Share this article

Rising investor expectations have spurred a global push for publicly listed companies (PLCs) to disclose comprehensive sustainability information. As a result, regulatory bodies worldwide are either mandating or strongly recommending the issuance of sustainability reports by PLCs, focusing on environmental, social, and governance (ESG) factors. The integration of ESG disclosures with financial reporting enables investors to more accurately evaluate the financial outlook and management effectiveness of PLCs, a trend strongly supported by regulators. Here we take a look at Singapore Climate-Related Disclosures, 2024 updates, timeline and how to prepare, plus an overview of the ESG landscape in APAC.

Singapore Climate-Related Disclosures

Against this backdrop, the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) launched a public consultation on mandatory climate-related disclosures for both PLCs and non-listed companies (NLCs). The consultation was based on the recommendations issued by the Sustainability Reporting Advisory Committee (SRAC) to advance climate reporting in Singapore, and concluded in September 2023.

PLCs on the Singapore Exchange (SGX) from five prioritised industries are currently required to report in line with the Task Force on Climate-Related Financial Disclosures (TCFD). All other PLCs are required to publish climate-related disclosures on a ‘comply-or-explain’ basis. The consultation proposed to extend this to large non-listed companies (NLCs) as well, and align mandatory disclosure requirements with the new global best practice standard on climate-related disclosures – the standards published in June 2023 by the International Sustainability Standards Board (ISSB).

Singapore Climate-related Disclosures – 2024 Updates

In February 2024, the Sustainability Reporting Advisory Committee (SRAC), an industry-led 15-member panel set up by ACRA and SGX RegCo, announced that Singapore will mandate that both the below groups are subject to Singapore climate-related disclosure requirements in line with the ISSB standards (press release). These are comprised of IFRS1 on general sustainability-related disclosures, and IFRS 2 on climate-related disclosures.

- Listed issuers listed on the SGX-ST (Listed Issuers), including those incorporated overseas, business trusts and real estate investment trusts

- Large non-listed companies with annual revenue of at least SGD 1 billion and total assets of at least SGD 500 million (Large NLCos)

The reporting of the climate-related disclosures (CRD) will be introduced in a phased approach, with Listed Issuers required to report and file annual CRD from FY2025, followed by Large NLCos from FY2027 onwards. SGX RegCo conducted a separate public consultation on amending listing rules to implement the recommendations relating to Listed Issuers, which closed on 5 April 2024.

Both ISSB Standards – IFRS1 and IFRS 2 apply

The two primary standards are S1 for general sustainability disclosures and S2 for climate-related disclosures specifically. Both S1 and S2 are structured based on four fundamental pillars, closely mirroring the same four pillars of the TCFD.

The proposed mandatory Singapore climate-related disclosures are recommended to be fully in line with S2 of the ISSB on Climate-related Disclosures, which we have unpacked in an earlier article. In addition, reporting entities will be required to apply the general requirements and conceptual foundations of S1 insofar as they relate to the assessment, management and disclosure of climate-related risks and opportunities. SRAC may review the implementation of the ISSB Standards for broader sustainability-related risks and opportunities beyond CRD a few years later.

The four pillars of the ISSB Standards as they relate to climate-related disclosures include:

- Governance – the governance processes, controls and procedures an entity uses to monitor and manage climate-related risks and opportunities

- Strategy – the climate-related risks and opportunities that could enhance, threaten or change an entity’s business model and strategy over the short, medium and long term

- Risk Management – how climate-related risks and opportunities are identified, assessed, managed and mitigated by an entity

- Metrics and Targets – the metrics and targets used to manage and monitor an entity’s performance in relation to climate-related risks and opportunities

Moreover, these standards are reinforced by critical conceptual foundations that define the determination of materiality, establish requirements for the aggregation or disaggregation of information, and address other pertinent details essential for comprehensive reporting.

IFRS S2 expands on the prior TCFD recommendations

IFRS S2 in the ISSB framework builds upon the recommendations outlined by the TCFD, albeit with some distinctions.

