Contents

- What are the ASRS?

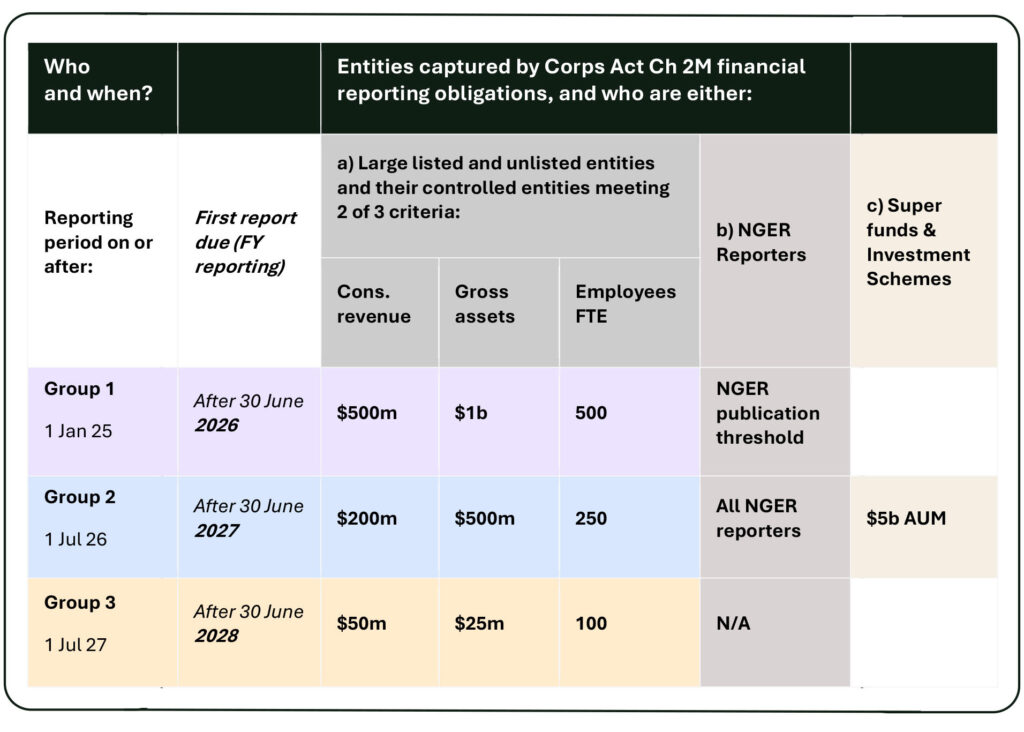

- Who is required to report?

- How to submit your Sustainability Report

- What is the reporting timeline

- Scope 3 reporting under AASB S2

- Are there penalties for non-compliance?

- What are the assurance requirements

- Why do we need mandatory reporting?

- Benefits of reporting to ASRS

- How to prepare for ASRS

- Comparison to other standards

- 5 Key steps to take now

Share this article

Australia’s mandatory climate-related financial disclosures began 1st January 2025 under the Corporations Act 2001 (Corporations Act). To comply with new rules in line with the mandatory Australian Sustainability Reporting Standard (ASRS) AASB S2, both large listed and private companies and financial institutions are required to assess and disclose information about their climate-related risks and opportunities in a ‘Sustainability Report’.

Whether your organisation falls under Group 1 starting from January 1, 2025, to report to ASRS and AASB S2, subsequent Groups 2 or 3, or is voluntarily reporting to align with stakeholders who must report and have heightened expectations for the supply chain – these new standards may still impact you.

This article covers the most common questions around ASRS and AASB S2, to help you understand the requirements and get started – or progress – your climate-related financial disclosures.

What are the Australian Sustainability Reporting Standards (ASRS)?

The Australian Sustainability Reporting Standards (ASRS) are new standards for assessing and disclosing information about an entity’s climate and sustainability-related risks and opportunities. The standards are internationally aligned to the International Sustainability Standards Board (ISSB) IFRS standards, to ensure consistent and transparent reporting globally.

What are ASRS AASB S2 and AASB S1 ?

The ASRS currently includes two standards – one is mandatory and one is voluntary (at this stage). They are:

- AASB S2 climate-related disclosures – applicable for mandatory climate reporting (integrates IFRS S1 and S2).

“‘This Standard requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. For the purposes of this Standard, these risks and opportunities are collectively referred to as ‘climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects.” AASB S2 is available here from the AASB website. - AASB S1 general sustainability reporting requirements (voluntary for sustainability matters other than climate).

