Share this article

Singapore’s climate strategy is anchored in a comprehensive carbon tax regime designed to accelerate the transition toward a low-carbon economy. As a key component of its national mitigation measures, the Singapore carbon tax sends a strong economic signal to reduce the reliance on carbon-intensive goods and services, incentivizes clean technologies, and ensures accountability for greenhouse gas emissions.

Currently, about 80% of Singapore’s total emissions are covered through the carbon tax and fuel excise duties, with roughly 70% directly covered by the carbon tax applied to around 50 major facilities in the manufacturing, power, waste, and water sectors.

This makes the Singapore carbon tax coverage among the most extensive globally.

Singapore Carbon Tax – Driving the Net Zero Transition

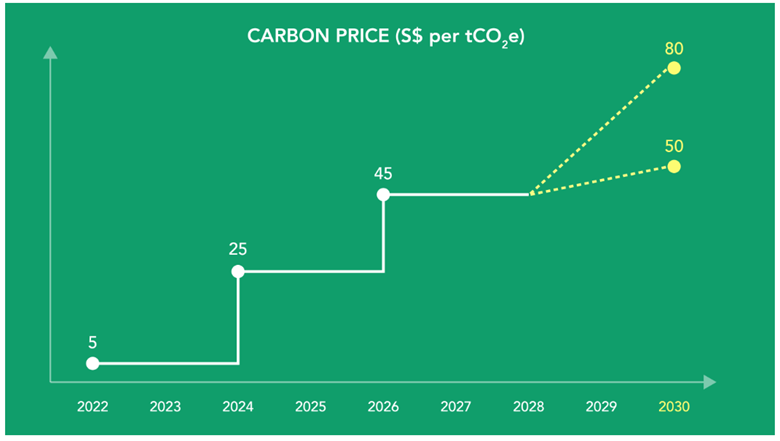

Launched in 2019, Singapore’s carbon tax was the first of its kind in Southeast Asia. It started at S$5 per tonne of CO₂-equivalent (tCO₂e) from 2019 to 2023, providing industries time to adapt.

In 2024, the tax increased to S$25/tCO₂e, and will rise to S$45/tCO₂e in 2026 and 2027. By 2030, the rate is expected to reach between S$50 and S$80/tCO₂e.

Image: Carbon Prices – National Climate Change Secretariat

This progressive trajectory supports Singapore’s net zero ambitions and encourages stronger decarbonisation efforts across sectors. It also strengthens business resilience and competitiveness by encouraging investments in low-carbon solutions aligned with national climate targets.

Learn about effective target setting on your path to net zero: Effective Target Setting: A Critical Pathway to Net-Zero

Supporting Business Transition and Carbon Market Development

Use of International Carbon Credits

From 2024, companies may offset up to 5% of their taxable emissions using high-quality international carbon credits (ICCs) that comply with the Paris Agreement’s Article 6. This provides flexibility for companies to manage costs while encouraging the growth of robust and regulated carbon markets. ICCs must meet stringent environmental integrity criteria and are expected to drive demand and catalyse local market development.

Transition Framework for Emissions-Intensive Trade-Exposed Companies

To support industries facing both high emissions and global competition, Singapore introduced a transition framework offering limited emissions allowances. These are allocated based on international benchmarks and each facility’s decarbonisation plans, with regular reviews to ensure alignment with long-term climate goals. Importantly, new investments are excluded from this support. Similar frameworks are used in jurisdictions like the EU, South Korea, and California to prevent carbon leakage while promoting low-carbon investment.

Outlook for the Singapore Carbon Market Amid Global Developments

Singapore is solidifying its position as a leading hub for carbon markets in Asia, leveraging international partnerships and robust infrastructure to align with global climate initiatives.

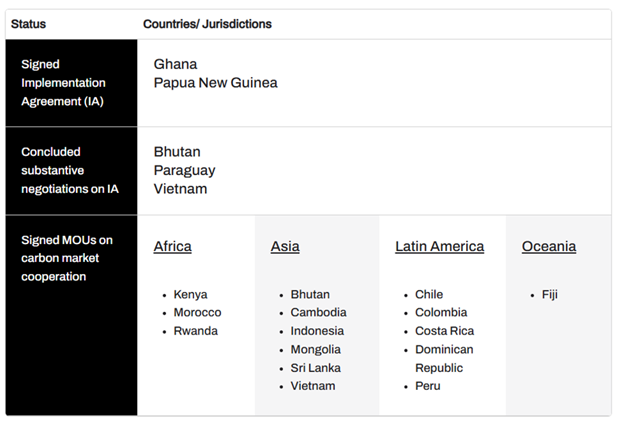

Singapore has signed Implementation Agreements (IA) under Article 6 of the Paris Agreement with countries such as Ghana and Papua New Guinea, facilitating the exchange of high-integrity carbon credits known as Internationally Transferred Mitigation Outcomes (ITMOs) . These agreements enable Singapore-based companies to access verified carbon credits to offset emissions, supporting both national and international climate goals. More substantive negotiations on IAs have been concluded with Vietnam, Bhutan and Paraguay.

To further enhance market participation, Singapore launched the Singapore Carbon Market Alliance (SCMA) in July 2024. This platform connects global carbon credit suppliers with local firms, streamlining access to high-quality carbon credits aligned with Article 6 of the Paris Agreement. Additionally, the Carbon Project Development Grant provides funding for early-stage carbon projects, addressing financing gaps and promoting the development of high-quality carbon credits.

Singapore’s active role in shaping Article 6 frameworks, including co-facilitating negotiations at COP26, underscores its commitment to fostering transparent and effective carbon markets. With these initiatives, Singapore is poised to play a pivotal role in advancing global carbon market mechanisms and supporting the transition to a low-carbon economy.

Learning from Australia’s Mistakes

In 2012, Australia launched the Carbon Pricing Mechanism (CPM), a pioneering initiative aimed at reducing carbon emissions through a national carbon price. The scheme began at around A$27 (adjusted for inflation) and was set to rise quickly. However, the policy faced strong public backlash, as many Australians viewed the tax as excessive in the absence of coordinated global climate efforts and viable low-carbon alternatives. The opposition was so intense that the CPM was eventually repealed.

In contrast, Singapore’s approach to carbon pricing reflects strategic foresight. By introducing its tax only after meaningful low-carbon technologies like battery storage, which have fallen in cost by over 90% since Australia’s CPM became viable, and by starting with a modest price, Singapore has managed to implement its carbon tax with minimal resistance and long-term staying power.

Article originally published in 2021, most recently updated: June 2025.

Need Support Navigating Singapore’s Carbon Tax? Contact Us

Anthesis supports Singaporean companies in navigating the carbon tax and broader climate policy landscape, providing expert guidance on carbon pricing, decarbonisation strategy and net zero . Our team helps organisations find value through tailored solutions that build climate resilience, meet compliance obligations and position businesses for sustainable growth in a low-carbon Asian economy. Learn more about how we can help with internal carbon pricing and carbon offsets.

Contact us on the form below for more information or email us directly.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.