Home – Regulations – EU Batteries Regulation

Table of contents

- Who is affected

- Timeline

- Requirements

- What organisations need to do

- Broader implications

- What's next?

Share this guide

Batteries are a key component of everyday life, from powering essential tech to supporting the clean energy transition. With ever-increasing applications, the global demand for batteries is growing and is estimated to increase by 14 times by 2030.

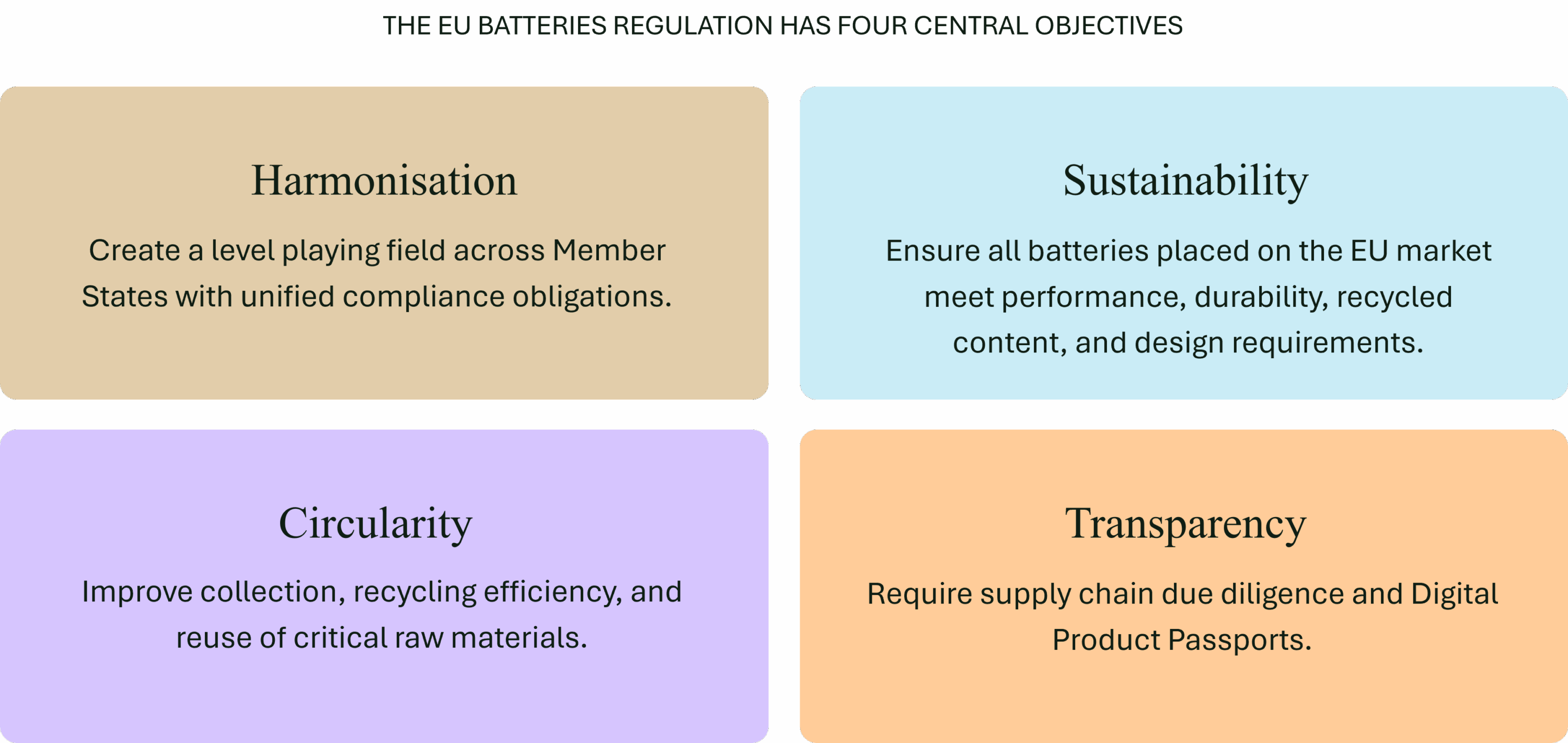

The way in which batteries are regulated in the EU changed in 2023, with the new Batteries Regulation (EUBR) being a key outcome of the European Green Deal, establishing a comprehensive legal framework for making batteries more sustainable throughout their entire lifecycle.

What is the EU Batteries regulation?

The EU Batteries Regulation, Regulation (EU) 2023/1542, establishes a comprehensive set of rules for placing batteries on the EU market, focusing on sustainability, safety, labelling, marking, and information. It sets minimum requirements for:

- Extended producer responsibility

- Waste battery collection and treatment

- Reporting

- Supply chain due diligence

It also sets green public procurement rules for buying batteries or battery-containing products.

