirements by referring to the AASB standards with the new Australian Sustainability Reporting Standards (ASRS). The release of the Exposure Draft of the legislative framework is a welcome step in helping reporting entities prepare for their first reporting period, which for Group 1 begins in the first reporting period on or after 1 July 2024.

*Note, the Government announced in April 2024, a new commencement date of 1 January 2025 for Australia’s largest listed and unlisted companies.

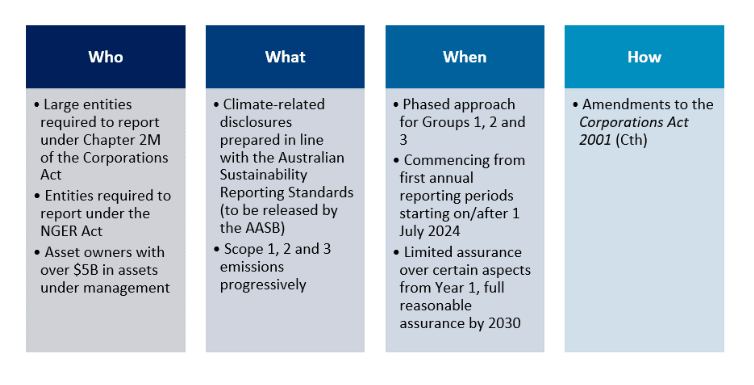

In this article we break down the key information around Australia’s climate disclosures policy.

Draft legislation on mandatory climate-related financial disclosures – at a glance

Deep dive into the draft legislation on climate-related financial disclosures

Who will be required to report?

Large entities that are required to report under Chapter 2M of the Corporations Act 2001 (Cth) (Corporations Act) will be required to publish climate-related disclosures depending on which group they fall under.

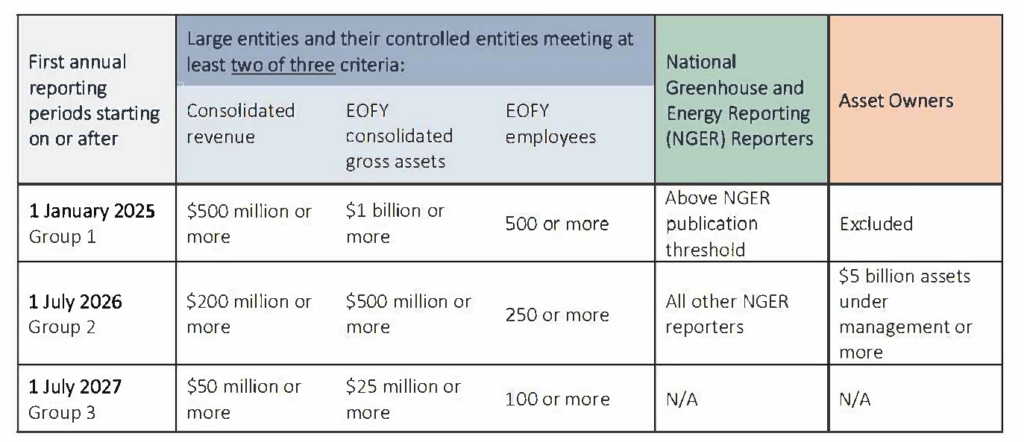

This is shown in the image below. *Note, the Government announced in April 2024, a new commencement date of 1 January 2025 for Australia’s largest listed and unlisted companies.

Reporting entities include:

- Listed and unlisted entities

- Financial institutions

- Superannuation funds

- Investment schemes

- Entities that are required to report under the National Greenhouse and Energy Reporting Act 2007 (NGER Act) will also be required to publish disclosures, regardless of size.

Exemptions include the following:

- Entities exempt from financial reporting under the Corporations Act, e.g., exemptions through the Australian Securities & Investments Commission (ASIC), charities, or not-for-profits.

- The Exposure Draft states that Group 3 entities are only required to publish climate disclosures if they face material climate-related risks or opportunities for the reporting period. If it is determined that they do not face any material risks or opportunities, a statement to that effect can be included in the annual report.

When will mandatory climate reporting commence?

As can be seen in the above image, mandatory reporting will be bought in under a phased approach starting from the FY24-25 reporting period for Group 1 entities, FY26-27 for Group 2 and FY27-28 for Group 3.

What are the specifics for entities who report to NGERs?

The draft framework clarifies previous uncertainties relating to NGER reporting entities and their disclosure timeframes.

Any controlling corporation’s group that meets the NGER publication threshold below will have to report in Group 1 (for the FY24-25 reporting period).

All other NGER reporters will commence reporting from the FY26-27 reporting period.

| Entity | CO2-e emitted | Energy produced | Energy consumed | Description |

| Group | 50 kt | – | – | If the total GHG/energy from the operation of facilities under the operational control of any entity/ies that are members of the group meets the thresholds. |

| Facility | 25 kt | 100 TJ | 100 TJ | Facility threshold for reporting transfer certificate holders. |

The Treasury and the Council of Financial Regulators will review the climate disclosure requirements and the policy framework in 2028-29, particularly with respect to coverage settings, the appropriateness of the liability framework, and any major barriers such as data availability and supporting materials.

What does the draft legislation on climate-related financial disclosures require to be reported?

