Contents

- The business case

- Understanding Natural Capital

- The impact of COP15

- The role of Economic Valuation

- How to measure Nature

- Where to begin

Share this article

Nature is the foundation of our societies, economies, and well-being. Yet despite growing scientific and regulatory consensus on the importance of protecting nature, biodiversity continues to decline at a rate that threatens not just ecological resilience, but business continuity.

At the intersection of science, economics, and systems thinking, a growing body of work is helping to clarify how organisations can begin to measure and account for the value of nature and biodiversity. This shift is not only about recognising environmental responsibility—it’s about embedding resilience, competitiveness, and long-term value into the core of business models and public strategies.

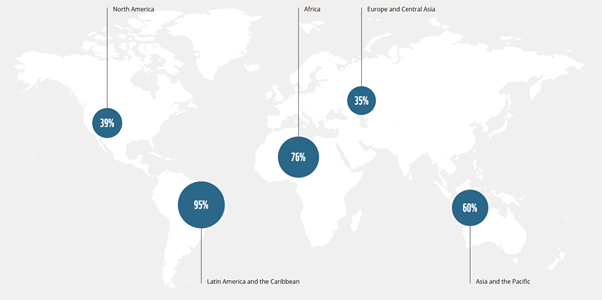

The case for valuing nature

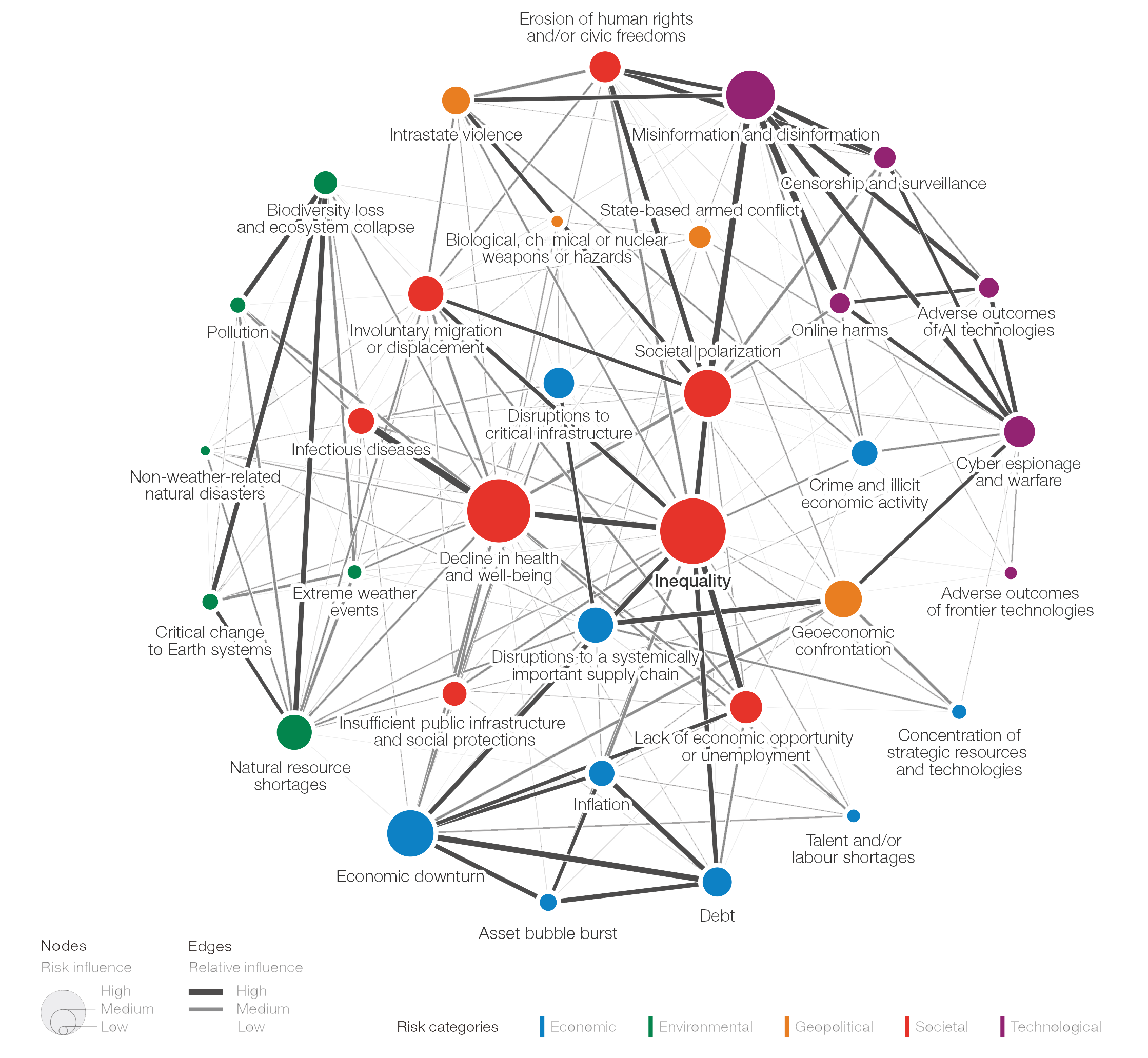

The urgency is clear. Since 1970, monitored vertebrate populations have declined by 68%, according to WWF’s Living Planet Index. At the same time, over 50% of global GDP is moderately or highly dependent on nature. Biodiversity loss is now ranked fourth among the most severe global risks in the World Economic Forum’s 2024 Global Risk Report.

What emerges is a stark but compelling reality: nature is not a peripheral concern. It is a critical enabler of long-term value creation, resilience, and licence to operate.

And yet, in most business models, nature’s value remains invisible—unmeasured, unmanaged, and unaccounted for.

This is where natural capital approaches play a transformative role.

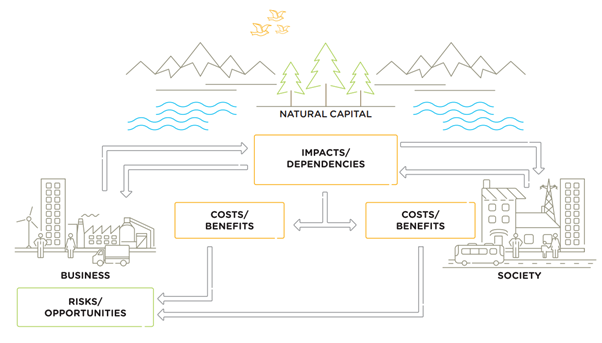

Natural Capital: A systems lens on nature and economy

