Share this article

Banks and financial institutions worldwide such as investors, pension funds, asset owners and managers play a crucial role in facilitating the transition to a decarbonised world. But how do we ensure this transition managed with a transparent and uniform approach globally, to have the most accurate and meaningful impact? PCAF, or the Partnership for Carbon Accounting Financials is the global framework for the finance industry to measure its financed emissions, but who and what is PCAF, what is ‘The Standard’, who should report to PCAF and what are the benefits of PCAF reporting?

Who is the Partnership for Carbon Accounting Financials (PCAF)?

The Partnership for Carbon Accounting Financials or PCAF, is a global industry-led partnership of financial institutions formed to create a harmonised approach to assess and disclose the greenhouse gas (GHG) emissions associated with loans, underwriting, investments, and any other financial assets. This framework is called the Global GHG Accounting and Reporting Standard for the Financial Industry also referred to officially as ‘The Standard’ and sometimes the PCAF standard.

What is the PCAF standard or ‘The Standard’?

The formal PCAF methodology is called the PCAF Standard or ‘The Standard’ facilitates transparency and accountability to provide financial institutions with the starting point required to set science-based targets and align their portfolio with the Paris Agreement using accountable and comparable financed emissions calculations.

The Standard conforms with the requirements set forth in the GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard for Category 15 Investment Activities.

Emissions are attributed to financial institutions based on robust, consistent accounting rules specific to each asset class. By following the methodologies for each, financial institutions can measure GHG emissions for each asset class and produce disclosures that are consistent, comparable, reliable, and clear.

PCAF is open to any financial institution and therefore it has developed GHG accounting methodologies that apply to any financial institution.

As of May 2024, worldwide 485 institutions are reporting using The Standard. Although relatively nascent in Australia, it is expected that reporting financed emissions will become increasingly commonplace and even potentially regulated in Australia similar what is happening in the US and EU.

How is the PCAF Standard implemented?

The development of the Global GHG Accounting and Reporting Standard for the Financial Industry is driven by regional implementation teams through local collaboration. The PCAF Standard is rolled out across five regions: Africa, Asia-Pacific, Europe, Latin America, and North America, each supported by a well-defined governance structure.

These regional teams receive comprehensive technical assistance to facilitate the implementation of GHG accounting and reporting, provided at no cost. The insights and lessons gleaned from these regional implementations are instrumental in refining the Global GHG Accounting and Reporting Standard, ensuring it remains robust and applicable across diverse financial contexts.

What is the purpose of PCAF reporting?

The purpose of reporting to PCAF is to help financial institutions measure and disclose financed (lending and investment) and insurance-associated GHG emissions.

By providing a common methodology and tools for measuring carbon emissions, PCAF aims to help financial institutions better understand and manage their climate-related risks and opportunities. It also provides a transparent and standardised way for financial institutions to report their carbon footprint to stakeholders such as investors and regulators, and community organisations.

The ultimate aim of PCAF is to promote greater accountability and action on climate change within the financial sector. By enabling financial institutions to align their lending and investment activities with the goals of the Paris Agreement, PCAF aims to drive the transition towards a decarbonised economy and support the achievement of global climate targets.

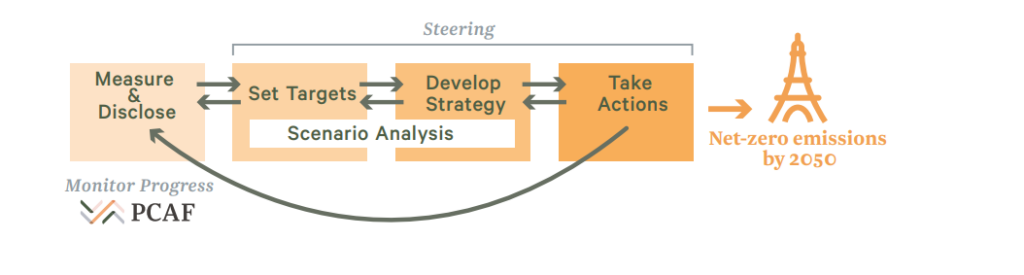

Image: PCAF. Non-linear flow of elements of Paris alignment

What are financed emissions and how do they relate to PCAF?

