Contents

- The Business Case for Risk

- The Decisive Decade

- Water Risk Reporting

- Solutions to Water Risk

- Becoming Water Positive

- The Anthesis Approach

- Contact us

Share this article

The Business Case for Mitigating Water Risk

Global water scarcity is now considered an imminent threat, and stakeholders from across industries are taking notice. Investors are increasingly turning their attention to the broad range of water issues that are potentially material to the long-term financial performance of their investments.

The World Economic Forum’s Global Risk Report has listed water crises among the top 10 risks in terms of impact every year since 2012. Water is also listed as a top 10 risk in terms of long-term severity over the next decade.

Historic droughts, more pronounced extreme weather events, and escalating water scarcity are all adding to the materiality of water as a financial risk. The total potential financial impact of reported water risks to CDP Water Security was US$301 billion in 2020, yet CDP responders reported that the money required to mitigate those risks was only US$55 billion, highlighting that the cost of inaction could be over five times higher than the cost of action.

It is paramount that companies prioritise their water resource management by completing a water inventory and water risk analysis as soon as possible. These initial steps will help to lay the foundation for a more robust water stewardship strategy that will increase business resilience to current and future disturbances, while also meeting the growing stakeholder expectations around water disclosure.

Water Stress vs Water Scarcity

Water Stress refers to the inability to meet human and ecological demand for freshwater relating to the availability, quality, and accessibility of water.

Water Scarcity is a term specific to water availability, referring to substantial limitation on the volumetric abundance of freshwater resources. There are two primary types of water scarcity:

- Physical Water Scarcity – is experienced when user water withdrawals and demand exceed supply.

- Economic Water Scarcity – refers to situations where sufficient water resources are available, but access is limited by economic costs associated with establishing adequate water storage, distribution, and infrastructure.

Water Sustainability in the Decisive Decade

Finite water supplies across the globe are being stretched to their limit.

In the 20th century, the world’s population quadrupled, but water use increased sixfold, creating a situation where global water demand is projected to outstrip global water supply significantly by 2030, as highlighted in the Global Risks Report 2020.

Approximately one quarter of the world’s population is currently experiencing extreme water stress and increasing periods of water shortages. In fact, 1 in 3 people globally do not have access to safe drinking water, meanwhile 80% of wastewater flowing back into the ecosystem is returned without proper treatment.

This situation is exacerbated by the climate crisis, aging infrastructure, increased demand for energy, the increasing middle class population, and increased water-intensive agriculture, all of which has driven unprecedented regional volatility in water resources, supply and quality.

Water scarcity can halt business operations, disrupt supply chains, raise the costs of raw materials, and put employee health and safety at risk. The COVID-19 pandemic has demonstrated that sustainability works best in building resiliency when embedded throughout an organisation instead of as a programmatic response. Investors will look for agility when assessing the adaptability of business models and workforces in the face of disruption.

Stakeholders Driving Water Risk Reporting

As water-related risks increase, companies must assure their investors that business operations will continue to be profitable and sustainable, and that the right policies are in place to secure water resources for their operations in both the short and long-term. Companies need to assess their water-related risks as a strategic challenge, especially in already water-stressed regions.

Companies that better understand water risk, disclose their water data, and take strategic action to address their water impacts will be far better positioned in the future. As a result, companies are engaging in corporate water disclosure (e.g., CDP, Global Reporting Initiative, Sustainability Accounting Standards Board, Dow Jones Sustainability Index) to provide data on their water stewardship practices, associated business implications, and strategic responses. Take CDP for example — in 2020, 515 investors, representing more than US$106 trillion in assets, requested companies to disclose their water-related impacts through CDP Water Security and take actions to reduce them. Investors use CDP water data to engage with portfolio companies, inform investment decisions, capitalise on climate-resiliency investment opportunities, and catalyse change.

Other companies are taking their management efforts a step further in pursuit of alignment with the Alliance for Water Stewardship (AWS) Standards to achieve a net benefit for environments, communities, and the business alike. These standards aim to drive water stewardship commitments towards a use of water that “is socially and culturally equitable, environmentally sustainable, and economically beneficial, achieved through a stakeholder-inclusive process that involves site- and catchment-based actions.”