Notably, S2 mandates a more comprehensive and detailed approach across all aspects. The ISSB has published a detailed comparison, highlighting how S2 builds upon and expands the recommendations of the TCFD.

Offering insight into the specifics of the disclosures, key requirements under S2 encompass detailed information concerning specific responsibilities for climate risk management at the Board and management levels under the Governance pillar. Within the strategy domain, extensive disclosures are expected regarding risks, opportunities, scenario analysis, and the company’s adaptability to climate change.

The expanded scope of Risk Management now also entails a focus on how companies prioritise opportunities. Additionally, Metrics and Targets call for the disclosure of Scope 1, 2, 3 emissions, and, where applicable, financed emissions, along with industry-specific metrics.

Essentially, S2 emphasises the necessity for companies to possess a comprehensive and integrated understanding of their climate-related risks and opportunities, their impacts, their resilience, and the comprehensive management strategies in place, all of which are instrumental in providing investors with the assurance of portfolio resilience.

TCFD/ISSB vs SGX Listing Rules

Overall, the requirements of SGX Listing Rules and its Sustainability Reporting Guide are consistent with the TCFD recommendations and ISSB Standards.

The SGX Listing Rules and its Sustainability Reporting Guide require ListCos to report on areas covering the four pillars of Governance, Strategy, Risk Management and Metrics and Targets, in a manner similar to how the various factors are to be reported under the TCFD and the SSB.

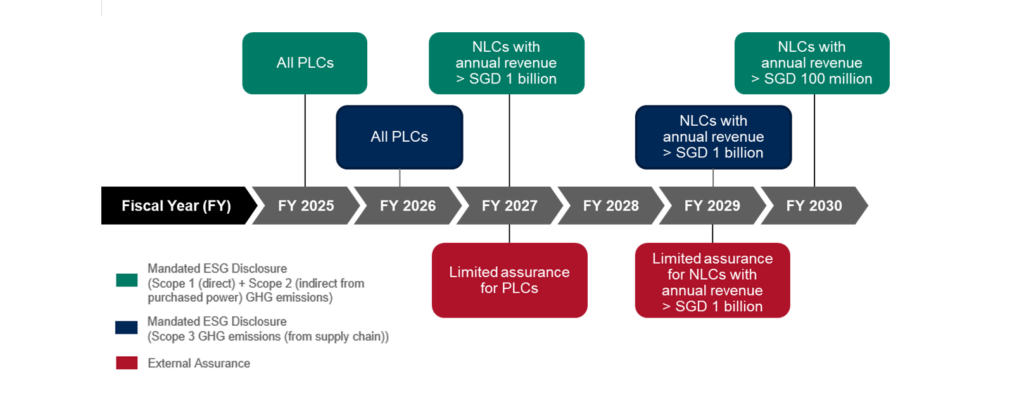

Singapore Climate-Related Disclosure Timelines

ACRA and SGX have provided further details of the implementation timeline for various mandatory reporting requirements and assurance pathways. Reporting entities will be expected to commence with disclosing Scope 1 and 2 emissions in their CRDs from the first reporting year, thereafter expanding to Scope 3 emissions and obtaining external limited assurance.

Proposed Subsidiary Exemption

NLCs are exempt from ESG disclosure requirements where:

- NLC has a parent company (local or foreign) that is minimally preparing ESG disclosures in accordance with Singapore standards or deemed equivalent AND

- Its activities are included in that parent’s report which is available for public use

Preparing for Singapore Climate-related Disclosures

While there is significant work ahead, there is ample time for preparation. Both PLCs and NLCs are strongly advised to identify resource requirements as soon as possible.

Achieving full alignment with the standard typically involves a two- to three-year process. Companies usually commence by establishing a fundamental assessment of their climate-related risks and opportunities, gradually deepening this understanding in subsequent years, and evaluating the resilience of their business strategy. Eventually, a robust and credible transition plan is formulated.

