In this episode, host Chris Peterson is joined by Don Reed to discuss the emerging risks and opportunities of climate change, and how organisations can begin to quantify them.

Read the transcript

Chris Peterson: Hello, and welcome to sustainability matters. A new podcast brought to you by Anthesis. We’re a global team of sustainability experts who strive to support others in achieving a more productive and resilient future. We believe that the world deserves better and that change is vital for our people, cities, businesses, and planet.

My name is Chris Peterson. I’m an associate director at Anthesis, and my passion really lies in leveraging the power of business to drive social value. Over this podcast series, we’ll look at a whole host of sustainability issues and consider their impact for different sectors. We’ll unpack the topic, explore the potential solutions and hopefully inspire others to share in our vision.

And our first episode, I’m excited to be joined by my colleague, Don Reed, executive director with Anthesis Group, Don and I have had some great conversations around climate risk and the investor community, and the expectations that are evolving within this space and I invited Don to come on to the podcast today to share some of those insights. So Don welcome.

Don Reed: Thank you very much, Chris. Looking forward to the conversation.

Chris Peterson: Fantastic. So why don’t we jump right in. Maybe you could start by just giving us a little bit insight around what is meant by climate risk.

Don Reed: Well, the key question is really what are the risks to business success that are posed by climate change?

And those can be things like, you know, business interruption costs, changes, brand reputation, revenue, all sorts of things. But the way we found that’s most successful for how to think about that is really a matrix between the impacts of climate then thinking about operations, supply chain and markets.

So on the impacts, usually that world is divided into the physical impacts and the transition impacts and the physical impacts, in turn, include things like chronic or incremental changes. Things like temperature rises and changes in growing seasons and that sort of thing. But particularly for utilities, things like reduced water supply in some regions, which can affect the cooling systems for thermal power plants.

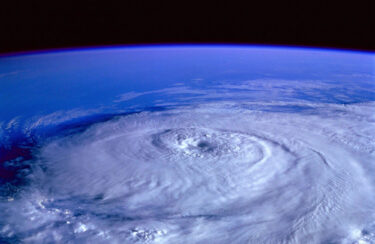

But not just those kinds of chronic effects, also acute or event effects, like more intense rainfall events, increase in cyclones or hurricanes. And then there’s those physical impacts that really cross over, like big storm surges from large hurricane-type events combined with higher sea levels, having the double whammy impact.

But the physical side and then transition, like how is the public policy world going to respond to climate change? You’re used to thinking about things like a price on carbon or regulation of carbon emissions in the utility industry, but it can also be things like greater incentives or renewables and changes in market preference for a low carbon power.

And then, you can’t think about transition without also having an overlay of the technology development curves, particularly in things like renewables and storage, where that’s an ordinary part of your business planning in the utility industry. But the added aspect of incentives changing that kind of break even cost point or cost parity between renewables and existing thermal assets.

All that is part of the complexity of thinking about transition risk. Then for all those kinds of risks, we also need to think about them in what do they mean for your own operations and that’s particularly true in utilities, but it helps to also think about them in supply chain and then in your end user markets.

So that’s kind of the framework for what do we mean by climate risk and all of those also have an opportunity aspect to them. We think if you can think first about the risks, and that’s very real, but we definitely have some utility clients that have put a lot of emphasis on their climate analysis, on the opportunities, because they think they’re really well positioned and they have good long-term assets.

Chris Peterson: That’s perfect. Thanks for that overview. Because I think that is that interesting insight, right? That there’s this evolving and emerging focus and structure around how people are thinking about this climate risks. And it feels like it’s evolved from being a relatively vague concept to one that is robust, having these really clear elements to it. And I guess maybe building off of that, why do you think that’s coming up more and more than now? Are there to drivers within that, or things that are really impacting that currently?

Don Reed: I think they’re probably three things that really drive it in particular in the utility industry. The first is just sort of the general ambient awareness about climate change as a big societal issue. It’s closer to the front of mind for a lot of folks. And so that’s true in the utility industry, your customers, your investors. And so that’s a big general one that sort of elevates the issue. I think particular to the utility industry investors, particularly global investors have an example or two that make them think that this could be a big issue in the utility industry.

