Home – Regulations – European Sustainability Reporting Standards (ESRS)

Table of contents

- What is ESRS?

- Who is impacted, and when?

- How to prepare

- Key features of the ESRS

- ESRS updates

- Changes to the ESRS

- Contact

Share this guide

Please note that the European Commission has released an update on an Omnibus Regulation, which may affect the information below. Among the potential changes are adjustments to the regulation’s scope, reporting thresholds, and some requirements. Updates will be provided once the details have been confirmed.

What are the European Sustainability Reporting Standards?

The European Sustainability Reporting Standards (ESRS) are a set of reporting standards that are used to meet the requirements of the EU Corporate Sustainability Reporting Directive (CSRD). In other words, whilst the CSRD sets out reporting requirements and obligations, the ESRS provide the framework and methodology for reporting.

The CSRD marks a landmark shift in requirements for companies to report sustainability-related information about their operations, alongside financial information and aims to promote sustainable development through transparency by advancing the scope and quality of corporate sustainability reporting. Implementing the CSRD through the ESRS enables stakeholders to gain improved and comparable insights into the business practices of obligated companies.

The time to start preparing for CSRD reporting is now

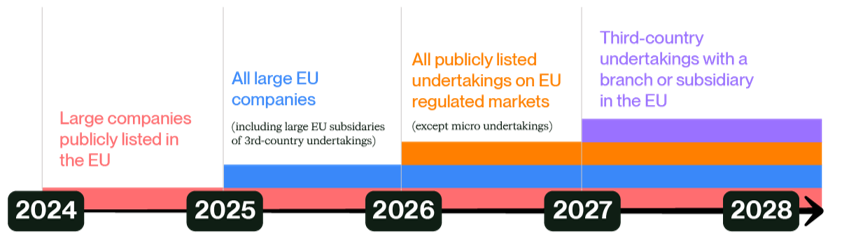

Large, publicly-listed EU companies are required to report in accordance with ESRS for financial years beginning on or after January 1, 2024, and other large companies will be called in for periods on or after January 1, 2025.

The adoption of the CSRD in 2022, and subsequently, the European Sustainability Reporting Standards ESRS in 2023 has continued to show the EU’s ambition to put sustainability reporting at the same level as financial reporting.

What companies are impacted and when?

Large companies with over 500 employees and who are publicly listed in the EU are required to report in line with the ESRS for financial years beginning on or after January 1, 2024. Other large EU companies have an extra year to prepare, being required to report for periods on or after January 1, 2025.

This second set of large companies consists of those that meet two of the following criteria:

- Companies with over 250 employees

- Companies with over 40 million EUR net revenue

- Companies with over 20 million EUR in total assets

The majority of publicly listed EU undertakings, as well as non-EU companies with branches or subsidiaries in the EU, will then be required to report in 2026 and 2027, respectively.

How can your organisation prepare?

The CSRD and ESRS represent a critical step forward in the EU’s journey toward a more sustainable business landscape. By harmonising reporting practices and elevating the quality of disclosed information, these initiatives empower stakeholders to make informed decisions, drive positive change, and contribute to a more equitable, sustainable future.

As companies align with these frameworks, they not only comply with regulatory requirements but also position themselves as leaders in sustainability, capable of navigating the complex terrain of ESG considerations with confidence and purpose.

Our approach to mandatory reporting spans six key steps

Discover Anthesis’ approach to mandatory reporting

| Approach | Services |

| Set the context – A range of regulations may apply based on your business context, and each carries it own timelines and requirements. | – ESG regulatory landscape evaluation – Product and value chain regulatory scan – Initial team education on requirements |

| Understand what matters – Most current ESG regulations require analysis and reporting based on a type of materiality, up to and including CSRD-compliant double materiality. | – Double materiality assessment – Impact materiality assessment – Financial materiality assessment Risk assessments |

| Identify gaps – Each regulation contains functional and content metrics, requiring in-depth, current state gap analysis. | – Readiness assessments |

| Plan for change – Closing compliance gaps typically means program, governance, and / or disclosure changes on a specific timeline, requiring a custom roadmap and stakeholder alignment. | – Implementation plans |

| Build capabilities – Depending on the regulation, you may need to implement expert-supported projects, such as developing a climate transition plan, to meet your compliance obligations. | – Executive education – ESG governance ESG data management – Transition planning – Scope 1, 2 and 3 GHG inventory – Scenario analysis |

| Report with confidence – Each regulation has specific requirements for assuring and reporting your data, and the higher stakes of financial reporting mean current voluntary reporting should be designed for consistency. | – ESG reporting and assurance support – Voluntary and management standards alignment |

What are the key features of the final ESRS?

Two cross-cutting ESRSs and ten topic-specific ESRSs (5 environmental, 4 social and 1 on governance) will require disclosure on governance, strategy, and impact, risk and opportunity management.