Financed emissions are a part of a financial institution’s Scope 3 emissions. Scope 3 consists of all indirect emissions that occur in a company’s value chain, including emissions from its suppliers, customers, and other stakeholders. Financed emissions are considered a downstream Scope 3 emission source, as they are emissions of companies in which financial institutions lend to and invest in.

Scope 3 emissions are often the largest component of a company’s carbon footprint, and they can be challenging to measure and manage because they involve emissions from sources outside of a company’s direct control.

In the case of the finance industry, these Scope 3 or financed emissions are the indirect GHG emissions that result from the investments and loans made by financial institutions. These emissions are generated by the activities of the businesses and industries funded by the financial institution.

PCAF reporting measures these Scope 3 financed emissions associated with investments and loans. By measuring and disclosing these, organisations can work to reduce the negative impacts throughout their value chain and provide investors, regulators, and other stakeholders with the information needed to make informed decisions about their sustainability.

What Are the PCAF Asset Classes

PCAF asset classes include:

- Listed Equity and Corporate Bonds: Encompasses all listed corporate bonds and equity traded on the market.

- Business Loans and Unlisted Equity: Includes loans and equity investments in private companies not traded on the market.

- Project Finance: Loans or equity for specific projects such as renewable energy or energy efficiency projects.

- Commercial Real Estate: Loans and investments in income-generating commercial properties.

- Mortgages: Loans for purchasing and refinancing residential properties.

- Motor Vehicle Loans: Loans and credit lines for financing motor vehicles.

- Sovereign Debt: Bonds and loans issued by sovereign entities in domestic or foreign currencies.

What are the benefits of PCAF reporting for Australian businesses?

- Comply with the TCFD and the United Nations Principles for Responsible Banking (UN-PRB). A GHG inventory of financed emissions is required for full disclosure in line with these entities.

- A PCAF GHG account is the basis for reputable climate action and robust commitment initiatives such as a science-based emissions reductions target under the Science Based Targets initiative aligned to the Paris agreement.

- A streamlined approach guided by emerging best practice adds to the credibility and robustness of financed emissions reporting when publicly reporting emissions data, e.g. to the Carbon Disclosure Project (CDP).

- Data gleaned from reporting can inform climate strategies and actions to develop innovative products that support the transition toward a net-zero emissions economy.

- Participants have access to a web-based emission factors database to calculate the carbon footprint of loans and investments.

PCAF provides data scores to identify where and how to improve the accuracy of the carbon footprint. - Ability to collaborate with other banks at regional/country level and to improve own carbon accounting by joining the regional implementation team in Australia (in dev.).

- Platform is open-access and free-of-charge with access to free technical assistance.

These asset classes enable financial institutions to measure and manage their financed emissions, supporting efforts to align with climate goals and regulatory requirements

Who should report to PCAF?

PCAF reporting is primarily aimed at financial institutions, such as banks, asset managers, insurance companies, and pension funds, that are interested in measuring and reporting the greenhouse gas emissions associated with their lending and investment portfolios.

While financial institutions are the primary target audience of PCAF, other stakeholders, such as regulators, policymakers, insurance companies and community organisations, may also use the information disclosed by financial institutions to better understand the carbon footprint of the financial sector and to advocate for more sustainable finance practices.

Need Advice or Assistance in reporting to PCAF?

We have a team of subject matter experts who support financial institutions report their financed emissions aligned to the PCAF framework. Our typical approach is a four-stage process of 1. Fact Finding and Alignment with PCAF and Boundary, 2. Data Synthesis, Transformation and Collection, 3. GHG Assessment and Accounting of Financed Emissions and GHG Reporting aligned with PCAF and 4. Data Management and Process Documentation, and Handover.

As technical experts and trusted advisors to some of Australia’s most well-known companies for over a decade, we’re here to help contact us for advice or to learn more or Call +61 3 7035 1740.