Contents

- Preparing for the rise of nature regulation

- Why does nature-related financial disclosure matter?

- How to harness TNFD

- Unlocking opportunity

- Contact us

Share this article

Preparing for the Rise of Nature Regulation: TNFD’s Final Recommendations

Twenty-seven months in the making, the release of the final recommendations from the Taskforce on Nature-Related Financial Disclosure (TNFD) will create a landmark reference enabling investors to better integrate nature-related risks into portfolio management and asset allocation.

As a result, any publicly listed company needs to be ready for the likelihood that TNFD—like its climate-focused counterpart, the Taskforce on Climate-Related Financial Disclosures—will follow a similar path in steering financial markets in pricing assets’ value and allocating capital accordingly. Consequently, what is now a voluntary, market-led disclosure framework could swiftly shift to become part of the mandatory regulatory framework in many jurisdictions.

Moving from Vision to Action after Montreal’s COP15

For the nearly 200 countries that agreed on the Kunming-Montreal Global Biodiversity Framework (GBF) at COP15 last December, TNFD offers significant potential to provide a readymade framework to accelerate progress against the GBF’s four goals and 23 targets for achievement by 2030.

Specifically, the GBF commits nations through Target 15 to take legal, administrative, or policy measures to ensure that large and transnational companies and financial institutions monitor, assess, and transparently disclose their risks, dependencies, and impacts on biodiversity through their operations, supply and value chains, and portfolios1.

Just as TCFD recommendations moved from voluntary disclosure guidelines to a regulatory requirement to comply or explain, we will likely see a page torn from the same playbook. New Zealand, the United Kingdom, South Africa, and Japan have each signaled intent or readiness to adopt TNFD. Brazil, the EU, Indonesia, and Singapore have already begun implementing or are in the process of requiring biodiversity-related disclosures.

Why Does Nature-Related Financial Disclosure Matter?

More than half of the global economy, valued at $58 trillion, is highly or moderately dependent on nature and its services, so managing nature-related risk is a material issue for any business and financial institution. The Global Risk Report ranks biodiversity loss and ecosystem loss as one of the top five threats to humanity in the coming decade. Yet at present, corporate disclosure around nature impacts is limited.

Although the value chains of many major businesses contribute to biodiversity loss, only 5% of 389 companies analysed by the World Benchmarking Alliance have carried out a science-based assessment to show how their operations impact nature and biodiversity. In 2023, CDP added new questions on biodiversity, signaling intent to begin scoring companies against an expanded range of environmental issues to better equip investors with key insights on nature-related risks.

In the same fashion, Nature Action 100, a global investor engagement initiative, is placing increased pressure on 100 companies to increase corporate ambition and action to reduce nature and biodiversity loss.

In June, the investor group, comprised of AXA Investment Managers, Columbia Threadneedle Investments, BNP Paribas Asset Management, Church Commissioners for England, Domini Impact Investments, Federated Hermes Limited, Karner Blue Capital, Robeco, Storebrand Asset Management, and Christian Brothers Investment Services, aligned on eight key sectors of focus (see left).

While the list of targeted companies is not yet public, reports indicate that investor engagement teams are being finalised and baseline engagement letters will be sent to companies by the end of September.

Eight key sectors

- Biotechnology and pharmaceuticals;

- Chemicals, such as agricultural chemicals;

- Household and personal goods;

- Consumer goods retail, including e-commerce and specialty retailers and distributors;

- Food, ranging from meat and dairy producers to processed foods;

- Food and beverage retail;

- Forestry and paper, including forest management and pulp and paper products; and