Scope of the EUBR

The EUBR applies to all battery types, including:

- Portable batteries including those used in small devices and consumer electronics

- SLI (Starting, Lighting, Ignition) batteries used in automotives

- Light Means of Transport (LMT) batteries such as those batteries in light electric vehicles (e.g., e-bikes and e-scooters)

- Electric vehicle batteries, specifically those used for use in EVs

- Industrial batteries used in large-scale application such as for energy storage and industrial machinery

It covers batteries regardless of form or function, including those built into or designed to be added to products.

Origins

The EU Batteries Regulation was introduced to replace the 2006 Batteries Directive, which allowed Member States to decide how to achieve its goals, leading to fragmented national laws and uneven enforcement. The shift from directive to regulation harmonises obligations across the EU and reflects priorities from the European Green Deal and the Circular Economy Action Plan.

The regulation was introduced to:

- Accelerate decarbonisation and sustainable product design

- Address supply chain risks linked to critical raw materials

Who is affected?

The new EUBR applies the same rules to all EU member states, setting out new obligations for manufacturers who place batteries on the EU market, depending on battery type. In addition to manufacturers, importers, distributors, authorised representatives and recyclers will also face new obligations.

The regulation impacts a wide range of actors:

- Manufacturers (design, labelling, reporting, recycled content requirements)

- Importers and distributors (ensuring compliance before placing products on the market)

- Authorised representatives (ensuring conformity where non-EU producers sell into the EU)

- Recyclers and Producer Responsibility Organisations (PROs) (meeting recycling targets and extended producer responsibility requirements)

- Downstream sectors including automotive, consumer electronics, and renewable energy (must adapt to supply chain and design changes)

The EUBR due diligence obligations apply only to companies with a turnover greater than EUR 40 million. This threshold may be increased to EUR 150 million under the Omnibus IV proposal (see below).

When placing a battery on the market or putting it into service, manufacturers must ensure that:

- They have carried out due diligence and conformity assessments

- The battery has been designed and manufactured in accordance with set requirements, including restriction of certain substances, recycled content stipulations and performance and durability requirements

- The battery is marked and labelled in accordingly

EUBR timeline

On 21st May 2025, the European Commission published a further Omnibus simplification package (Omnibus IV), which proposes to delay the enforcement of EUBR due diligence obligations by two years, moving the compliance date from 18th August 2025 to 18th August 2027.

The ‘stop-the-clock’ provisions of the Omnibus IV package were adopted on 18th July 2025 and the new Regulation (EU) 2025/1561 amending Regulation (EU) 2023/1542 was published on 30th July 2025. According to this new update, the European Commission’s official guidelines on due diligence is now expected by 26th July 2026, thereby affording companies additional time to prepare for the start of the compliance period.

Core compliance requirements

The regulation sets out a number of provisions covering design and performance, recycled content and material recovery, labelling and information, collection and recycling, extended producer responsibility (EPR), and due diligence and supply chain transparency.

To comply with the EUBR, companies must:

- Register as producers in Member States before placing batteries on the market.

- Meet performance, durability, and labelling requirements.

- Ensure due diligence, including supply chain risk assessments and third-party verification.

- Implement extended producer responsibility schemes.

- Contribute to collection and recycling targets, including critical raw material recovery.

Due Diligence and Supply Chain Transparency

- Battery Due Diligence Policies (Article 48)

- Management System (Article 49)

- Risk Management Obligations (Article 50)

- Third-party Verification of Battery Due Diligence Policies (Article 51)

- Disclosure of Information on Battery Due Diligence Policies (Article 52)

Design, Performance, Labelling and Information Requirements

- Product Durability & Performance (Article 10 and Annex IV)

- Replaceability of Batteries (Article 11)

- Collection & Recycling (Articles 59, 60, 61, 71 and Annex XII)

- Digital Product Passport (Chapter IX and Annex XIII)

Due Diligence and Supply Chain Transparency

Chapter 7 of the EUBR (‘Obligations of economic operators as regards battery due diligence policies’) comprises seven articles and sets out five key requirement areas summarised below.

Battery Due Diligence Policies (Article 48)

Companies within scope must establish a policy outlining their battery due diligence processes. This policy should be verified and audited by an independent third party and supported by documentation demonstrating compliance with due diligence obligations.

Management System (Article 49)

Companies must structure their internal management systems to support the implementation of the due diligence policy. This includes:

- Assigning responsibility at the top management level

- Integrating risk management measures into contracts and supplier agreements

- Communicating the due diligence policy to suppliers and the wider public

- Ensuring alignment with international due diligence standards

The EUBR also requires companies to establish and operate a system of controls and transparency across their supply chains. This includes a chain of custody or traceability mechanism to identify upstream actors. Companies must also set up a grievance mechanism and a remediation process or participate in collaborative mechanisms with other companies.

