Table of Contents

Share this article

Climate and nature are inseparable, with intertwined impacts on business, society, and daily life. However, most companies still analyse and report on climate risk and nature risk separately — often following frameworks such as the TCFD for climate and the emerging TNFD for nature — creating blind spots in corporate strategy and resulting in sourcing, investment, and land‑use decisions that are based on an incomplete picture of the risks involved.

By integrating climate and nature risks, and by aligning approaches across both TCFD and TNFD guidance, companies can instead leverage a more comprehensive foundation for resilience and can gain a competitive edge.

From frameworks to foresight: Using TCFD and TNFD together

The consequences of a fragmented approach to climate and nature risks can be significant. Climate risks like extreme weather events and the transition to a low-carbon economy can accelerate biodiversity loss and ecosystem degradation. In turn, degraded ecosystems weaken natural defenses against physical risks like flooding or drought, amplifying sourcing and supply chain disruptions for businesses dependent on critical commodities. When climate and nature risks compound each other, assessing them separately creates gaps and dangerously underestimates true exposure.

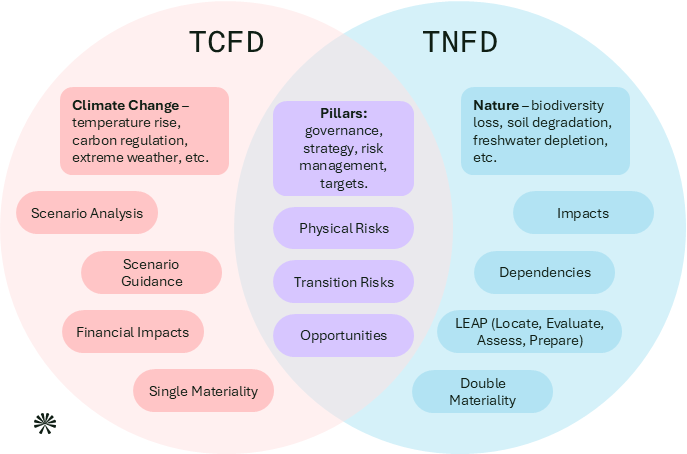

Integrated assessments of both climate and nature can work to close these gaps. The Task Force on Climate-related Financial Disclosures (TCFD) and the Taskforce on Nature-related Financial Disclosures (TNFD) are complementary frameworks for assessing and disclosing the financial impacts of climate-related and nature-related risks and opportunities, respectively. TNFD’s LEAP approach (Locate, Evaluate, Assess, Prepare) provides a structured process for understanding nature‑related dependencies and impacts, making it a natural companion to TCFD’s framework for assessing climate-related financial risks.

TCFD helps organisations disclose the financial impacts of physical risks (extreme climate events) and transition risks (policy, technology, market, and reputation) from climate change, while TNFD addresses nature-related risks, including ecological dependencies and impacts, through tools like the LEAP (locate, evaluate, assess, prepare) approach. Importantly, TNFD highlights the ecosystem services that businesses and their supply chains rely on to grow commodities or maintain continuity in their operations, like pollination, water regulation, soil fertility, and disease control, which are often missing in traditional climate risk models.

By integrating TCFD and TNFD, companies can move beyond compliance to strategic foresight, recognising how climate and nature changes interact and compound financial impacts across operations, supply chains, and markets.

TNFD vs TCFD: What’s the difference?

The TCFD provides a globally recognised framework for assessing and reporting climate‑related financial risks and opportunities. The TNFD expands the scope of this structure to include nature‑related risks and dependencies — such as biodiversity loss, ecosystem degradation, and natural‑capital impacts — reflecting the growing expectation for organisations to disclose sustainability‑related financial risks beyond climate into nature, biodiversity, and ecosystem services.

While TCFD remains the foundation for climate disclosure, TNFD enables companies to adopt a more holistic, integrated view of environmental risk. Together, the two frameworks help organisations move from climate‑only strategies to a more complete approach that recognises the interconnected nature of climate, ecosystems, and long‑term business resilience.

Compounding climate and nature risks in action: commodities

Climate risk assessments have become more common as financial reporting becomes mandatory, yet many companies still overlook the equally critical, and interlinked, nature-related risks. Deforestation, biodiversity loss, and water stress are not only nature issues – they amplify climate-related disruptions – and assessing climate and nature risks separately can create specific blind spots in sourcing, land use, and resource planning. Integrated assessments are therefore no longer a niche consideration, but a strategic imperative.

At Anthesis, we support clients in developing integrated assessments that holistically combine climate and nature risk analysis for reporting and planning, uncovering critical, interacting blind spots. Beyond operations, we also assess how climate change may affect commodity yield, pricing, and productivity across plausible futures.

A real‑world example: soy sourcing and compounding risks

For example, consider a multinational food and beverage company sourcing soy:

- A standalone climate assessment might show that the region faces future water stress from drought, flagging a moderate risk to supply.

- A regulatory review may flag new deforestation-free sourcing laws or disclosure requirements.

- A separate nature assessment might flag that same region for high rates of deforestation.

An integrated analysis reveals the critical insight these silos miss: deforestation (a nature risk) is eroding the ecosystem’s ability to retain water and regulate local climate. This amplifies the financial and operational impact of the projected climate-driven droughts (physical risk) and exposes the company to compliance and market-access risks from emerging deforestation-free laws (transition risk).

This compounding effect reveals a far greater threat of supply chain disruption and price volatility than either analysis would suggest alone. With integrated foresight, the company can shift from reactive risk management to proactive strategy, enabling smarter, more resilient sourcing and capital investment decisions.

