Home Regulations Hub SEC Disclosure

Contents

- Introduction

- Key Implications

- How to prepare

- Understanding the SEC rule

- What this means for you

- Anthesis Support

- 7 Takeaways

- What's next?

Share this guide

Navigating SEC’s Climate Disclosure Regulations

On March 21st, 2022, the U.S. Securities and Exchange Commission (SEC) proposed a new rule, called The Enhancement and Standardization of Climate-Related Disclosures for Investors, which seeks to enhance and further standardise mandatory climate change disclosures for all publically listed U.S. companies.

The rules were passed by the SEC on March 6th, 2024, become final upon Federal Register publication on May 28, and are currently the subject of legal challenges. In the meantime, the SEC’s regulations are in effect.

Under the climate disclosure rule, companies must provide detailed reporting of their climate-related risks, greenhouse gas (GHG) emissions (Scopes 1 & 2), adaptation and mitigation costs and plans where material and relevant respectively, as well as governance approaches based on these factors. The proposal from the commission has further laid out plans to increase pressure on organisations asserting environmental claims and Net Zero commitments.

The Key Implications

The rule would applies to US 10-K filers as well as foreign private issuers who file 20-F forms with the SEC.

- public companies will need to rapidly move towards investor-grade reporting

- this signals greater alignment with frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD).

- there will be three categories of disclosure:

- material climate impacts & risks

- greenhouse-gas emissions – including Scopes 1 and 2

- any climate targets or transition plans, where relevant

How to prepare for the SEC climate disclosure rule and changing disclosure landscape

To best prepare, companies need to be addressing the challenge as one of disclosure controls and procedures (DCP) rather than purely sustainability related. The subject matter is secondary to the procedures behind data methodology, collection, quality assurance, and auditability.

Often this process starts with simple questions such as:

- Where does my ESG data come from internally?

- Who owns it?

- Is the chain of custody documented?

- What quality assurance (QA) is there on ESG data prior to publication?

The answer to those foundational questions will help determine at what stage in ESG reporting and disclosure-process maturity your company is at. In the shorter term, as requirements are still taking shape, companies will see increased internal reviews and approval for ESG related disclosure through corporate finance, legal, and executive teams who are looking to understand and vet what was previously considered immaterial, voluntary disclosure, relegated to Corporate Social Responsibility teams.

To streamline the ever-growing annual disclosure calendar, companies need to establish a detailed system of record for ESG-type data. This necessitates the development of improved documentation, process, and procedures so data can be confidently collected, QA’d, traced, and ultimately assured externally. Building out this method of substantiation for ESG reporting allows company stakeholders to access and audit data integrity much more confidently.

Developing that system of record is a deceptively challenging task. It often involves coordinating dozens of subject matter experts, which may be from internal departments or affiliated external organisations. Companies will need to set clear expectations and define documentation procedures. Only once the data owners and business processes have been exhaustively mapped, can companies begin to look at refining for efficiency, or automating collection and reporting.

Most companies do not have well defined processes, controls, and systems of record for ESG information and disclosure. Getting this organised should be priority number one. Once established, auditability and compliance with regulated disclosure requirements will not feel so overwhelming. With well-defined business requirements instituted, moving to the next stage of building process efficiency improvements and automation is much simpler. However, while on this journey and similarly to prior Sarbanes-Oxley transformations, companies are often finding that certain parts of their current processes need immediate upgrades to satisfy the forthcoming control regimes and subsequent audit process.

Find more detailed information on the final rules in our SEC FAQ

Understanding the SEC’s Rule:

I. The Path from Voluntary to Mandatory:

Investor Pressure:

- Acknowledge the growing demand for higher quality ESG data from investors.

- Understand the disparity in ESG reporting and the need for greater controls to ensure consistency and decision-useful data.

Regulatory Trends:

- Compare regulatory approaches, with a focus on the EU, UK, and the SEC’s proposed rules.

- Recognize the trend of moving from voluntary to mandatory disclosures and the implications for companies.

II. Practical Steps for Preparation:

Data Quality Assurance:

- Emphasize the need for high-quality, defensible ESG data aligned with financial reporting requirements.

- Recognize the importance of third-party assurance and the role it plays in validating ESG data.

Building Disclosure Controls and Procedures (DCP):

- Approach the challenge as one of disclosure controls and procedures rather than solely sustainability-related.

- Address fundamental questions regarding ESG data ownership, chain of custody, and quality assurance.

System of Record Development:

- Establish a detailed system of record for ESG data to streamline annual disclosure calendars.

- Develop improved documentation, processes, and procedures for confident data collection, QA, tracing, and external assurance.

III. Seeking Assistance:

Service Providers:

- Consider engaging with ESG service providers for support.

- Explore services like those offered by Anthesis, which can assist in ESG data procedures and disclosure governance.

What does this mean for your company?

The SEC’s ruling will phase in reporting requirements based on the size of your organization. In preparing for compliance, there are a number of steps to begin taking action on and working towards:

Short term expectations

- Understand climate risk; this means figuring out which climate risks your company is most vulnerable to and planning ways to mitigate, adapt and strategize on how these impacts will affect the future of your business

- Understand the reporting recommendations of the TCFD framework and the accounting methods of the GHG Protocol

- Measure your company’s Scope 1 and 2 GHG emissions where material for your business

- Implement board and/or management oversight and governance of climate risks

- To provide your Investor Relations team with the necessary tools to report accurate information and effectively communicate with investors on climate risk

- Expect increased scrutiny on all angles related to climate risk disclosures

- Identify and accelerate mitigation and adaptation strategies in each part of the company

Long term expectations

- Understand the business implications under different climate scenarios from moderate to severe impacts

- Establish a thorough understanding of Scope 1 and 2 GHG emissions and your company’s direct and indirect emissions and levers to reduce emissions

- Continue improving disclosure activity through TCFD recommendations, using it as an opportunity to identify, assess, manage, and disclose on climate-related risks and opportunities

- Monitor the convergence of voluntary disclosure frameworks to international standards for corporate sustainability reporting, combined with financial reporting

- New Performance Baseline: Investors and other stakeholders will leverage these disclosure standards as a “baseline” for performance.

