Table of Contents

- Leveraging the New Guidance

- Climate Ambition

- Climate Reporting

- Private Equity Concerns

- Impact on Financial Institutions

- Contact Us

Share this article

In July 2025, the Science Based Targets initiative (SBTi) released its updated Financial Institutions Net Zero (FINZ) guidance, marking a significant step forward for the sector and arriving just as early adopters of the previous guidance reach their 5-year target review horizon. The guidance also presents greater alignment with other frameworks, such as the Net Zero Investment Framework (NZIF).

In this article, we outline how and when companies should leverage this updated guidance for target setting, summarise the key points about the new standard’s requirements for climate ambition and reporting, and outline what this all means for financial institutions.

How and when to leverage the new guidance

Companies are encouraged to start applying the new guidance as soon as practicable, but a phase-in period has been proposed. Either the FI Near Term (FINT) or the new FINZ guidance may be used for companies looking to set targets until December 2026. SBTi suggests:

| How to Set Targets | Timing | |

|---|---|---|

| Financial Institutions | Set near-term targets using FINT; or set long-term targets using FINZ. | Both versions can be used until at least December 2026. |

| Financial Institutions with Net-Zero Commitments | Set near and long-term targets using FINZ. | Within 24 months of FINZ publication. |

| Financial Institutions with Existing Near-Term Targets | Existing near-term targets remain valid. Revalidate near-term targets using FINT; or set near and long-term targets using FINZ. | Both versions can be used until at least December 2026. |

Redefining climate ambition

SBTi has redefined climate ambition in its FINZ guidance, with more stringent requirements on certain sectors, namely the fossil fuel, transport, industry, energy, and real-estate sectors. The latest guidance introduces the concept of portfolio segmentation – four segments are used to define target-setting requirements and climate ambition:

- Segment A: Fossil fuels (coal, oil, gas).

- Segment B: Transport (air, maritime, land); Industrial (steel, cement); Energy (power generation); Real estate (residential and commercial buildings); Forest, land and agriculture (FLAG).

- Segment C: Other sectors (not listed in segments A or B).

- Segment D: Subset of activities in emissions-intensive sectors and other sectors. This includes private equity, venture capital and private debt in non-fossil fuel sectors with <25% ownership or no board seat, as well as funds of funds.

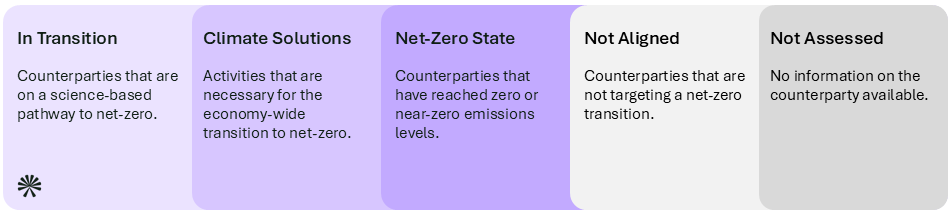

SBTi’s updated guidance introduces clearer criteria for how financial institutions should treat different types of assets on their journey to net zero. Assets are now categorised as either “in transition” (shifting toward lower-carbon operations), “climate solutions” (assets that directly support decarbonisation, such as renewable energy), or already in a “net zero state”.

For “in transition” assets, the guidance includes an Implementation List of approved benchmarks and third-party methodologies that institutions can use. This expands options for demonstrating portfolio alignment, which previously were limited to either using the ITR methodology or having SBTi-validated targets.

Unlike earlier drafts of the guidance, the final version does not require financial institutions to demonstrate that their portfolio is making progress towards the targets they have set. Institutions must still report their own progress annually and renew targets at the end of each near-term cycle (set at five years). However, there is no requirement to show that portfolio companies are delivering on the targets they have set, as is required in NZIF. In practice, this means financial institutions can meet the standard by ensuring companies set targets, without being responsible for how quickly those companies achieve them.

Climate ambition requirements also depend on the location of assets – financial institutions with assets in developing economies have longer timelines to bring those holdings into alignment, recognising regional differences in transition pace.

As with previous guidance, SBTi mandates that companies make certain over-arching strategic commitments to align with climate goals. These have been expanded with the addition of a commitment to monitor and phase out deforestation and land conversion from the portfolio, as well as to conduct and publish a deforestation assessment by 2030. Requirements for ending new finance to fossil fuel assets and divesting from fossil-fuel related assets remain similar to those outlined in the near-term guidance and are in alignment with coal phase-out by 2030 for OECD countries and 2040 for the rest of the world. The guidance also makes clear that offsets or carbon credits cannot be used to meet near- or long-term decarbonisation targets. Only residual emissions at the point of net zero can be neutralised.

Increased climate reporting expectations

Alongside these ambition requirements, SBTi FINZ also raises expectations for climate reporting and transparency. This includes requirements to report:

- Scope 1 & 2 financed emissions for segments A, B, and C. This was previously only required where companies were setting portfolio coverage targets on an emissions coverage basis. Reporting requirements are stricter if targets are set based on the share of emissions covered rather than the share of assets. If setting portfolio coverage based on emissions coverage, investors must also include segment D activities in their financed emissions statement.

- Scope 3 financed emissions for automotive, coal, oil & gas, and real-estate assets, as these are deemed to be “high impact” sectors. From 2030, Scope 3 financed emissions must be included for all assets.

- Exposure to fossil fuel-related activities and related GHG impacts. This includes a new requirement to report a ratio of fossil fuel financing relative to renewable energy financing.

Addressing private equity concerns

During the consultation period, key concerns raised by private equity firms included the need to maintain the 24-month post-investment grace period for portfolio companies to be integrated into targets, as well as the looser requirements around minority investments (<25% ownership or no board seat). SBTi has honoured these concerns by classifying private equity, venture capital, and private debt of private corporates and SMEs in non-fossil fuel sectors with <25% ownership or no board seat as segment D, on which the least stringent requirements are placed. Segment D assets are only required to be included in near-term targets if the target coverage of segment A-C assets is <67%, but it must be phased in to targets from 2040.

What this means for financial institutions

The new FINZ guidance is currently in a period of transition and will take a while to be adopted more widely in the sector given a phase-in timeline of December 2026. The target-setting tools and associated documentation are not yet published, and there is a generous transition period to prepare key elements of new target-setting requirements, notably portfolio GHG accounting.

The guidance provides increased flexibility in defining climate alignment targets, which is intended to make internal implementation more straightforward. However, this flexibility may also lead to slight discrepancies in target ambition, as it is not always obvious from the standard SBTi target language how ambitious a target really is.

While it will be a few months before the first FINZ-aligned targets start to be validated and published, Anthesis is already supporting clients in navigating the new guidance and the implications for their businesses. The practice of setting SBTs enables companies get on track and future-proof growth, and is one of the best practices for publicly communicating a company’s commitment to limit the effects of climate change. At Anthesis, we view the process of setting Science Based Targets not merely as a checkbox but as a transformative business journey.

Explore our Science Based Targets Solution

End-to-end SBT consulting support, enabling organisations across the globe to play their role in cutting their emissions and combating the climate crisis through the Science Based Targets initiative.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.

Related Content

The Sustainability Agenda 2026: Where Leaders Should Focus Their Attention | Matthew Bell, CEO of Anthesis

SBTi’s Draft Corporate Net Zero Standard Version 2.0 Whitepaper: Overview & Insights Into The Proposed Changes