- Metals and mining

Getting Started: How to Harness TNFD to Identify & Act on Nature-Related Risks

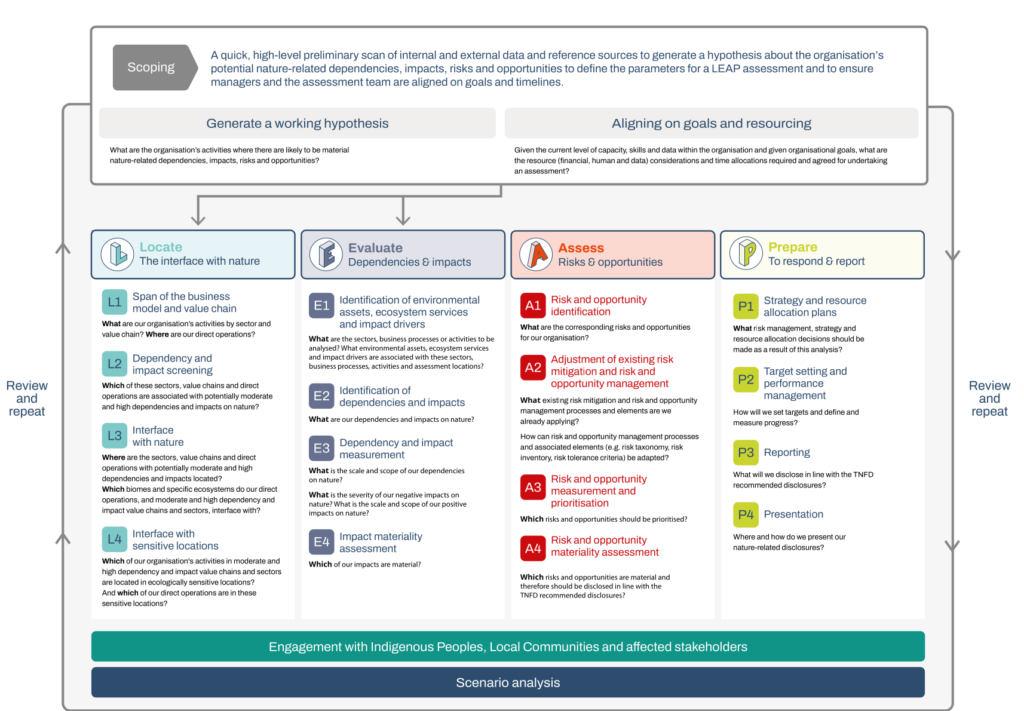

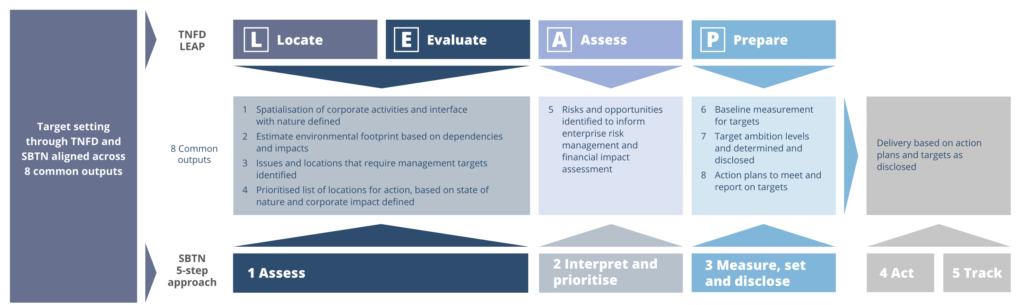

TNFD offers a framework for companies and financiers to assess and disclose their dependencies and impacts on nature and integrate this information into financial decision-making. Through its LEAP Risk and Opportunity Assessment approach, TNFD equips businesses and financial institutions to understand the extent to which the enterprise depends on ecosystem services provided by nature and how these dependencies create material risks to the business or capital-allocation portfolio.

Providing a stepwise process, the LEAP approach supports organizations in conducting a nature-related impacts and dependencies assessment of their direct operations and value chain and prioritising nature-related risks and opportunities.

Getting started on this journey begins with five key action areas:

- Scope the Assessment

Begin gathering information and existing data (biodiversity, water, pollutants, key commodities, waste) across business units, assets, and upstream value chains. Next, review existing standards (Natural Capital Protocol, CDP, Global Reporting Initiative, Science Based Targets Network) and resources (ENCORE, Integrated Biodiversity Assessment Tool, WWF’s Risk Filter Suite). Lastly, build an understanding of material nature issues. - Locate the Interface with Nature

An organisation’s nature-related risk exposure is directly related to the integrity and resilience of the ecosystems and ecosystem services on which the business relies. Start by overlaying your organisation’s operational and commercial footprint with spatial data on terrestrial, freshwater, and ocean biomes and ecosystems to identify where economic activities interface with nature and the health of ecosystems at each location. Utilise this information to prioritise locations by nature-related risks and opportunities. - Evaluate Priority Dependencies and Impacts