At Anthesis, we work with the definition of natural capital as “the stock of renewable and non-renewable natural resources”—including air, water, soil, biodiversity, and ecosystems—that combine to yield a flow of benefits to people and the economy.

These benefits, often called ecosystem services, are categorised into:

- Provisioning services (e.g., food, water, timber)

- Regulating services (e.g., climate regulation, pollination)

- Supporting services (e.g., soil formation, nutrient cycling)

- Cultural services (e.g., recreation, spiritual value)

Through production, consumption, and disposal, businesses both depend on and impact natural capital. These interactions create operational risks, regulatory exposure, reputational concerns, and strategic opportunities.

To address this, businesses need to move beyond compliance and risk mitigation and toward nature-positive value creation—embedding nature in governance, strategy, decision-making, and disclosure.

Biodiversity: The quality dimension of nature

Nature and biodiversity are interrelated but distinct. While nature refers to the totality of the natural world, biodiversity describes the variability and richness of life forms within it—including genetic, species, and ecosystem diversity. Biodiversity is often a key indicator of ecological health and resilience.

In our work, we see biodiversity not only as an ecological imperative but increasingly as a business materiality issue. In a recent WBCSD survey, 96% of participating companies identified nature as material, with 74% specifically citing biodiversity.

Yet biodiversity is inherently complex to measure. Unlike greenhouse gas emissions, there is no single metric. Valuation approaches must be multidimensional, context-specific, and sensitive to trade-offs.

