Table of Contents

- Methane Emissions Under-Reporting

- Implications for ASRS and Directors

- Impact on Safeguard Mechanism

- What Should be Done

Share this article

Methane emissions from fossil fuels are being materially underreported in Australia’s industrial sector. This has direct implications for compliance, carbon liability, and the effectiveness of decarbonisation strategies, especially under the Safeguard Mechanism and the AASB S2 mandatory climate- related disclosures. As scrutiny intensifies and regulatory thresholds tighten, these hidden emissions risk becoming a catalyst for financial exposure and reputational damage.

Australia’s Methane Emissions Under-Reporting

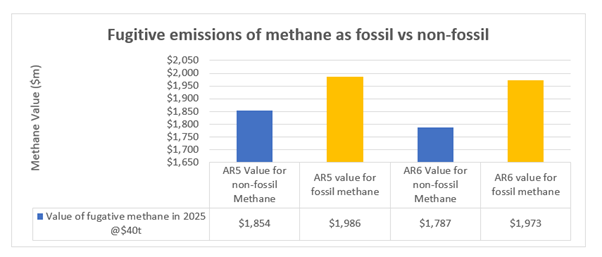

As of March 2025, DCCEEW’s quarterly update shows Australia’s fugitive methane to be 46.3 MtCO2e, accounting for 10.5% of Australia’s annual net emissions. This figure is based on a methane GWP of 28, derived from the IPCC’s 5th Assessment Report (AR5) for non-fossil methane.

This basis is misleading and outdated.

Fugitive methane is of fossil origin, not biogenic. Further, the 2014 AR5 value was superseded in March 2023 by the AR6 report, providing the most accurate figures for Australian reporters. Unfortunately for reporting entities in Australia however, there will be no formal change until the government updates its policy.

The financial implications of these under-reported emissions for Australia’s major emitters are significant.

By reporting fossil methane as non-fossil, $132m of emissions are being under-reported. Should Australia move to the IPCC’s AR6 – while failing to differentiate fossil and non-fossil methane – this gap will widen to 5mtCO2e, worth ~$200m.

This is a missed opportunity to incentivise decarbonisation and a risk exposure that many emitters may not be accounting for.

Implications for ASRS and Director Responsibilities

For organisations preparing to report under the Australian Sustainability Reporting Standards (ASRS), this underreporting of fossil methane emissions presents a serious governance issue.

Directors signing off on climate-related disclosures must ensure that reported emissions reflect a true and fair view of climate risk. Using outdated or inaccurate GWP values when more accurate data is available could expose companies to reputational, regulatory, and even legal risks.

The question boards should be asking is: Does our current reporting reflect the true and full extent of our climate liability? How do we account for future changes in GWP?

Impact on Safeguard Mechanism Baselines and Liabilities

Accurate methane emissions reporting also has direct implications for compliance under the Safeguard Mechanism.

If fossil methane is correctly accounted for using the appropriate GWP (29.8 for fossil fuel methane), our analysis found many facilities could see their reported emissions increase by 7% or more. This would significantly raise their carbon liability and potentially push them over their baseline thresholds, triggering the need to purchase additional ACCUs or invest in abatement. For some emitters, this could mean millions in additional costs or a strategic rethink of their decarbonisation pathway.

Considering the decline rate under the reformed Safeguard Mechanism is already 4.9% annually, this presents a real risk to decarbonisation initiatives and the bottom line.

What Should be Done About this Under-Reporting of Methane Emissions?

These issues highlight a broader challenge: compliant industrial emitters may be facing greater financial and compliance risks than currently recognised, and the incentive to decarbonise is being weakened by inaccurate data.

To address this, we recommend that large emitters, particularly in oil, gas, and coal, begin assessing and separately reporting fossil methane emissions using the appropriate GWP for their emissions (29.8). This will ensure their risk profile is future-proofed and aligned with evolving regulatory expectations.

Regulators must also act. From 2026 onward, the NGER Determination should adopt AR6 GWP factors, and reporters under both NGERs and AASB S2 must be required to distinguish between fossil and biogenic methane. This will help ensure that climate disclosures are accurate, liabilities are correctly calculated, and decarbonisation incentives are based on real impact.

How Anthesis Can Help

Anthesis are market leading experts in carbon accounting and decarbonisation in the oil, gas and coal sectors. We have deep policy experience and understand how to effectively understand, quantify and mitigate climate risk and offer expert guidance for compliance with the ASRS, Safeguard Mechanism and NGERs. Reach out today and let us help you to future-proof your business.

Explore our Reporting Solutions

The sustainability reporting and disclosure landscape is complex and evolving – we make it simple.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.