“This Standard requires an entity to disclose information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. For the purposes of this Standard, these risks and opportunities are collectively referred to as ‘sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects.”

More information on AASB S1 is available here from the AASB website.

As AASB S2 underpins mandatory climate reporting, it is the one business leaders are focusing their immediate attention on.

AASB S2 requires reporting entities to assess and disclose information about their climate-related risks and opportunities, with a focus on improving consistency, comparability and transparency of reported information.

Some Australian businesses are also considering AASB S1 to enhance broader sustainability-related disclosures and to prepare for future mandatory standards on nature and other topics.

The Australian Accounting Standards Board (AASB) developed the ASRS based on the International Financial Reporting Standards (IFRS) S1 and S2, issued by the International Sustainability Standards Board (ISSB), which set a comprehensive global baseline for sustainability-related financial disclosures.

The IFRS sustainability standards are being implemented by many jurisdictions globally and build on the work of the previous reporting guidance from the Taskforce for Climate-related Financial Disclosures (TCFD).

Does my organisation have to consider AASB S1 to comply with mandatory climate reporting?

No. In Australia, AASB S2 includes relevant provisions from AASB S1 / IFRS S1 for the purpose of climate-related disclosures, avoiding the need to consider AASB S1 separately.

You may wish to consider AASB S1 for nature and other sustainability-related disclosures.

Who is required to report in line with ASRS and AASB S2?

One of the first steps is to understand if and when you are captured by the new mandatory reporting rules. Your organisation may also choose to voluntarily report to ASRS and AASB S2.

Your organisation or financial product may be captured if it is required to publish financial statements under Chapter 2M of the Corporations Act, including if it is:

- A large proprietary company

- A listed company that triggers the company size thresholds

- An NGER reporter

- A Responsible Superannuation Entity or Managed Investment Scheme with 5 Billion or more in assets under management.

Reporting is being phased in based on a range of entity sizes and emissions criteria. To understand if your organisation falls under Group 1, 2 or 3, see the criteria below:

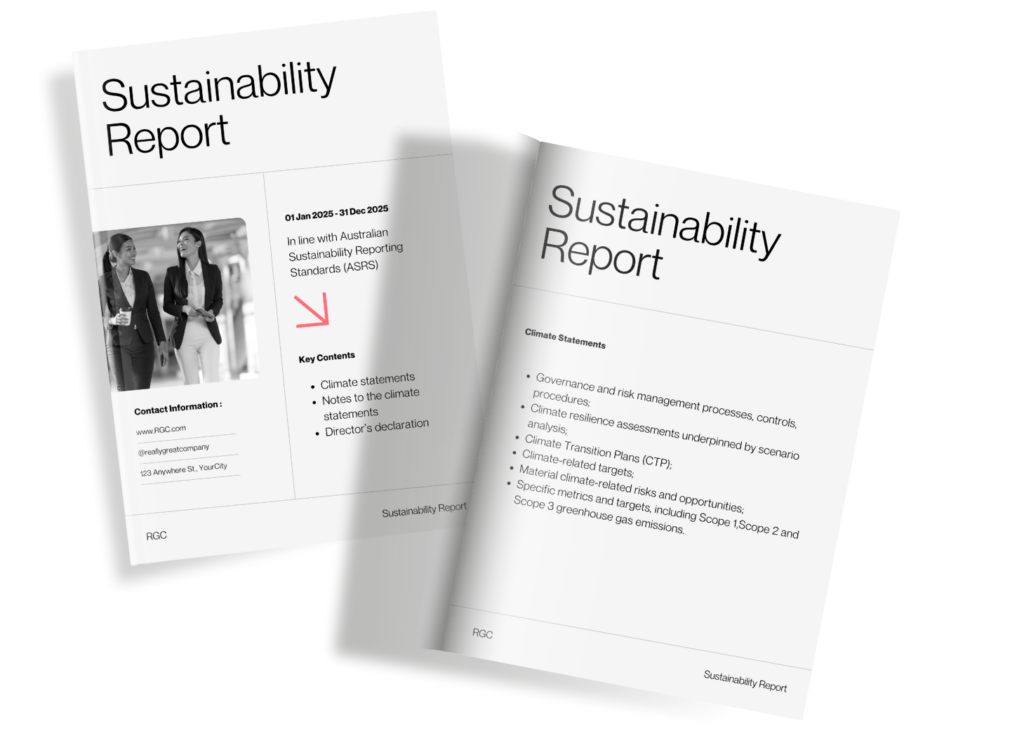

How to submit your mandatory climate-related financial disclosures – the Sustainability Report

Under the new mandatory climate reporting rules in Australia, companies must prepare an annual ‘Sustainability Report’ which forms part of annual reporting, alongside financial statements.

