Table of Contents

- ESG data collection challenges

- Best practices for ESG data collection

- How to streamline data collection

- Key questions to ask

- Frequently asked questions

Share this article

ESG data provides crucial insights into the environmental, social, and governance (ESG) attributes of a company. This data is used by investors, analysts, companies, policymakers, and other stakeholders to assess business effectiveness, risk exposure, and sustainability performance.

Effective ESG data collection supports risk mitigation, enhances corporate reputation, improves investor confidence, and enables informed decision-making. It is increasingly required for both mandatory reporting (such as CSRD, SFDR, and SEC) and voluntary disclosures (such as GRI, SASB, and CDP).

With growing investor and consumer demands for transparency and sustainability, having an accurate, auditable ESG data collection process is more critical than ever.

- Environmental Data – Metrics on resource usage, carbon footprint, climate risks, waste management, and biodiversity.

- Social Data – Insights into labour practices, diversity and inclusion, community engagement, and customer satisfaction.

- Governance Data – Information on board structure, executive compensation, business ethics, regulatory compliance, and risk management.

- Investors & financial institutions – Use ESG data for due diligence, risk mitigation, and sustainable investment decisions.

- Corporations & business leaders – Leverage ESG data to ensure regulatory compliance, enhance brand reputation, and improve sustainability performance.

- Regulators & government bodies – Enforce ESG regulations and monitor corporate disclosures.

- Insurance companies – Assess climate risks and underwrite sustainable projects.

ESG data collection challenges

In today’s digital landscape, good data is the foundation of all good decision-making. Yet in its current form, ESG data isn’t very useful. In fact, the challenges associated with proper data collection and processing may be skewing results, misleading stakeholders, wasting resources and leading to poor decisions.

Companies often face several hurdles when gathering ESG data, such as managing large volumes of information stored across disparate sources, ensuring data accuracy, and dealing with integration challenges within existing business operations. Additionally, they must navigate the complexity of evolving ESG regulations, collect data from suppliers across the value chain, and overcome resource constraints caused by limited internal expertise and bandwidth.

Best practices for ESG data collection

How to address the challenges associated with ESG data collection

1. Determine the right data to collect

To effectively collect ESG data, organisations must first determine what the right data is to collect. This begins with identifying key reporting frameworks that your organisation needs to report on, such as CSRD, TCFD, and GRI, to establish the data points required. This will help you to determine the data you need to collect and when.

2. Establish a governance and controls framework

Establishing a governance and controls framework is essential in defining data ownership and responsibilities. ESG data collection should involve collaboration across various departments, including finance, HR, operations, and legal. Organisations must then implement clear processes that outline how data is collected, verified, and reported to maintain consistency and accuracy.

3. Engage stakeholders and data owners

Companies should conduct education sessions with employees to ensure all stakeholders understand the importance of ESG data, their roles in the collection process, and the broader implications for corporate reporting. Regular progress check-ins, dashboards, and tracking tools can also incentivise timely data submission and improve internal accountability.