I think that the leading example is the German utility industry and we all, as all of us focused on the utility industry, you understand that while the German utility industry is quite different and unique and different set of circumstances. But if you’re an investor that invests across a lot of different industries, you might just see the example of Germany and what happened with the utilities there as being well, ‘why couldn’t that happen here’ and our company’s really ready for it because Germany really adopted the Energiewende policy, which provides a lot of incentives for renewables behind the meter. And that really drove down wholesale power costs, enhanced the profit margins for conventional generation and had a huge impact on the valuation of utilities and drove merger activity in the space, et cetera.

That really sort of set the stage in the industry for thinking about this as a new and different source of uncertainty. Investors are used to uncertainty in general, but they think about utilities as being relatively safe, you know, sort of sector. And so any sort of new uncertainty or different uncertainty with different qualities feels prominent.

I think the third thing why a reason why this is really on the agenda is the task force for climate related financial disclosure, which is a G20 finance initiative to promote reporting on these risks in

Regulatory financial filings. It’s a framework for disclosure, which ends up really setting up a framework for analysis, and so it’s very useful that way. It has key features of requiring or suggesting scenario analysis and saying ‘well, how would you be ready? And what would be the financial implications if there were no effective action on climate change and there were lots of physical changes?’, ‘but if it was just business as usual or if there were effective actions for limiting climate change to one and a half or two degrees Celsius?’.

And all of that is a new reporting framework and so it attracts some attention and some investors will have already begun engaging companies in the utility industry about: are they reporting? When will they be reporting against the standard?

But I think that you don’t do it just because there’s a new standard. You do it because it’s a good business choice. Those are three of the factors really driving this onto the agenda.

Chris Peterson: Yeah that’s really helpful. And maybe just circling back to the investor climate, cause I know that’s an area that has always fascinating digging in with you. Do you see that evolving relatively quickly? I know that there’s been this kind of shift in mentality that we’re hearing about in practice; the BlackRock comments and drivers and boards, et cetera, as an example of that. Is that something that you are seeing reflecting in practice? Is that something that you think is kind of matured at this stage or is evolving and growing over time? Or how do you view it?

Don Reed: You’re absolutely right that the trends are still in that early stage, that there are definitely some thought leaders on the investor side that are vocal advocates for doing this kind of analysis and providing disclosure.

BlackRock is a good example, but there are other institutional investors that publicly announced that they will do this disclosure themselves and that they will advocate for the companies they hold to also do it. I think it’s still early days because the institutional apparatus that really gets that rolling is just starting, but you’re seeing very public examples of investors saying this is how they’re approaching the analysis, this is how they’re thinking about these risks and then engaging companies around their analysis and disclosure on it. And so it’s definitely building and has the potential to move very quickly. I guess I stopped short of predicting that because I think a lot of times the talk about these kinds of changes precedes the action. So there’ll be a lot of talking before there’s lots of action.

But I would say that utilities along with the oil and gas industry, some parts of the materials and chemical industry will be the first, or are already the first, key targets for those investors.

Chris Peterson: It was an interesting indicator for me to reinforce your statements there of seeing BlackRock as an example is really investing in regional data sets to understand what do those climate risks look like for their investments and trying to map that against the location of the utility assets, for example. Which speaks to that next step from lip service to really starting to recognize and differentiate their investments within that.

Don Reed: Right. And parallel to that, we’ve also done work with the utility groups at a commercial bank that was really looking to upgrade significantly their analysis of these issues across their whole credit portfolio. We did that by drawing on numerous public data sources, some of them very specific to the asset location, but also very specific to their regulatory situation.

Just because you have large admitting assets means that they’re going to be challenges around cost recovery. It’s a more complicated situation than that. And so the level of sophistication of that analysis is growing pretty rapidly and the adoption of those kinds of techniques on the investor and lender side is the game.

Chris Peterson: Well, assuming you have now scared people, how do you recommend that organizations respond to this based off your experience and what you’re seeing out there in the marketplace?

Don Reed: Well you never really want to come at any of this from a point of fear. I think what you want to do is really come at it from the point of view that this is a business issue and we want it treated as such. And so we really recommend a three step process where you really assess what risks you are have on these and where your opportunities are. So in assessment phase, and then really evaluate the business impacts quantitatively, and that gets to the application of scenario analysis.