The timing of publication must be consistent with the requirements under the Corporations Act for corporate reporting. More on that below under timelines.

What type of information must be included in the Sustainability Report?

Under the Corporations Act, the Sustainability Report consists of:

- the climate statements for the year;

- any notes to the climate statements; and

- the directors’ declaration about the statements and notes.

Climate Statements

Climate Statements must include information on climate-related risks and opportunities in line with AASB S2. This requires information including on:

- Governance and risk management processes, controls, and procedures;

- Climate resilience assessments underpinned by scenario analysis;

- Climate Transition Plans (CTP);

- Climate-related targets;

- Material climate-related risks and opportunities;

- Specific metrics and targets, including Scope 1, Scope 2 and Scope 3 greenhouse gas emissions.

Is the directors’ declaration for sustainability reporting the same as for financial reporting?

The directors’ declaration is a critical part of the Sustainability Report. This is similar but distinct from the director’s declaration for financial statements.

The declaration confirms that the climate-related disclosures (i.e. the climate statement and notes) comply with the Corporations Act and AASB S2.

What is the timeline for implementing reporting requirements in line with AASB S2?

Reporting commences from 1 January 2025 and applies to your first full reporting period on or after that date.

The reporting period for Sustainability Reports must align with your financial reporting.

- Group 1 – To start reporting for reporting periods from (i.e. the full reporting period starting on or after) 1 January 2025.

- Group 2 – To start reporting for reporting periods from 1 July 2026.

- Group 3 – To start reporting for the first full reporting period on or after 1 July 2027.

Given Group 1 starts from 1 January 2025, do some Group 1 entities have to include a half-yearly report for FY25?

Report timing aligns with your first full financial reporting period on or after 1 January 2025.

For example, if you complete financial reporting for the period 1 July to 30 June, your first reporting period is 1 July 2025 to 30 June 2026 (FY26).

Commonwealth public sector entities will also be captured by new Commonwealth Climate Disclosure requirements, tailored for the public sector. Read here for more information on Public Vs Private Climate-related Financial Regulations in Australia.

ASIC information on submitting your Sustainability Report

ASIC provide helpful information on their website. Broadly, ‘Reporting entities must lodge their sustainability report and the auditor’s report on the sustainability report with ASIC:

- within three months after the end of the financial year for disclosing entities, registered schemes and registrable superannuation entities (RSEs); and

- within four months after the end of the financial year for other reporting entities,

see s319(3) and s1232(1) of the Corporations Act.’

For more information on timelines for varying FY periods and how to lodge the Sustainability Report for ASRS AASB S2 see ASIC’s Sustainability Reporting Information page.

Scope 3 emissions reporting under the ASRS

ASRS and AASB S2 allow for a 1-year relief for reporting Scope 3 emissions (which cover indirect emissions related to your organisation’s value chain and financing or investment activities). This means reporting Scope 3 emissions will be mandatory from your second reporting period. For group 1 entities, you should be putting a serious focus on your scope 3, full value chain inventories in 2026.

For a deep dive into Scope 3 emissions, read our ‘A Comprehensive Guide to Understanding and Reporting Scope 3 Emissions‘ and ‘Scope 3 Data Challenges‘.

You can also watch our webinar recording on Scope 3 emissions – ‘A Closer Look at Material Scope 3 Emissions: How Deep to Dive?’ here.

What is the AASB S2 amendment that was released in December 2025?

The AASB issued AASB S2025-1 Amendments to Greenhouse Gas Emissions Disclosures in December 2025, updating AASB S2 Climate-related Disclosures for annual periods starting on or after 1 January 2027. These amendments align AASB S2 with targeted changes made by the International Sustainability Standards Board and clarify key greenhouse gas disclosure requirements. They make it clear that entities may limit Scope 3 Category 15 emissions reporting to financed emissions, provide relief on how financed emissions are classified by industry, and allow flexibility on using alternative GHG accounting methods or jurisdictional measurement approaches where required. More information on financed emissions.

Are there penalties for non-compliance with ASRS and AASB S2?