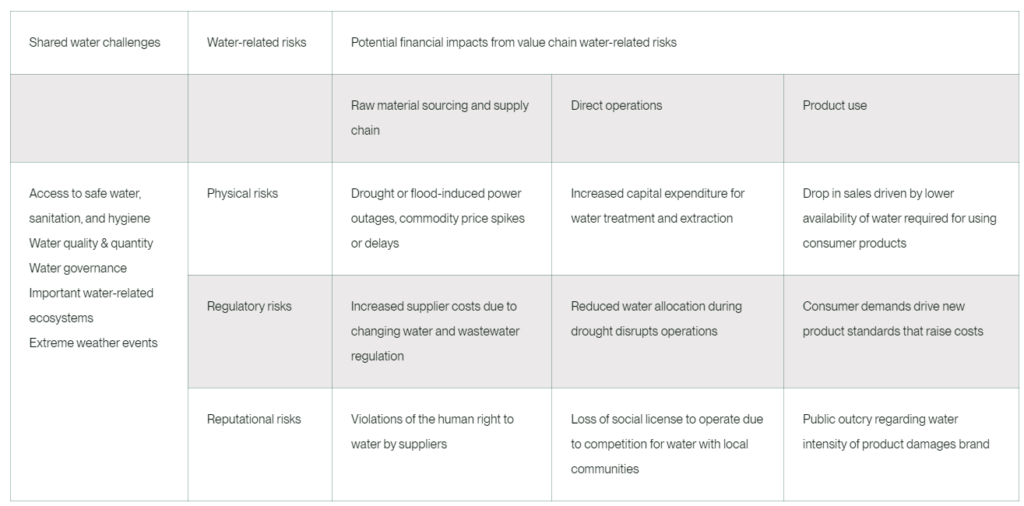

Business Solutions for Water Risk

The best way for your business to begin addressing its water risk is to complete value chain water footprinting and accounting to help assess and identify the long-term availability of clean water throughout the value chain. After this step has been completed, we recommend that businesses complete a water risk assessment annually to assess physical, regulatory, and reputational risks to a company’s facilities categorised by water basin and sub-basin. Individual facility risks are then aggregated to rank a company’s overall water risk exposure. This analysis may be supplemented by operational data, such as production or water withdrawals, and may be extended to assess specific products and services as well as suppliers across a company’s value chain. The water risk assessment can inform short- and long-term business planning and management and the development of a water stewardship strategy.

For more information about developing your approach to water stewardship, please see our WATER STEWARDSHIP OVERVIEW PAGE

Stay tuned for our next water risk blog that will define water risk assessments and will provide an overview of the leading publicly available water risk and valuation tools.

Implementing Water Stewardship Practices

Becoming Water Positive

Meeting water goals and targets is often achieved through implementing projects that address shared water challenges at a business’s own facility locations, and also through working with stakeholder groups to develop projects within the larger water basin that address shared water challenges.

Companies with water positive pledges typically commit to reintroducing – or replenishing – more water into the water-stressed regions in which they operate than they withdraw. These companies will identify areas in their operations where water stress is an issue through a risk assessment, look for ways to reduce their water use in these water stressed areas through water efficiency and innovation, and then work with stakeholder groups to finance water resource management actions or environmental restoration projects that brings additional water into the water-stressed basin.

If a company brings in enough additional water to a water-stressed basin that is greater than the amount of water they use in that basin, they are water positive for that basin.

Water Efficiency & Alliance for Water Stewardship (AWS) Certification

Companies that have identified facilities in water-stressed areas must first look for opportunities to facilitate water stewardship at these locations. The Alliance for Water Stewardship provides a framework and certification system for demonstrating that a site has met the global benchmark for responsible water stewardship.

Sites that have implemented the AWS Standard and are AWS Certified have taken actions to understand their water use, engage with key stakeholders within their water basin, and create site-specific strategic plans that address unique internal and external water-related risks.

Anthesis has credentialed AWS specialists that can guide clients through their AWS certification journey.

Volumetric Water Benefits

Volumetric water benefits (VWBs) are the volume of water resulting from water stewardship activities, relative to a unit of time, that modify the hydrology in a beneficial way and/or help reduce shared water challenges, improve water stewardship outcomes, and meet the targets of Sustainable Development Goal 6.

Using the VMBA Method to Calculate & Communicate Water Stewardship Activity Benefits

Volumetric water benefit accounting (VWBA) provides a standardised approach and set of indicators to estimate and communicate the volumetric water benefits of water stewardship activities. This takes into account a range of water stewardship activities, from implementing measures taken during AWS certification at the site level, to working with stakeholders at the basin level to address shared water challenges. It provides a credible methodology to measure and communicate the water benefits of water stewardship activities and progress towards water goals and targets.

| Identify Shared Water Challenges and Understand Local Context | Define Water Stewardship Project Activities and Partners | Gather Data and Calculate Volumetric Water Benefits |

| Identify shared water challenges and their root cause, understand the catchment Understand catchment stakeholders and ongoing water stewardship activities | Select project ativities and partners based on VWBA activity guidelines Determine allocation of volumetric water benefitsStart water stewardship activity | Document baselineSelect VWB indicator and complementary indicators Gather required data and calculate volumetric water benefits (VWBs) and complementary indicators Allocate volumetric water benefits (VWBs) and complementary indicators |

Building on water footprinting and water accounting, water risk assessments, and Water Goal and Target Setting services, Anthesis helps businesses implement water stewardship activities that meet water goals and targets.

The Anthesis Approach

- Identify opportunities to avoid and reduce water-related impacts at the site level.

- Guide clients through the AWS certification process with one of our AWS credentialed specialists.

- Engage relevant stakeholders at the water basin level.

- Identify and implement locally relevant water-related initiatives.

- Calculate VWM and complimentary indicators.

- Report on progress towards achieving water goals and targets.

- Identify opportunities to take action towards system-wide change.

Examples of Shared Water Challenges That Lead to Increased Value Chain Water-Related Risks

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.