The limits of current frameworks and the power of integration

Increasing water stress on soy crops is a physical climate risk, but its residual effects create nature risks: reducing water availability, crop yields, and biodiversity. These impacts disrupt supply chains, increase production costs, and threaten long-term resource security. Soy expansion is a major driver of deforestation, which destroys habitats, reduces pollinators, and weakens natural buffers against floods, landslides, and water stress. New regulations like the EU Deforestation Regulation add transition risks by limiting market access for soy linked to deforestation.

Viewed separately, these risks understate true exposure. And while TCFD and TNFD provide structured outlines to identify, assess, and disclose these risks, their true power lies in integration. Integrated risk assessments reveal how climate, nature, and policy pressures interact, enabling companies to anticipate systemic disruptions and make better sourcing, investment, and resilience decisions.

TNFD extends TCFD by focusing on the ecosystems and ecosystem services that businesses rely on to function: pollination, water regulation, soil fertility, and more. As an added benefit, aligning with both frameworks not only meets regulatory and investor expectations under CSRD, SB 261, and ISSB, but also helps companies build adaptive strategies in a world shaped by dual environmental crises and expanding disclosure mandates.

For example, in the food sector, soy expansion upstream drives deforestation and water stress, creating exposure for processors and traders. Downstream, consumer goods companies and retailers face reputational damage and market-access risks if deforestation-linked soy is embedded in their supply chains. Similarly, in the apparel sector, cotton production depends on water-intensive upstream processes, while brands downstream are vulnerable to both physical supply shocks and rising scrutiny over nature impacts.

Bringing the value chain into focus

While the TCFD and TNFD share structural similarities (governance, strategy, risk management, and metrics), there are important differences. Climate risk analysis benefits from decades of scientific modeling and standardised data, while nature risk evaluation in the corporate context is newer and less harmonised. TCFD, though foundational, is not sufficient on its own: it does not explicitly consider nature-related dependencies and impacts that may pose material financial risks across supply chains, operations, and valuation. For investors and businesses seeking resilience, long-term value creation, and regulatory alignment, especially under frameworks like the CSRD and the emerging ISSB–TNFD convergence, integrating climate and nature risk is not optional, but essential.

Importantly, value chain analysis is now a regulatory mandate, not just good practice, CSRD and ISSB both require companies to examine upstream and downstream dependencies and impacts. For sectors heavily reliant on commodities like soy, cocoa, or cotton, integrating ingredient risk screening is critical. Dual analysis is also required: understanding risks to the business (like drought affecting soil fertility and crop yields) and risks from the business (like deforestation and biodiversity loss driven by sourcing practices). Tools such as TNFD’s LEAP approach help structure this assessment, capturing both dependencies on nature and impacts to nature, and translating them into financial and strategic terms.

This raises important questions for companies: How does your business connect the dots between climate and nature? Full integration requires a deliberate effort to link nature dependencies (like healthy soil, pollinators, or water availability) with climate hazards (like drought or floods), and then to quantify how those compounded effects translate into operational and financial risk. This is the work that moves companies from compliance to resilience.

Businesses that proactively integrate climate (TCFD) and nature (TNFD) can:

- Address systemic risks: Recognising climate change and nature loss as systemic threats to the global financial system.

- Improve transparency: Enhancing disclosure of interconnected environmental risks and opportunities.

- Enable better decision-making: Providing investors and executives with data that drives smarter capital allocation.

- Drive sustainable outcomes: Catalysing the shift to a more sustainable, resilient economy.

- Anticipate disruptions: Identifying compounding risks and value chain vulnerabilities before they materialise.

- Build resilient strategies: Creating forward-looking plans grounded in a complete risk picture.

- Meet regulatory and investor expectations: Aligning with CSRD, ISSB, and other regimes increasingly requiring integrated climate-nature risk.

Both frameworks are critical to ensuring that financial markets properly value environmental risks and incentivise responsible corporate action. Businesses that proactively incorporate climate and nature into their risk management practices can better anticipate market shifts, address investor concerns, and unlock opportunities for sustainable innovation and natural resource preservation. By understanding the full spectrum of environmental risks and opportunities, companies can not only enhance resilience but also secure long-term competitive advantage.

How should organisations integrate climate and nature risk assessments?

As climate-related risks become more widely assessed, it’s increasingly clear that nature risks are deeply connected yet often overlooked. Companies that treat them in isolation risk missing blind spots in strategies, especially as environmental disruptions compound across supply chains, assets, and markets. A unified approach that integrates climate and nature risks goes beyond compliance, offering a competitive edge through forward-looking value creation and resilience. Businesses that proactively align with TCFD and TNFD can anticipate market shifts, meet investor expectations, and capitalise on opportunities for sustainable innovation – all while protecting the natural systems their operations depend on.

At Anthesis, we help companies move from insight to action through integrated climate and nature risk assessments tailored to their value chains. Our approach combines geospatial and financial analysis to identify location-specific exposure, quantify impacts under different scenarios, and prioritise strategic responses. Whether the goal is to meet regulatory requirements, safeguard continuity, or evaluate investment trade-offs, we provide the data, tools, and guidance to turn risks into resilience. By aligning with both TCFD and TNFD, we enable clients to future-proof operations and build competitive advantage in an increasingly risk-aware marketplace.

Explore our Climate & Nature Solutions

We provide tailored climate‑ and nature‑risk solutions, combining TCFD‑ and TNFD‑aligned analysis with value‑chain risk assessment to help organisations turn emerging pressures into long‑term resilience and opportunity.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.