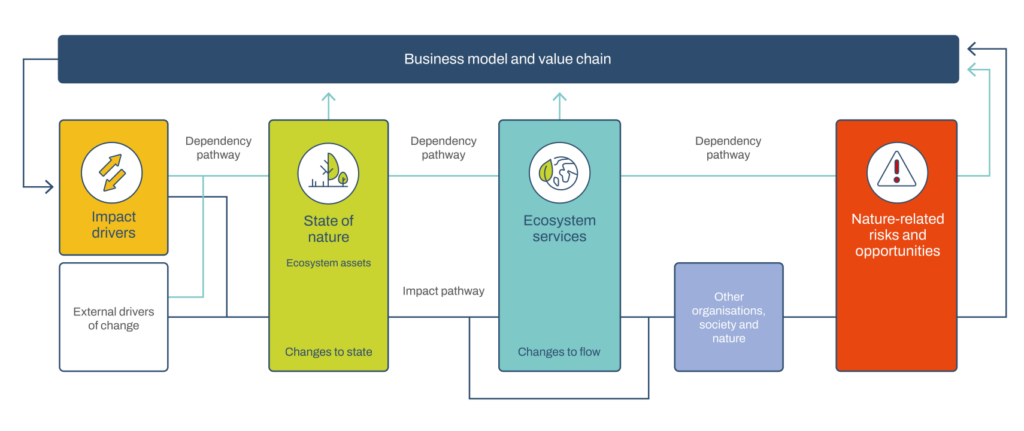

Consider the role of nature in providing ecosystem services to support business processes that not only produce products or services, but ultimately drive revenue and create enterprise value. By identifying the nature-related dependencies and impacts at each priority location, you can begin to make explicit the environmental assets and ecosystem services on which the enterprise depends and generates financial value. Making dependencies more visible in corporate and investment decision-making is a crucial first step to better understanding nature-related risks. Likewise, identifying impact drivers that lead to changes in natural capital can help organizations value the resulting loss. For instance, certain approaches to agricultural production could drive land conversion that contributes to decline in species populations, including pollinators, resulting in reduced crop productivity and yield. - Assess Material Risks and Opportunities

An organisation’s material nature-related risks and opportunities will arise from the enterprise’s dependencies and impacts on nature, as illustrated in the figure below. Dependencies and impacts can lead to nature-related risks through changes to the state of nature, flow of ecosystem services, and impacts to society resulting from business impacts on nature. Nature-related opportunities arise by first prioritising opportunities to avoid and reduce negative impacts, while also contributing to a nature-positive future by regenerating and restoring nature through strategic transformation of business models, products, services, and investments. - Prepare to Respond and Report

At the culmination of this assessment, organisations should be prepared to demonstrate what risk management, strategy, and resource allocation decisions are made as a result. Based on the risks and opportunities identified, senior management teams across the business should set targets and define and measure performance on managing nature-related dependencies, impacts, risk, and opportunities. TNFD recommends that companies set science-based targets using the Science Based Targets Network framework for freshwater and land.

Beyond Risk: Unlocking Opportunity by Integrating Nature’s Value into Decision Making

Businesses that are not prepared will face a variety of nature-related risks. From disruptive shocks to supply chains and manufacturing operations due to dependencies on depleted resources to financial risks from higher insurance premiums and capital costs or transition risks from regulatory changes, the cost of inaction is not a question of likelihood, but how fast and to what degree.

And for some, these risks are already here. Greenwashing, for example, poses a substantial risk to companies by undermining consumer trust and satisfaction when environmental claims are exaggerated or false. This creates reputational risks for the company as well as potential legal and regulatory consequences.

Yet for others, integrating nature’s value into decision-making can create a myriad of nature-related opportunities, from improving brand value to strengthening market access and attracting new sources of capital and revenue streams.

You don’t have to travel this journey alone. Our nature experts stand at the ready to support your organization in understanding, locating, and identifying nature-related impacts, dependencies, risks, and opportunities.

In addition, our experts in water stewardship, forests, and agriculture can enable your organization to set targets and develop strategies to align with the Kunming-Montréal Global Biodiversity Framework. Wherever you are on the journey, Anthesis offers a comprehensive set of integrated services to equip and empower your organization to integrate the value of nature into business and investment decisions and unlock opportunity.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.