The non-compliance penalties under ASRS and AASB S2 closely mirror financial reporting penalties under the Corporations Act.

As the regulator, ASIC has stated it recognises there will be a period of transition as industry builds its capabilities and implements the organisational changes required to comply with these mandatory climate-related reporting requirements. Accordingly, they will take ‘a pragmatic and proportionate approach to supervision and enforcement as industry adjusts to the new requirements.’

In March 2025 ASIC released its regulatory guidance, Regulatory Guide 280. “It explains how ASIC will exercise specific powers under legislation (primarily

the Corporations Act), how ASIC interprets the law and the principles

underlying ASIC’s approach. It also provides practical guidance to entities

about complying with their sustainability reporting obligations.” ASIC.

In line with non-compliance penalties for financial reporting, directors may face personal liability for misleading statements in Sustainability Reports due to a lack of due diligence. False or misleading climate statements could result in penalties up to $15 million or 10% of annual turnover, with directors personally liable.

Will small and medium-sized enterprises (SMEs) have to comply with the ASRS?

The smallest company size thresholds (i.e., in Group 3) match those for large proprietary companies under the Corporations Act, meaning most SMEs are excluded.

The Legislation allows the Minister to lower these thresholds in the future, potentially including more entities.

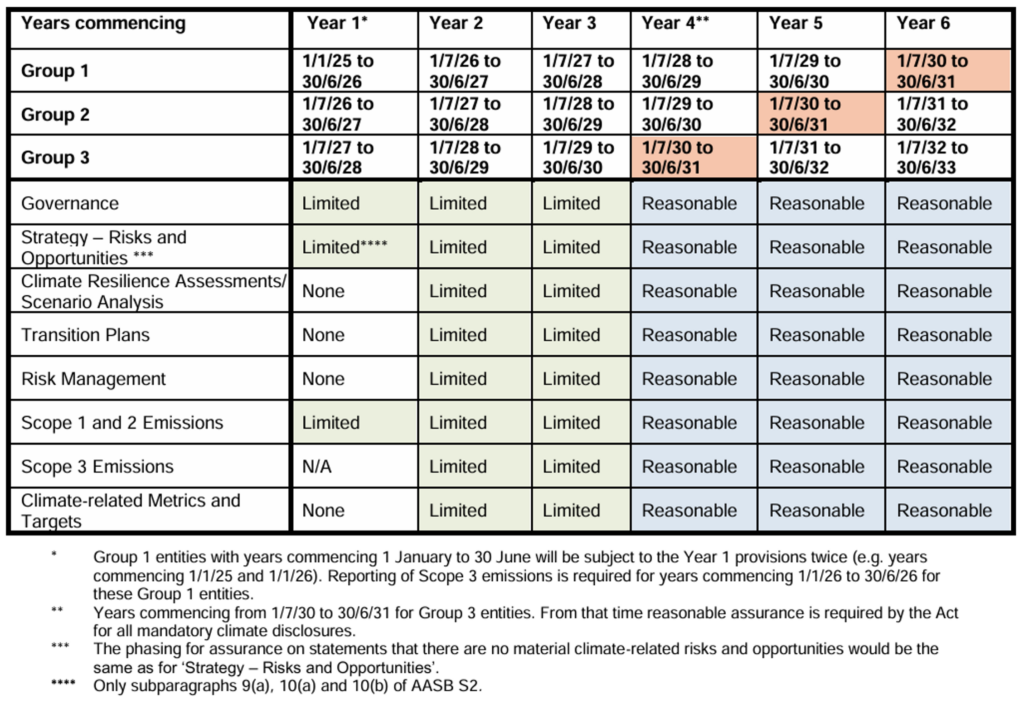

What are the assurance requirements for ASRS and AASB S2?

The AUASB released ASSA 5000 and ASSA 5010 in January 2025 as Australia’s first sustainability assurance standards.

ASSA 5000 sets the foundational requirements for how assurance over sustainability information must be conducted across all topics and frameworks, while ASSA 5010 defines which disclosures must be reviewed or audited and the timeline for doing so. Together, they create a structured pathway that not only supports credible assurance but also acts as a practical guide for organisations preparing their disclosures.

Organisations that align early with the expectations in ASSA 5000 and the staged approach in ASSA 5010, will strengthen internal systems, anticipate assurance needs and build reporting processes to ensure compliance.

From 1 July 2030, climate disclosures will move to full reasonable assurance under the Corporations Act. This shift means organisations will need an audit opinion that provides positive assurance that their climate information complies with legislative requirements and the applicable Australian Sustainability Reporting Standards. See below for ASRS assurance timelines from AUASB.

