The Oxford Principles, originally developed in 2020, have become an essential guideline for credible design and delivery of net-zero commitments. The Anthesis Group best practice approach is based upon the original four elements developed by The University of Oxford.

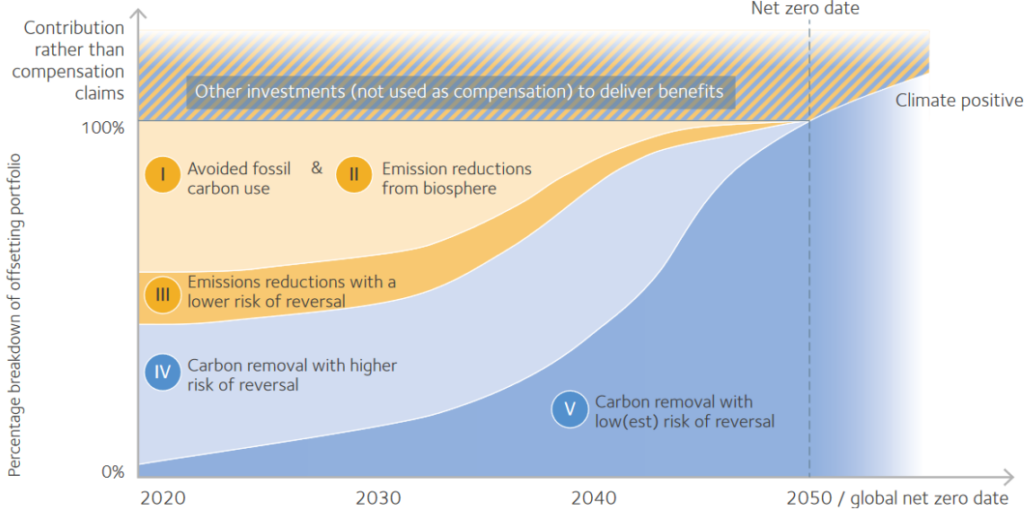

Since the initial publication of the Oxford Principles in 2020, there has been growing interest in aligning organisational carbon management and carbon credit procurement strategies within a net zero pathway. Despite this, many of today’s carbon investment strategies are not net zero aligned to include long-storage removals credits. Furthermore, the supply of these credible removals is still far from sufficiently scaled.

The revised Oxford Principles underscore the original fundamental components while calling for a course correction in carbon markets and ‘climate contribution’ (carbon credits procurement) practices and clarifying aspects required for net-zero alignment.

Key highlights include an urgent call to accelerate emissions reduction while closing the carbon removals gap and harnessing the power of nature-based solutions. With a clear focus on transparency, durability, and innovation, this welcomed and timely revision charts a renewed course for organisations to navigate the evolving landscape of carbon investment and ‘climate contribution’ practices.

The most significant revisions include:

- Reinforcing the urgency of reducing emissions. Organisations with net zero commitments must prioritise early investment in renewable energy and improved energy efficiency within their own value chains while investing in genuine and additional carbon reduction and removals credits.

- Re-emphasising the need to close the carbon removals gap.Today, there are not enough high-quality carbon removals credits or storage available to meet present or future demand, particularly removals approaches with the lowest risk of reversal.

- Highlighting further recent evidence that nature-based solutions are critical for addressing the drivers and impacts of climate change.It is critical to protect and restore ecosystems to achieve global net zero and support adaptation to climate change impacts, irrespective of whether such projects generate credits which are retired as ‘offsets’.

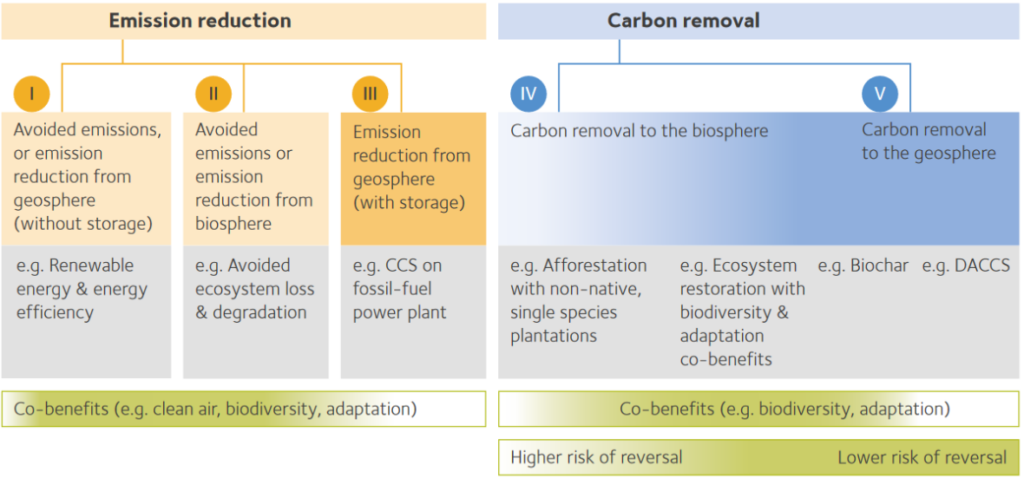

- Clarifying the durability risks and co-benefits of different types of removals and storage.The revised Oxford Principles discuss the various risks to storage across different types of projects in more detail. They also emphasise the co-benefits of different carbon removals and storage options.

- Defining terms to reflect new international guidance on net zero and nature commitments and claims.Since the initial publication of the Oxford Principles, guidance has emerged and converged significantly across international net-zero initiatives and standards; including the need for companies to set additional targets for the restoration of ecosystems and biodiversity. This revision intentionally distinguishes between ‘offsets’, ‘credits’ and ‘projects’: although these terms are often used interchangeably. A carbon credit is a unit of CO2 emission removed or reduced. Credits are generated by projects and may be used (‘retired’) to ‘offset’ emissions but may also be used for other purposes.

- Recognising the value of mitigation efforts outside of organisational net-zero targets.In response to heightened standards of integrity for climate claims, many actors and initiatives continue to purchase credits and support mitigation projects without making net-zero claims or to ‘compensate’ for ongoing emissions. While the Oxford Principles discuss net-zero-aligned ‘offsetting’, we acknowledge there are many other reasons to procure carbon credits and support mitigation projects other than to ‘offset’ emissions, e.g., to pay for reductions in wider society or to restore ecosystems.

Would you like to know more about how to use the Oxford Principles in your net zero strategy and ensure maximum quality in your carbon credit investment strategy? Don’t hesitate to contact us.

And do want to keep up to date? Check our news & insights and our page with events & webinars regularly.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.