Article 49 further specifies that the management system should capture key information, including:

- Description, quantities, and weight of raw materials

- Names and addresses of raw material suppliers

- Country of origin of raw materials

- Market transactions from extraction to Tier 1 suppliers

Risk Management Obligations (Article 50)

Companies must identify and assess risks of adverse human rights and environmental impacts in the supply chains of cobalt, lithium, nickel, and graphite. Based on this assessment, they must design and implement a strategy to address identified risks, including:

- Reporting internally to top management

- Implementing risk management measures consistent with internationally recognised due diligence frameworks from the UNGPs, OECD, ILO, etc.

- Tracking and monitoring the performance of risk mitigation measures

- Considering suspension or disengagement from a supplier after unsuccessful mitigation efforts

Third-party Verification of Battery Due Diligence Policies (Article 51)

Independent third-party verification must cover all activities, processes, and systems established to fulfil due diligence obligations. The verification report should also highlight potential areas for improvement in due diligence practices.

Disclosure of Information on Battery Due Diligence Policies (Article 52)

The battery due diligence policy must be accompanied by a publicly available report outlining:

- Steps taken to meet due diligence obligations

- Findings of significant adverse impacts and the measures taken to address them

According to the original EUBR text, this report should be published annually. However, under the Omnibus IV proposal, the frequency may be extended to once every three years, starting one year after enforcement (from August 2028).

The third-party verification report must be made available to relevant authorities upon request. Additionally, companies in scope are required to share all relevant due diligence information with their immediate downstream purchasers, while safeguarding business confidentiality and competitive concerns.

Learn more about EUBR due diligence requirements

Discovery why early preparation matters, despite the two-year delay.

Design, Performance, Labelling and Information Requirements

Product Durability & Performance (Article 10 and Annex IV)

Batteries must meet minimum performance and durability standards, including requirements for capacity retention and cycle life. These standards ensure longer battery lifespan and reduce the need for early replacement.

Replaceability of Batteries (Article 11)

Most portable batteries integrated into appliances (e.g. consumer electronics) must be removable and replaceable by the end-user using commonly available tools, without damaging the product. This provision is central to enhancing repairability and extending product life. Certain exemptions apply (e.g. for toys, due to safety considerations), but professional replaceability must still be ensured.

Collection & Recycling (Articles 59, 60, 61, 71 and Annex XII)

The regulation imposes ambitious collection targets for batteries to recover critical raw materials. It also sets high recycling efficiency and material recovery targets, particularly for lithium, cobalt, nickel, and lead, promoting closed-loop recycling and reducing dependence on virgin resources.

Digital Product Passport (Chapter IX and Annex XIII)

To support transparency and traceability, a Digital Product Passport (DPP) will be required for certain batteries (initially EV, LMT, and industrial). It will contain structured, accessible information on battery characteristics, materials content, and end-of-life handling. While portable batteries are not yet included, this is under review and may expand. The DPP information aims to enable the circular management of batteries, namely reuse and recycling.

Waste Management & Extended Producer Responsibility

Registration (Chapter VIII, Articles 54 and 55)

Member States are required to create a register of producers, with the aim to monitor compliance with end-of-life requirements. Producers may only make for sale batteries within a given Member State market if they are registered in that Member State. A ‘competent authority’ shall be designated by each Member State to monitor fulfilment of producer obligations and should producers be found to be non-compliant, i.e. placing batteries on the market before being registered, they face fines and cost damages through product confiscation and product bans.

Extended Producer Responsibility (Chapter VIII, Articles 56 to 63)

The regulation also outlines requirements for extended producer responsibility (EPR), with producers being required to have an EPR scheme for the batteries they make available on the market of a Member State for the first time .Under EPR producers are responsible for covering the cost of separate collection of waste batteries and their transport and treatment along with costs related to compositional surveys of municipal waste, the provision of information on prevention and management of waste batteries and data gathering and reporting. EPR for batteries has been in place across Europe for many years already. The EUBR looks to build upon the waste management structures established by previous legislation and lays out a consistent set of minimum requirements for EPR compliance that Member States will be required to implement which should result in a more harmonised approach across the EU.

As is common with most EPR schemes, producers may appoint a Producer Responsibility Organisation (PRO) to fulfil EPR obligations on their behalf. Producers seeking to register with Producer Responsibility Organisations (PROs) must be prepared to be provide standard company and contact information as well as details of the batteries they intend to place on the market including the category, brand names and chemistry type. Furthermore, information on how the producer complies with the other regulatory requirements such as labelling, take-back and separate collections as well as the methods taken to ensure reliability of data, will be required prior to a completed registration. Once registered, ongoing reporting of placed on market volumes becomes the norm.