What are the key changes in the final ASRS from the initial Exposure Draft?

Following the AASB consultation process, the AASB has made some key changes to the final Standards. The overarching change is to more closely mirror the ISSB standards IFRS S1 and S2. This includes:

- Introducing AASB S1 aligned with IFRS S1, as a voluntary standard for general sustainability reporting on topics other than climate.

- Updating AASB S2 to better align with IFRS S2 for climate-related disclosures and incorporate

- applicable IFRS S1 provisions. This means some of the Australian nuances have been removed, reverting more closely to the international standard. Such as: Removing prioritisation of NGER methodologies for measuring GHG emissions, with the Standards now prioritising the use of the GHG Protocol unless otherwise required by law. Removing the scope of scenarios to use. While noting that requirements to apply a 1.5°C scenario and a higher warming scenario have been included in the Corporations Act, which means entities must still apply a minimum of two scenarios. The AASB confirmed its decision, however, to remove requirements to consider industry-specific metrics (which IFRS S2 requires) until a later date.

Why do we need mandatory climate reporting?

The need for standardised, mandated reporting is being recognised globally, with countries around the world implementing climate-related disclosure requirements similar to Australia.

For the last decade, Australian companies have been reporting on their climate-related sustainability efforts using a range of global and voluntary standards. This lack of unified structure poses challenges for stakeholders in understanding and comparing a company’s approach, objectives and prospects towards climate and sustainability, particularly in the context of risk management, targets and transition plans.

Investors now want to understand clearly how companies incorporate sustainability considerations into their strategic decision-making, risk management, and financial statements. They want to know how a company’s sustainability-related risk and opportunities align with its strategy and business model and, ultimately, its prospects for creating long-term value.

From submissions to the consultation, it is clear that many business leaders view the ASRS as a crucial step toward improving transparency and accountability in sustainability reporting. They see it as both a compliance requirement and an opportunity to enhance governance, drive innovation, and meet market expectations. Leaders also welcome the government’s commitment to positioning Australia as a global sustainability leader by promoting sustainable finance.

What are the benefits of reporting in line with the ASRS?

Key benefits of climate-related reporting in line with ASRS and AASB S2 and AASB S1 include:

- Aligns with Global Standards: The ASRS positions Australian businesses alongside global peers in major markets around the world, setting a global benchmark and standard for sustainability-related reporting.

- Consistency and Clarity: With a standardised framework built on accounting principles, ASRS improves consistency and robustness in your reporting, giving you a clearer path for understanding your strengths and weaknesses to identify improvements.

- Investor Transparency: Reporting in line with ASRS provides investors with crucial insights into your company’s climate-related risks, opportunities, and sustainability performance.

- Government Oversight: ASRS enhances government and regulatory visibility of climate risks and opportunities across the economy, supporting informed policy decisions.

- Drive Sustainable Performance: ASRS reporting enables your business to improve internal risk management processes, uncover cost-saving opportunities, foster innovation, enhance resilience, and ultimately – and critically – drive sustainable performance by integrating sustainability into your overarching business strategy.

- Build Stakeholder Trust: Reporting to ASRS strengthens stakeholder trust, aligns with ESG investment trends, and reinforces how you are meaningfully acting on corporate social responsibility.

- Enhanced Data Management and Insights: If you are leveraging tailored digital software to manage and analyse your data to align with mandatory reporting, it will improve your reporting efficiency while enhancing the quality of your insights. A robust software platform reduces errors, delivers accurate real-time data, and supports informed decision-making, resulting in a stronger, more transparent, and rigorous sustainability strategy.

How to prepare for ASRS and AASB S2 compliance

Here are some key questions your organisation should be asking itself to begin preparing for compliance with ASRS and AASB S2.

- When and how will new requirements affect your organisation? Understand the timeline and scope of ASRS compliance to determine your reporting timeline – or that of your supply chain partners.

- Is training required to bring senior leadership teams up to speed? Assess whether your senior and leadership team need training on ASRS and AASB S2 to ensure informed decision-making and to fully understand the breadth and collaborative efforts of work to be done. This is a big change to business-as-usual (BAU), so you need the whole leadership team on board for success.

- Is your materiality assessment up to date? Have you identified the correct climate-related risks and opportunities? Review your materiality assessment to ensure you’re addressing your most relevant and material climate risks and opportunities.