And then you really want to optimize your response plan. Where most utilities are really is in that assess phase. And so where you really want to look at is where do we have value at stake on climate change broadly? And that language is chosen carefully because it really is both risks and opportunities -where’s the value here.

What’s the order of magnitude of that value, which of these impacts is most important to us and our utility and our strategy long-term. And then what are the value pathways that you expect to see that follow? So is it around a price on carbon that changes a generation mix? Is it incentives for renewables that decrease demand because there’s a greater cost parity behind the meter. all those kinds of questions.

So you really try to narrow the universe of topics to focus on. Where are their physical risks to our actual plants, water availability or, persistent flooding, how are they hardened? How are they insured?

But really narrow it down to the set of risks and opportunities that you think are most important or salient for your company. And then move into that evaluation of business impacts, using quantitative techniques and be testing your response plan and maybe refining that. Certainly testing your existing plan for how you deal with climate change, risks and opportunities. But then be open to what are the other response plans that are better suited to your particular situation and are more valuable under a full range of different scenarios.

Chris Peterson: It’s fascinating to see how that develops and I’d be curious to hear, I know that you’ve supported a number of companies in understanding this, understanding the growing investor pressure, how best to respond to that. Has there been any kind of key lessons learned through that in terms of how companies have approached it and in particular, how they’ve extracted value from that effort, whether that’s communication to an investor or changing the practices internally?

Don Reed: Yeah. So I think that there’s a couple of things in some of these, this is very straightforward, so not exotic. To get started and don’t be paralyzed. think that a number of companies have looked to at the TCFD framework and what they’re asking for and thought, oh my God, this is grandiose. How are we going to do this? This is would be really hard maybe outside of our organizational capabilities.

And we just think that that’s the wrong response, you don’t want to be paralyzed by these great ambitions, but really say, oh, okay, we’re good. Every journey starts with his step.

And so we’re going to begin with some assessment. We’re going to build among multifunctional team on our side that can understand what’s going on in the market and lay out plans for how you would do this kind of an assessment as a first step. It’s really important to come at this from a mindset of this is ‘good business planning’, and you want to take it all in and think about this in conjunction with other things going on in your business, not as an isolated thing and multifunctional teams really help with that.

Some of the other things that have been more specific to utilities, particularly the risks and opportunities thing, like I mentioned earlier; power generators and utilities have great opportunities in this space and they may or may not be well positioned for that.

But to really think about it really as both opportunities and risks: one of the challenges is that a lot of business planning has a relatively short time horizon and sometimes, even in the utility industry where assets are extremely long lived, the planning horizon is constrained, and a bunch of these impacts are already occurring, but they’re anticipated to be happening over long periods of time as well. And so having longer time horizons or being able to willing to experiment with longer time horizons is very much to your advantage to be able to say, ‘oh, okay, maybe this is not, or these issues are more important in the near term, but there are some other things that are really important in the long-term and we want to build, understanding and capability over some of those long-term issues and not just concentrate on those that are already important in the near term.’

Chris Peterson: Well, I think as you said too, like with the long lived assets within the utility space, some of these short-term decisions have very long term, long tails to them. And I guess just out of interest, when you think about the investor community, are there specific groups within that that are thinking that longer term that are shifting to expectations around this? Or is it still that kind of short-term impact and considering what are the implications of this backend risk to the ability to kind of transfer those assets?

Don Reed: Right. So it’s really important to be able to understand the full universe of your investors and that we hear a lot from the active investors that are moving in and out of utilities and your particular company, and there’s an analyst community that follows them and they attend your quarterly earnings calls and things like that.

That’s a very important part of the shareholder base. But there’s also a whole other part of your shareholder base, which are large passive long-term investors, really permanent holders. And that’s represented by investment firms like BlackRock, but a number of others that own your company, because you’re a part of an index and they’re tracking that index and they don’t buy and sell around your latest trends and news. And they are really permanent holders of you. They tend to engage your company at the board and separate corporate secretary level, rather than at investor relations. And they have the mindset that they’re going to own you forever so they want you to get this right.

So they may be a very important constituency for you for this, but they have different access points to your company than perhaps you’re used to working with.