COP15 and the Global Biodiversity Framework

The UN Biodiversity Conference (COP15), held in December 2022, signalled a new era for nature-related governance. One of its key outcomes was the Kunming-Montreal Global Biodiversity Framework, which includes 23 targets—three of which will have profound implications for business:

- Target 15: By 2030, large and transnational companies and financial institutions must assess and disclose their risks, dependencies, and impacts on biodiversity across their operations, value chains, and portfolios.

- Target 18: Calls for the reform or removal of environmentally harmful subsidies—estimated at $500 billion annually—creating new drivers for sectoral transformation.

- Target 14: Embeds natural capital accounting into national policy and planning frameworks, further institutionalising ecosystem valuation.

These developments represent a shift from voluntary leadership to mandatory action. They also provide a global north star for companies preparing nature strategies and transition plans.

Economic valuation: translating nature into decision-making language

Economic valuation refers to a set of methods used to assign monetary value to ecosystem services and environmental impacts that are not captured in market prices. While the idea of pricing nature can raise ethical and methodological questions, valuation plays a crucial role in bridging the gap between environmental and financial decision-making.

When integrated into business and policy processes, economic valuation helps organisations:

- Compare the relative value of ecosystem services

- Prioritise biodiversity and nature-related investments

- Conduct cost-benefit analyses of products, projects, or land-use decisions

- Communicate effectively with finance teams, investors, and policymakers

Common valuation methods include:

- Market pricing – Using observed market data for nature-based goods or services (e.g., timber or water pricing)

- Hedonic pricing – Inferring value through associated markets, such as real estate or tourism

- Travel cost method – Estimating recreational value based on the time and money people spend to visit natural sites

- Restoration cost method – Using the cost of ecosystem restoration or damage remediation as a proxy for lost value

- Contingent valuation – Using surveys to understand people’s willingness to pay for environmental improvements or avoid degradation

No single method offers a complete picture, and each has limitations. But collectively, these approaches offer a robust and scalable toolkit. When paired with scientific modelling—such as impact pathway analysis—they provide a powerful foundation for nature-based decision-making that is both rigorous and actionable.

Measuring nature and biodiversity

Measuring nature is inherently complex—but that does not mean it’s impossible. A range of tools now exist to help companies get started:

- ENCORE: Helps identify sector-specific dependencies on ecosystem services

- BioScope: LCA-based tool for identifying biodiversity hotspots in global value chains

- WWF Biodiversity Risk Filter: Assesses location-based nature-related risks

- Natural Capital Protocol: A globally recognised framework for conducting natural capital assessments

- TNFD’s LEAP Framework: A practical structure for understanding location-based nature-related risks and dependencies

Choosing the right tool depends on your objectives, maturity level, and data availability. But for most companies, a logical starting point is a double materiality assessment that maps both how the business affects nature and how nature affects the business.

Where to begin

The journey to nature-positive transformation is complex—but increasingly necessary. Based on our experience, we recommend the following steps:

1. Conduct a materiality and risk assessment

Identify your business’s most significant impacts and dependencies on nature. Use tools like ENCORE and BioScope to support a structured assessment.

2. Set ambitious but achievable nature noals

Align with science-based targets for nature, even as the methodologies are evolving. The SBTN framework provides a robust foundation.

3. Integrate nature into governance

Ensure board oversight and assign internal accountability. Embed nature into enterprise risk management, sustainability planning, and product development.

4. Translate nature into financial language

Use economic valuation to assess and communicate nature-related risks and opportunities. This will be essential for engaging with finance teams, regulators, and investors.

5. Engage stakeholders across the value chain

From suppliers to customers to communities, nature-related impacts are often shared. Collaborative approaches will be needed to address them.

How Anthesis can help

At Anthesis, we combine scientific integrity, economic rigour, and strategic insight to help clients drive nature-positive outcomes. Whether you are responding to regulatory pressures, setting voluntary targets, or developing new products, our teams can support you across the full journey—from impact assessment and valuation to circular design and strategy execution.

Get in touch with our nature and biodiversity experts at Anthesis.

If you’re ready to explore how your organisation can better value, protect, and benefit from nature, we’re here to help.