4. Utilise ESG data management tools

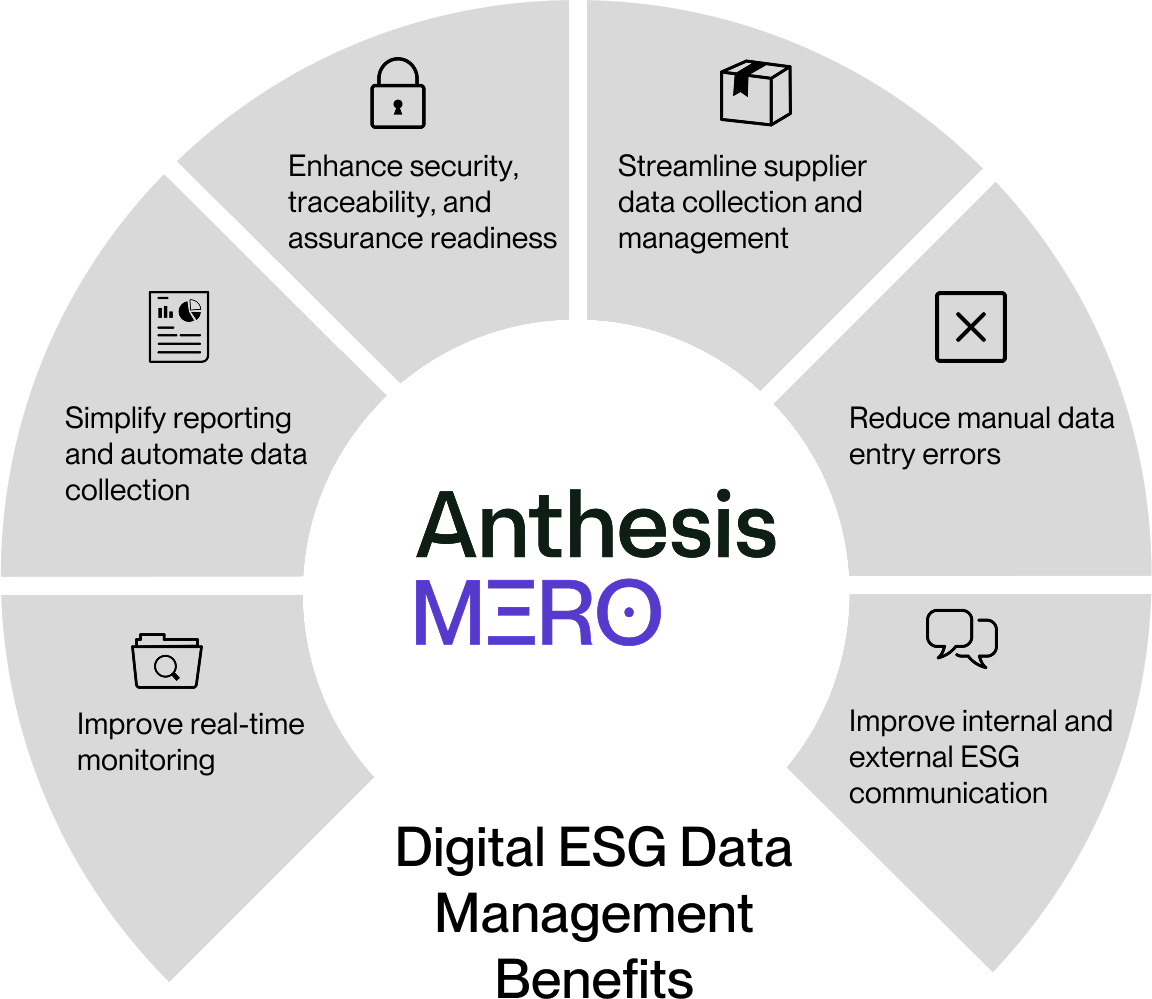

Implementing an ESG data management tool can significantly enhance efficiency and accuracy. Digital tools such as Anthesis’ Mero platform streamline the data collection process, reducing manual effort and streamlining compliance with reporting frameworks. These tools automate data validation, minimise duplication, and provide centralised data storage, allowing for better analysis and decision-making.

5. Ensure data integration and accessibility

Companies should align their ESG data strategy with existing IT systems and financial reporting tools to create a seamless flow of information. Exploring ways to efficiently integrate with third-party platforms and external data sources, such as through APIs, can further improve the accuracy and comprehensiveness of ESG reporting.

6. Enhance data quality assurance

Organisations must also establish validation mechanisms to verify data accuracy, completeness, and reliability. Adopting audit-ready controls ensures that ESG data meets regulatory requirements and can withstand external scrutiny.

How to streamline ESG data collection

Adopting a robust ESG data management platform offers significant benefits to organisations, streamlining the ESG data collection and management processes, and helping bring it in line with best practice. If this is something you are considering, look for a system that provides:

- Configurability – Seamlessly integrates data from multiple sources, including APIs, minimising manual effort and centralising information.

- Framework compatibility – Ensures compliance with the reporting frameworks and standards that your organisation reports to, for instance CSRD, GRI, SASB.

- Technical and advisory expertise – Is backed by ESG specialists who understand your organisation’s material impacts, risks, and opportunities, helping you make informed decisions and uncover commercial value.

- Security and compliance – Implements strong security measures to safeguard data and prevent unauthorised access.

- Accessibility and user-friendliness – Simplifies data input and analysis, enhancing usability across your organisation.

Case Study: Nutresa’s ESG Data Transformation

Nutresa, a global food conglomerate, faced challenges managing ESG data across 52 production plants, 32 companies, and 8 business units. Their reliance on Excel-based manual data collection led to inefficiencies, errors, and limited real-time insights.

By implementing Mero, Nutresa:

- Automated data collection and minimised errors.

- Enabled more frequent and detailed ESG reporting.

- Gained granular visibility into ESG performance across operations.

- Strengthened investor confidence through transparent disclosures.

Nutresa’s success illustrates how ESG data automation drives efficiency and sustainability leadership.

Key questions to ask at the beginning of your ESG data collection journey

- How does your company assess ESG disclosures today?

- Have all ESG data sources been identified?

- How is ESG data captured, and what internal controls exist?

- How reliable and complete is the current ESG data?

- How prepared is your company for ESG assurance and audit requirements?

Ensuring a structured and efficient ESG data collection process is essential for regulatory compliance, investor confidence, and sustainability success. Organisations should evaluate their current data strategy and consider implementing an ESG data management system to streamline data gathering, improve accuracy, and enhance reporting capabilities.

Get in touch with Anthesis today for a demo of Mero and discover how digital ESG data management can transform your organisation.

Frequently asked questions

Companies report ESG data through standalone sustainability reports (GRI, SASB), integrated annual reports, regulatory filings (CSRD, SFDR), and voluntary disclosures (CDP, B Corp).

- Mandatory: CSRD, TCFD, SFDR, EU Taxonomy, SEC (proposed).

- Voluntary: GRI, SASB, CDP, ISSB.

Anthesis offers modular digital solutions such as Compliance Suite and Anthesis RouteZero, which integrate ESG data collection with supply chain due diligence and ESG training.

By leveraging digital tools and best practices, companies can streamline ESG data collection, ensuring accuracy, efficiency, and compliance in a rapidly evolving regulatory landscape.

Discover how digital ESG data management can transform your organisation.