Christ Peterson: I think that’s a really helpful insight. I don’t know if you have any perspective on the bond market as well, for those that aren’t necessarily investor-owned utilities, but you know, still looking for, for those ratings.

Don Reed: The debt or similar in the lending world is a little less exposed to the risks and opportunities than the equity world. And so, they are maybe one step behind in timing and rigor on analysis of these issues. But we increasingly see fixed income investors paying a lot of attention to these topics and really adopting the analytical techniques of evaluating these issues from their fellow investment professionals on the equity side. They have a big difference, of course, in the sense that they were thinking about this in terms of the impact on credit quality. And so cashflow coverage is their, you know, kind of lingua franca.

But there are definitely many of them that are increasingly thinking about this as a part of the mix. But I think they are maybe half a beat behind the equity investment professionals on how do you integrate this into their investment decision making?

Chris Peterson: And then maybe just a couple kind of final questions before we look to wrap up, you had mentioned this overall process, and I’m curious, time-wise, given that we are talking about these like fairly significant kind of efforts to really get our heads around where this is going and that pivot within the organization, what kind of timeframe should an organization be thinking about, when they’re thinking about implementing a plan or really getting started on this journey?

Don Reed: Yeah. So the time to be thinking about and building support for the idea of doing this kind of analysis, if it doesn’t already exist, is now because we really find that getting started early is a long-term advantage because it enables you to socialize the idea across those kinds of multi-functional teams that you’re going to need to have to do this.

It doesn’t have to be a multi-year process to begin with. It can really start with ‘oh, okay, we’re going to create a multifunctional team. We’re going to organize our horsepower to do that assess phase and think about that. We’re gonna school up, um, a core people that really understand that’ And all that can happen in the course of really just a couple of months.

The key is to start thinking about real action steps now to get that process in motion because all of our organizations are kind of slow to get moving. You can use examples of other utilities and power generators that are reporting on this and being able to see out there in the public domain, but some of them are sharing with regulators as well, and sort of get a sense of what the speed of traffic is out there.

Not that you should do what everybody else is doing. Rather that you should understand what the what’s happening in the market than others that are your investors are seeing others do. And that all that is helpful getting something started on this.

Chris Peterson: The last question I have is around extracting value from the effort. I see lots of channels for that, but just curious if there’s a few key takeaways that you’ve had through your experience of when you initiate on this, here’s how you set yourself up to really get the biggest return.

Don Reed: So there’s some real simple, early returns that you get from doing this kind of work. Some of it is, you know, just directly from those investors where you’re communicating: “Hey, we’re on this case, we are flexible in our thinking about this, and we’ve got a process in motion and with a number of investors on this”. That’s a big plus because their greatest fear is that companies they hold don’t have this on their agenda and aren’t thinking this way.

So I think that’s a quick, early return. I think that same sort of return can happen with regulators as well and with policymakers. That’s, of course, really specific to your own jurisdiction, you’re on your own regulators, if you have them. But I think that that’s a real early return.

What we found in some utility clients when we’ve actually gone from the assessment phase, which kind of gives you that roadmap of where you should be concentrating and into the evaluation phase, we found that a couple of them have really seen a new kind of way of seeing the value of their investments in renewables, efficiency and storage. And seen in scenarios where those assets are even more valuable and have a stronger business case than they had currently.

And it’s that rigor of the process and really looking at that across different scenarios that’s really valuable. Being able to say how valuable are these assets and how do we think about what that value looks like over time?

We do have a client who’s done that and who was almost hesitant to talk publicly about the value of those assets over a long period of time, just because it was so much more valuable than they had thought when they started making those investments. It was almost like admitting, ‘oh, we didn’t even really know how good this was’.

Chris Peterson: That’s the outcome you want from that versus the opposite. But I think what’s interesting throughout all of this and was your consistent message of it’s better to know. And that expectation with investors right that we expect that you will know these answers. And we’re going to start asking those questions. So, Don, this was, this was fantastic. Thank you very much. Anything, anything you missed or any final comments from your side?

Don Reed: Wonderful conversation, and really look forward to more of these kinds of conversations at the utility company level.

I just want to say, thanks again, really appreciate the insights. Thank you again to everybody for listening today. And looking forward to connecting with you again soon.

If you have any feedback on the podcast, get in touch with our host Chris Peterson at: [email protected]