The cross-cutting ESRS 1 and 2 are mandatory to report on for all obligated companies, whereas the topical standards are only mandatory to report on where material. This is determined through a Double Materiality Assessment, which will support stakeholders in understanding the organisation’s impacts on people and the environment as well as the material financial impacts of sustainability matters on the organisation.

The 12 ESRS Standards

| Group | ESRS Number | Subject |

|---|---|---|

| Cross-cutting | ESRS 1 | General Requirements |

| Cross-cutting | ESRS 2 | General Disclosures |

| Environment | ESRS E1 | Climate |

| Environment | ESRS E2 | Pollution |

| Environment | ESRS E3 | Water and marine resources |

| Environment | ESRS E4 | Biodiversity and ecosystems |

| Environment | ESRS E5 | Resource use and circular economy |

| Social | ESRS S1 | Own workforce |

| Social | ESRS S2 | Workers in the value chain |

| Social | ESRS S3 | Affected communities |

| Social | ESRS S4 | Consumers and end users |

| Governance | ESRS G1 | Business conduct |

There are four reporting areas and three reporting layers that are part of the disclosures.

Four reporting areas

- Governance: aims to provide stakeholders with insights into a company’s commitment to sustainable practices.

- Strategy: aims to provide a clear understanding of the governance mechanisms, controls, and procedures established for monitoring and managing sustainability aspects.

- Impact: aims to report on the procedures used to identify critical sustainability impacts, risks, and opportunities.

- Metrics and targets: aims to provide insight into performance indicators used by the company to assess critical sustainability issues.

Three reporting layers:

- Sector-agnostic disclosures

- Sector-specific disclosures

- Entity-specific disclosures

ESRS news and updates

On July 25, 2024, the EFRAG released a study on the early implementation of the ESRS. The objective of this study was to provide an overview of of emerging practices in the implementation journey of the CSRD and ESRS. The key five takeaways include:

1. ESRS – Double Materiality

- Most companies see the benefit of a thorough, data-driven approach to assessing their ESG impact, rather than relying on guesswork. This helps them report accurately and prioritise their ESG efforts. About 85% plan to integrate these findings into their overall business strategy.

- While a few view this as just a compliance exercise, around 70% are already using a data-driven approach, involving internal experts and stakeholders.

Discover our Double Materiality Services

2. ESRS gap analysis & Data Points

- Many companies struggle to align their assessments with specific data points they need to report, which can lead to reporting more data than necessary. About 80% find data collection challenging across all ESG areas.

- Most use a specific guidance (EFRAG IG 3) for gap analysis, with 75% gradually implementing the standards. Around 95% use this guidance, and 20% are preparing for future digital reporting.

3. Value Chain Mapping

- This is the least developed area. Companies could use more sector-specific guidance. Many have simplified their value chain mapping (suppliers, own operations, customers) and plan to go more in-depth later.

- Around 90% are refining their value chain details, with 45% already doing detailed mapping. Non-financial institutions are starting to go beyond just direct business relationships.

4. ESG reporting – Organisational approaches

- Companies are rethinking and reorganising their structures for ESG reporting, which varies widely and is still evolving.

5. CSRD reporting – Organisational impact

- New reporting requirements have improved collaboration across departments like Sustainability, Finance, Risk, IT, and business units. All companies engage in cross-departmental collaboration.

- There’s a push to standardise ESG reporting processes, similar to financial reporting. About 90% are improving data quality controls, and 85% see the need for IT transformation.

- The ownership of ESG reporting is being debated, with 65% assigning it to a single role (e.g., Chief Sustainability Officer or Chief Financial Officer), while 35% use a co-leadership approach.

Changes compared to previous iterations on ESRS

After the standards were first released, they went through a 15-month public consultation process. The basic principles (e.g., double materiality) were retained however, the structure was changed to align more closely with the Task Force on Climate-related Financial Disclosures (TCFD).

Key changes to this iteration of the ESRSs include:

- Providing more flexibility in deciding what information to disclose in reports. All disclosures except ESRS 2 are now subject to the materiality assessment. However, companies will need to provide a detailed explanation to support stakeholders to understand why the company has not disclosed the information.

- Relief measures introduced to support companies in implementing data collection and reporting systems. Companies are now not required to disclose the expected financial impacts of environmental risks in their first year of reporting. For the following two years, companies may provide qualitative disclosures of these impacts but are not required to provide specific numbers.

- An increase in the number of voluntary data points due to the difficulty and cost for companies to provide them.

The difference between CSRD and ESRS

Anthesis Solutions

Our services help you navigate today’s regulatory landscape with ease. We guide you in conducting a CSRD-compliant double materiality assessment, identifying data gaps, and planning necessary changes for ESRS compliance.

We build your team’s capabilities to drive positive impact on key topics, ensuring you have the expertise to gather accurate data and report with confidence. With our support, your sustainability reports will be both compliant and meaningful, highlighting your commitment to transparency and responsible business.

Get in touch

ESRS Content

Get in touch

We’d love to hear from you

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.