Home – Prepare for Mandatory Climate Disclosures and the Australian Sustainability Reporting Standards

The Australian Government’s introduction of mandatory climate-related financial disclosures legislation under the Australian Sustainability Reporting Standards (ASRS), mean transparency and accountability in climate-related reporting are now mandatory for a large cohort of Australian businesses.

Is your organisation prepared to navigate the complexities of the new Australian Sustainability Reporting Standards (ASRS) AASB S2 and comply with mandatory climate-related disclosures?

What are the Australian Sustainability Reporting Standards (ASRS)

The new Australian Sustainability Reporting Standards (ASRS), are aligned internationally with the ISSB Standards, and will redefine corporate responsibility in Australia. The standards are sometimes referred to as Mandatory Climate Disclosures (MCD) or Mandatory Climate Reporting (MCR).

The standard AASB S2 mandates comprehensive reporting on climate-related financial information, including climate risks, opportunities, and GHG emissions. By enhancing transparency and accountability, they will ensure that sustainability is integral to corporate strategy and operations, supporting Australia’s emission reduction targets.

Note ASSB S1 sustainability standard is currently voluntary, but future-focused organisations are already looking at this to prepare for potential compliance in the years ahead.

For a deeper dive see our articles:

ASRS and AASB S2: A Guide to Mandatory Climate Reporting in Australia and

A Guide to Public Vs Private Climate-related Financial Regulations in Australia.

Who needs to comply with ASRS?

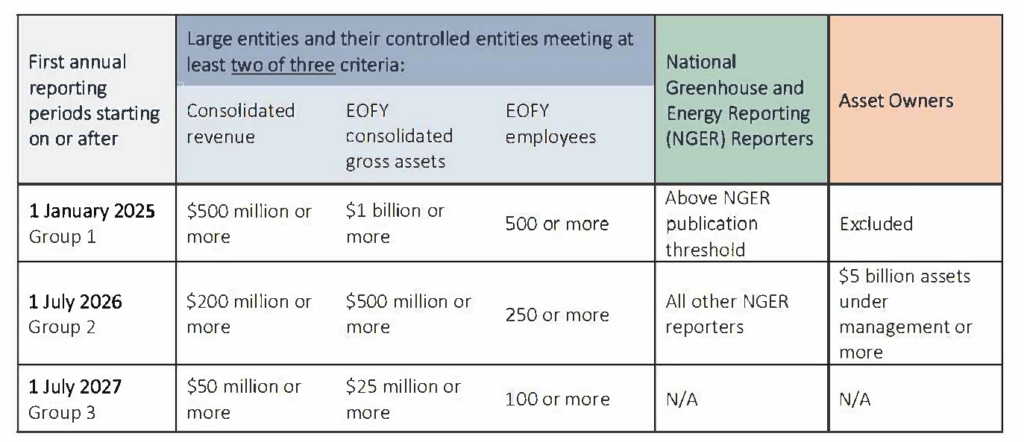

The mandatory climate disclosures to ASRS impacts a wide range of entities, including:

- Large Corporations: Large entities exceeding 2 out of 3 thresholds for 1) consolidated revenue, 2) EOFY consolidated gross assets and 3) EOFY employees.

- NGERs Act Reporters: Companies already reporting under the National Greenhouse and Energy Reporting (NGER) Act.

- Asset Owners and Managers: Managing assets in investment schemes and superannuation funds over $5 billion.

It is essential to determine early on whether your business falls under these categories to ensure timely compliance with the new standards.

Understanding the ASRS Framework

The ASRS framework is designed to integrate seamlessly with existing global standards, enhancing the comparability of disclosures worldwide. It encompasses:

- Governance: How organisations govern and assess climate-related risks and opportunities.

- Strategy: The actual and potential impacts of climate-related risks and opportunities on business, strategy, and financial planning.

- Risk Management: The processes used to identify, assess, and manage climate-related risks.

- Metrics and Targets: Metrics and targets used to assess and manage relevant climate-related risks and opportunities.

How to Prepare for Mandatory Climate Disclosures to AASB S2 under the ASRS

- Risk and Governance Assessment: Ensure your governance framework robustly manages climate risk. Begin by assessing your current risk profile and governance to align with ASRS requirements.

- Skills and Capabilities Review: Evaluate your internal capabilities to meet these disclosures. Where necessary, seek to bridge knowledge gaps through training or hiring, ensuring your team is up to speed with the latest in climate risk management.

- Action Plan Development: Develop a comprehensive action plan to address any compliance gaps. Set clear milestones and deadlines to achieve ASRS readiness before 2025.

Mandatory Reporting | ASRS Webinar Series

In this webinar series, our experts explore in detail the key elements of the ASRS standards and offer practical tips for everything you need to know to prepare for reporting, answer your questions and explore the opportunities that exist beyond compliance to drive innovation, efficiency, sustainable performance and business value.

How we help clients

Our sustainability and climate risk specialists help organisations understand and implement effective climate risk assessments, strategies and climate‑related reporting. We support businesses at every stage of their disclosure journey and align with ASRS standards, including AASB S2 and S1, as well as ISSB, ESRS, CSRD and leading ESG frameworks such as the Global Reporting Initiative.

For more than a decade, we have been focused solely on climate, helping many of the world’s largest companies. We are not newcomers. Our team combines deep technical expertise with an assurance lens that helps clients build confidence in their disclosures and meet new mandatory reporting requirements with clarity and rigour.

We apply specialist climate knowledge to help you manage risk, identify opportunity and strengthen your business. Our approach emphasises efficiency, stakeholder value, increased resilience and measurable positive impact for the short and long term. We help you generate decision‑useful information, uncover opportunities for value creation and build stronger insight and governance that support sustainable performance across your organisation.

We also bring cross‑functional teams together, strengthening collaboration across finance, risk, sustainability, executive leadership and operations to support a smoother, more aligned and effective reporting process that goes well beyond compliance. It helps anchor climate disclosures within your broader business strategy, guiding smarter decisions, clearer priorities and stronger organisational performance.

Our Mandatory Climate Disclosures | ASRS Support Services include:

- Climate-related financial disclosures aligned with ASRS, ISSB and CSRD standards.

- Training and upskilling your team, including exec level, plus governance uplift.

- Developing strategies for climate mitigation and adaptation, and establishing metrics and targets.

- Qualitative and quantitative scenario analysis to assess the financial impacts of climate-related risks and opportunities.

- Greenhouse Gas (GHG) emissions inventories including full value chain scope 3 accounting based on NGER methodologies, GHG Protocol and financed emissions measurement using PCAF framework.

- Developing Climate Transition Plans.

- Advising and reporting on nature-related risks and opportunities to TNFD.

- Seeking out opportunities for efficiencies, innovation, long-term resilience building and driving sustainable performance.

What Our Clients Say

Working with industry leaders

Our Experts

We work with ambitious leaders who want to define the future, not hide from it. Together, we achieve extraordinary outcomes. Contact us for a complimentary advisory call to discuss assistance with your sustainability initiatives and climate -related assessment and reporting.