- Are you prepared for scenario analysis? Start developing an understanding of scenario analyses to evaluate how different climate outcomes could impact your business. Seek expert help if you are unsure here.

- How are you planning to capture and disclose GHG emissions, including Scope 3? Ensure your systems for accurate GHG emissions data collection and transparent reporting are up to date. A good software solution will be a valuable tool to help you manage and enhance your reporting.

- How does your corporate strategy align with your sustainability agenda? Review your corporate strategy in line with new mandatory climate-related financial disclosures to ensure they are both integrated and directed towards including your sustainability goals into your overarching plan for long-term resilience and to drive sustainable performance.

- Start exploring digital software that will ease reporting requirements: Tools like Mero, can help automate data collection and manage all ESG data and reporting, aligned specifically to ASRS. Digital platforms can simplify complex reporting processes, improve data accuracy, and save significant time and resources for your organisation while establishing rigour and transparency to support assurance.

How do the ASRS compare to other international sustainability reporting standards?

The Australian Accounting Standards Board (AASB) developed the ASRS to align with the International Financial Reporting Standards (IFRS) Foundation’s Sustainability Disclosure Standards (also known as ISSB Standards).

These standards provide a consistent and comprehensive global baseline across IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information; and IFRS S2 Climate-related Disclosures. The standards also build on the work of the Taskforce for Climate-related Financial Disclosures (TCFD).

In Europe, the ESRS (European Sustainability Reporting Standards) are part of the CSRD (Corporate Sustainability Reporting Directive), which mandates sustainability reporting for large companies in the EU, focusing on environmental, social, and governance (ESG) issues.

In the U.S., the Securities and Exchange Commission (SEC) is responsible for regulating sustainability and climate-related disclosures. The SEC proposed climate disclosure rules in 2022, requiring publicly listed companies to disclose their GHG emissions, climate-related risks, and impacts on financial performance.

Many countries around the world are implementing mandatory climate and sustainability disclosures. Learn more about Singapore and the wider APAC region here, and the global state of play here.

5 Key steps to take now

As we are now in 2026, key steps organisations should take now, depending on which group you fall into include:

- Undertake a gap analysis between current practices and incoming mandatory reporting requirements in line with ASRS and AASB S2.

- Analyse gap analysis findings and prepare an actionable roadmap addressing gaps and what you need to focus on to achieve compliance.

- Start capacity building and training for Board, executive and management levels.

- Start scenario analysis and identify your key climate-related risks and opportunities across your business, focusing on both short- and long-term impacts to guide strategic decision-making and compliance with AASB S2.

- If you aren’t sure where to start or if you are on the right track, get help now. This is complex, and few companies will be able to navigate this alone. There are many experts available to help guide you through, so don’t be afraid to reach out to set yourself up for – and maximise – your success.

ASRS Preparation – Case Study with The Sussan Group

Learn how we provided The Sussan Group with expert support to prepare for its inaugural climate disclosures under ASRS and reporting to AASB S2 and strengthen its emissions reporting processes. Link to case study.

What our clients say

How can Anthesis help you to prepare for reporting in line with ASRS and AASB S2?

Anthesis is among a select group of firms with extensive expertise in all aspects of climate disclosures, supported by advanced digital tools and software. Our experts understand the complexity required for compliance and have the skills to drive long-term resilience and sustainable performance for your business.

Anthesis experts can guide you through the full process of reporting to the Australian sustainability standards or assist with particular elements of reporting, such as analysing your climate-related risks and opportunities, scenario analysis, Scope 3 reporting and climate transition planning. We can guide you on how to integrate outcomes into strategic plans and risk management processes, ensuring you’re prepared for compliance. Our digital solution Mero, is designed to align with ASRS disclosures, providing a streamlined solution for data collection and management. It ensures transparency, data integrity and rigour, supporting your reporting processes and assurance requirements.

See more insights below and check out our events page to learn from our experts in our 6 Part Flash Webinar Series dedicated to navigating the ASRS AASB S2 standards.

As technical experts and trusted advisors to some of the world’s most well-known companies for over a decade, and have helped hundreds of clients with reporting to Frameworks and Standards. We’re here to help you through this new era of reporting.

Examples of organisations we’ve supported on climate risk and ASRS disclosures

Original post published October 2024, last updated January 2026.

Get in touch

We’re here to help you navigate the complexity of the new disclosures. Call us for a chat on +61 3 7035 1740 or reach out to our experts via email or this form.