Where a collective fulfilment is in place, the PRO must ensure that financial contributions made by producers are modulated as a minimum by battery category and battery chemistry, taking into account rechargeability and the level of recycled content in the manufacturing of the battery and whether the battery was subject to preparation for reuse, repurposing or remanufacturing, along with its carbon footprint.

Under EPR, producers of portable batteries (or their PRO) must ensure that all waste batteries are collected separately in the territory of a Member State (Article 59). To fulfil this, they must establish a waste portable take back and collection system, offer free of charge collection of waste portable batteries to set entities and provide for the necessary practical arrangements for collection and transport of such batteries. In addition, there are collection requirements for LMT, SLI, industrial and electric vehicle batteries.

One potentially significant change to the way in which waste batteries are managed is the potential for a deposit return scheme (DRS) for batteries, in particular portable batteries of general use. This policy tool is commonly used for beverage containers. The Commission is due to assess the feasibility and potential benefits of introducing a DRS by the end of 2027.

Impact on Critical Raw Materials

Cobalt, lead, lithium and nickel, which are present in some battery chemistries, come from resources which are considered critical raw materials and are not available within the European Union. In line with its Industrial Strategy, the EU is looking to enhance its strategic autonomy and increase its reliance in preparation for potential supply chain disruptions. To enhance strategic autonomy and strengthen supply chain resilience, the EUBR sets mandatory recycled content targets for these materials (Article 8), promoting circularity and resource efficiency through increased recycling and recovery.

Furthermore, Article 71 stipulates recycling and recovery targets for end-of-life batteries that should be obtained by all permitted recyclers. This approach supports the EU’s broader goal of developing a sustainable, circular economy by encouraging the use of recovered raw materials in battery production.

In addition to the EUBR, businesses involved with critical raw materials must also comply with the EU’s Critical Raw Materials Act (CRMA), which imposes further due diligence, sourcing, and sustainability obligations across the entire CRM supply chain. Therefore, companies using CRMs need to ensure they meet the requirements of both regulations to maintain full compliance.

Penalties for non-compliance

Non-compliance may result in fines, restrictions on placing products on the EU market, or liability for failing due diligence and EPR obligations. While penalties are set at Member State level, the Commission requires them to be effective, proportionate, and dissuasive.

How can businesses prepare?

While there have been delays to the introduction of key features of the EUBR it is vital that companies still continue to prepare and ensure their internal system and process are set up appropriately to meet compliance requirements once the legislation is introduced. Anthesis can help you prepare, and would suggest the three key actions as a starting point:

- Identify and understand relevant EUBR due diligence requirements for your company and potential crossover with other legislation including CSDDD

- Map your battery supply chain to gain visibility into upstream suppliers and high-risk areas

- Begin risk assessment to identify key ESG risks and priority areas for action within your battery supply chain

Implications for businesses

| Role | Action |

|---|---|

| Manufacturers | Must redesign products for battery replaceability and durability. |

| Investors | Greater risk exposure if portfolio companies fail on ESG and supply chain compliance. |

| Consumers | Benefit from longer-lasting, safer, and more repairable batteries. |

| Supply Chains | Higher transparency expectations; dependency on critical raw materials now directly regulated. |

Interconnections with other policy measures

It is important to not consider legislation in isolation, with alignment between legislation across the EU increasing. The EUBR closely aligns with several key European Union initiatives aimed at promoting sustainability, circularity, and responsible supply chains. It reinforces the objectives of the CRMA by securing ethical and resilient access to essential battery materials.

As one of the first product-specific regulations to implement a DPP, it also pioneers the traceability goals outlined in the Ecodesign for Sustainable Products Regulation (ESPR). The Regulation’s product design and carbon footprint requirements reflect ESPR principles, demonstrating sectoral application.

Mandatory due diligence obligations complement the broader Corporate Sustainability Due Diligence Directive (CSDDD), ensuring environmental and human rights standards throughout the battery value chain.

Finally, it modernises the approach to EPR and aligns with the Waste Electrical and Electronic Equipment (WEEE) Directive by harmonising rules for battery collection, recycling, and repurposing, particularly for batteries embedded in electronic products.

Future trends

- Enforcement delays: Due diligence obligations are postponed from 2025 to 2027 under the Omnibus IV simplification package. Given uncertainty surrounding other due diligence regulations such as CSDDD, further delays cannot be ruled out.

- Digital Product Passport expansion: Likely to cover portable batteries in future revisions.

- Deposit Return Scheme feasibility: Commission assessing for portable batteries.

- Review cycles: Commission must periodically update performance, recycled content, and reporting requirements.

Get in touch

Related Content

Get in touch

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.

We’d love to hear from you