Crucially, climate risks and opportunities should progressively become integrated into the organisation’s standard governance, strategy, and risk management procedures, akin to any other financial and business considerations. This journey is an iterative process, requiring continual reinforcement of foundational efforts while concurrently advancing in climate risk assessment, response, and implementation.

What companies should do now

- Companies should determine their reporting category and assess how well the business is already complying with the requirements of the ISSB.

- Next get an understanding of the details of the disclosure framework for IFRS S1 and S2, the company material risk profile, and governance setup for compliance.

- Then assess the team’s strengths and capabilities to evaluate where expert technical support is needed to upskill the team formulate a structure, and plan of action to start closing gaps within the next six months.

The ESG Disclosure Landscape in APAC

Current ESG landscape

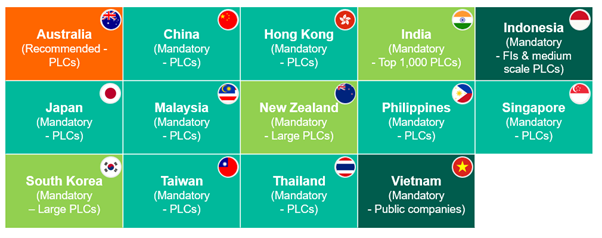

In many jurisdictions, it is mandatory for PLCs to adhere to reporting requirements, although the specifics may vary from one jurisdiction to another. Several jurisdictions promote reporting in line with the guidelines proposed by the TCFD and accept internationally recognised reporting standards like GRI, Sustainable Development Goals (SDGs), and International Organisation for Standardisation (ISO). Notably, there is often limited to no external assurance provided for ESG disclosures in these jurisdictions.

Upcoming ESG landscape

There is a proposal in place to broaden the scope of ESG disclosure requirements to encompass significant non-listed companies (NLCs) in Australia, the Philippines, New Zealand, Singapore, and Taiwan (specifically for bank and insurance companies).

Furthermore, Hong Kong, Japan, the Philippines, and Singapore have suggested the adoption of ESG disclosure standards aligned with the ISSB Standards. Similarly, Australia has recently released its climate disclosure standards based on the ISSB. In contrast, other jurisdictions, such as Taiwan and Thailand, have proposed the enforcement of TCFD standards. A pathway to external assurance has been proposed in several regions, including Australia, India, New Zealand, Singapore, and Taiwan.

APAC Countries with ESG Disclosure Regimes

Need help in understanding how your business might be impacted and how you can get prepared for the Singapore climate-related disclosures?

About Anthesis

Our team of sustainability and climate risk experts helps clients understand and implement effective climate risk assessments, strategies and reporting. We assist businesses at all stages of their

sustainability and climate disclosure journey, aligning with ISSB, and other ESG frameworks like the Global Reporting Initiative (GRI). With over a decade of experience as trusted advisors to leading APAC companies, we’re here to guide you through the mandatory climate-related mandatory disclosures framework. As established climate experts, we offer the advice based on years of experience, to manage your climate risks, seize opportunities, and drive compliance and sustainable performance across your business now and into the future. We’ll help discover efficiencies, create stakeholder value and

increase your positive impact. Contact our experts here or reach out direct to Director Hannah Meade.

About Baker McKenzie

Against the backdrop of rapidly developing ESG regulations, as well as the increased enforcement activity by regulatory bodies and stakeholders across various jurisdictions, businesses today are certain to face tremendous challenges in ensuring compliance with the myriad ESG laws, both presently in force and on the horizon. In this complex and evolving regulatory climate, businesses aided by experienced and trusted legal counsel will be well-positioned to navigate the growing challenges posed by ESG. At Baker McKenzie, we are well-positioned to advise on such matters, and we are committed to helping our clients develop optimal solutions amidst this developing regulatory landscape. Please contact our team members Celeste Ang, Min-tze Lean, Richard Allen or Pradeep Nair if you have any questions.