The contents of the climate-related disclosures will be set out in the ASRS; the Exposure Draft of these was released by the AASB in October 2023 and is open for comments until 1 March 2024. These are broadly in line with the ISSB’s IFRS S2 Climate-related Disclosures, albeit adapted to the Australian context. At a high-level, climate disclosures will be expected to include:

- Governance and risk management processes, controls, procedures

- Climate resilience assessments, i.e., scenario analysis

- Climate Transition plans (CTP)

- Climate-related targets

- Material climate-related risks and opportunities

- Consideration of industry-based metrics

- Emissions

Scope 1 and 2 emissions[1] will be required to be reported from the first reporting year.

Entities will be required to estimate Scope 3 emissions[2] from the second reporting year.

In recognition of the complexities in Scope 3 emissions accounting, organisations will be able to estimate Scope 3 emissions for any one-year period up to 12 months before the reporting period, e.g., for its disclosure covering the FY27-28 reporting period, a company may estimate Scope 3 emissions for CY2027 or FY26-27.

Qualitative scenario analysis will be expected from the first reporting period, and quantitative analysis from reporting periods FY27-28 onwards.

How will an organisation be expected to implement its mandatory climate disclosures?

Upon conclusion of this consultation, amendments to the Corporations Act will be put forward to Parliament.

The amendments will include a new requirement for sustainability reports to be prepared in addition to current financial reporting requirements.

This will consist of:

- Climate statement for the year, in line with the AASB standards

- Notes to the climate statement

- Any statements prescribed by legislation

- Director’s declaration on compliance of the statements

It is expected that company Annual General Meetings may now include sustainability reports, which must be provided to members similarly to the presentation of financial reports.

The draft legislative framework outlines several additional reporting requirements, which include, but are not limited to, the following:

- Climate disclosures to be published in sustainability reports, which form the fourth report in annual financial reporting obligations, i.e., climate disclosures should ultimately sit within annual reporting

- The annual report must have an index table for locating climate disclosures

- Timing of publication must be consistent with the current requirements under the Corporations Act

If a company is required to prepare consolidated financial statements, it may choose to publish a consolidated sustainability report. In this case, the individual entities covered within this consolidated report need not each publish their own individual climate disclosures – the group head entity could publish a sustainability report for the entire consolidated group.

Three Options for Implementation

The Treasury is seeking feedback on three potential options for implementing this policy framework, as follows.

Treasury has indicated 1b) as its recommended option, balancing the need for urgent climate action while also recognising the capability uplift required in the assurance and audit industry.

| Option | Option 1 | Option 1a | Option 1b |

| Coverage | Large listed & unlisted entities Group 1: FY24-25 reporting period Group 2: FY26-27 reporting period Group 3: FY27-28 reporting period | Mandatory for Groups 1 and 2 Group 3 entities required to complete a materiality assessment in FY27-28. If the material climate-related risks or opportunities are identified, full disclosures would be required. Otherwise, a statement may be published in the annual report stating that no material climate risks or opportunities were identified. Asset owners who meet a specific threshold for assets under management would be required to report. | Same coverage as Option 1a |

| Assurance | Phased approach: Year 1: Limited assurance of Scope 1 & 2 emissions, reasonable assurance of governance disclosures. Year 2: Reasonable assurance for Scope 1 & 2, governance disclosures. Limited assurance for Scope 3, scenario analysis, climate transition plans (process, methodology, assumptions). Year 3: Reasonable assurance for all elements except Scope 3, scenario analysis, climate transition plans (full quantitative assurance). Year 4: Reasonable assurance over full disclosure. | Same assurance framework as Option 1 | No phased approach for assurance, and AUASB to determine flexible roadmap with the following milestones: Year 1 onwards: Limited assurance of Scope 1 & 2 emissions 2030: Reasonable assurance over full disclosure |

The Shifting Mandatory Climate Reporting Regulatory Landscape

The regulatory landscape in Australia is shifting quickly, and organisations will need to get prepared to report as soon as possible, regardless of which group they fall under. Investors are increasingly expecting climate disclosures as a standard part of financial reports, given the extent to which climate change has become a material topic across sectors.

Reach out to us for more information on the draft legislation on climate-related financial disclosures and how to prepare

Follow us to get fresh insights from our experts with practical and actionable tips on financed emissions, the regulatory environment, climate-related disclosures, climate risk and how businesses can integrate climate change into their strategies and reporting. Sign up to our mailing list or connect with us on LinkedIn.

We support businesses across all stages of their sustainability and climate disclosure reporting including in line with the emerging AASB standards, ISSB standards, TCFD framework and other ESG reporting frameworks such as the Global Reporting Initiative. Our experts can help you understand and expand your GHG inventory in line with the global GHG Protocol, Climate Active, and financed emissions under PCAF (Partnership for Carbon Accounting Financials).

Globally our Anthesis colleagues are also available to assist clients in different jurisdictions around the world on emerging climate and mandatory reporting compliance. TCFD Reporting Services – Anthesis Group

We’ve been technical experts and trusted advisors to some of Australia’s most well-known companies for over a decade, contact us to learn more or call +61 3 7035 1740.

[1] As defined in the NGER Act

[2] As defined in the Corporate Value Chain (Scope 3) Accounting & Reporting Standard