- Improved Benchmarking: Investors and other stakeholders will be able to compare across industries more easily.

- Expect More Climate-Related Questions: Investors will increasingly consider ESG performance, and be favorable to companies that are transparent and serious in their commitment to combat climate change.

- Increased Decarbonization Expectations: Investors and other stakeholders will want to understand the percentage and/or amount of cashflow going to support the company’s transition to net zero carbon emissions.

- Increased Market Efficiency: Increased market efficiency and accuracy due to higher integrity and better-informed asset pricing.

- Reduced Greenwashing Risk: Regulatory oversight from the SEC and standardized reporting requirements will set a level and transparent playing field grounded in data, providing investors with clear insight into the variances in climate risk exposure and strategic action of companies with existing and robust climate strategies against those lagging on climate action.

- Improved Capital Allocation: Help markets allocate capital more effectively, both within and across companies and projects. Also help to ensure that the cost of capital better reflects how well companies are managing climate-related risks and opportunities.

- Green Projects: Supporting climate risk disclosures across the investment chain encourages better business, risk, and investment decisions, helping markets allocate capital to the right projects at the right price.

- Climate change poses significant risks to investors. Nearly $4 trillion worth of assets will be at risk from climate change by 2030.

- Existing measures are not providing enough transparency, with 93% of institutional investors stating that climate-related financial risks have not been accurately priced by markets.

- The systemic impacts felt from global disruption including those caused by the COVID-19 pandemic and emerging geo-political conflicts have proven that the importance of developing climate resiliency plans is greater than ever. Therefore, the SEC has acted to support the flow of accurate climate reporting to reduce climate risk.

- Beyond climate: While SEC will initially lean on the TCFD framework to shape climate risk reporting requirements, we can expect that the scope will expand; therefore, companies will need to keep their ESG focus broad.

- Beyond risk: Initially, the rule will emphasize climate risk through TCFD considerations; however, looking forward, we can expect updates to the requirements that encourage sharing of information that assesses how companies are contributing on a “net positive” basis. A net positive company is one that gives more than it takes.

- Beyond compliance: In effect, the SEC rule will raise the floor for laggards. However, investors (and other stakeholders) will continue to look “beyond compliance” when assessing the sustainable performance of firms.

- Revisit existing position: IIf your company hasn’t already, it’s time to understand emerging frameworks (CDP, CDSB, SASB. TCFD, SBTi, etc.). For those that have, it’s time to revisit reporting strategies and processes with key stakeholders to reassess the clarity, relevance, completeness, and accuracy of your disclosures in all channels including financial regulatory filings, annual reports, CSR reports, websites, sales & marketing materials and any others.

- Improved Benchmarking: Investors and other stakeholders will be able to compare across industries more easily.

- Envision the ideal future state: Determine what climate resiliency looks like for your company and what needs to change among each business unit to achieve your goals. Anthesis works with clients to build climate resiliency into their strategy.

- Plan for how to get there: Begin to map out the necessary step your organization needs to take towards fulfilling climate risk disclosure requirements following the SEC proposal and TCFD framework. Anthesis helps to prepare clients for TCFD disclosures and build data architecture and processes for robust and transparent reporting.

Why Anthesis?

Anthesis has extensive experience in developing robust climate change and environmental information for mainstream corporate reports, and we have worked with a wide range of companies, including many from the financial services sector.

Our approach allows clients to go beyond the mandatory or required financial disclosure to mitigate the risks that pose the biggest threat to the organisation. We also help you define a powerful, differentiated narrative about your performance and ambitions that inspires and motivates staff, customers, and other stakeholders to understand, communicate and adapt.

- Climate Risk Screening: We assess the risks and opportunities that climate change poses to each area of your organisation and define those that will have the greatest impact.

- Scenario Analysis: We model your organisation’s climate-related risks and opportunities and the impact on financial results under different climate scenarios to give you clear, quantitative insight into areas of concern.

- Climate Risk Strategy: We develop a strategy that defines a forward path for setting and meeting targets and prepares you for disclosure to help minimise risk and maximise value.

- Climate Mitigation & Adaptation: We support you to identify and measure the performance of the mitigation and adaptation actions required to reduce climate risk exposure and maximise the opportunities presented in a net zero transition.

7 Key Takeaways

The SEC rules clarify GHG reporting in attempt to provide a consistent reporting structure. Below are what we see as seven key takeaways related to the GHG reporting portion within the SEC proposed rules.

1. New federal rules for mandatory climate risk reporting include GHG disclosure

The SEC rules require publicly listed companies to include specific climate-related information in their registration statements and periodic reports. Under the rule companies are obligated to disclose GHG emissions in CO2e for all scopes: Scopes 1 and 2 where deemed material. Also, to be required is reporting on a disaggregated basis for certain GHGs, such as methane (CH4) or hydrofluorocarbons (HFCs), (as deemed material).

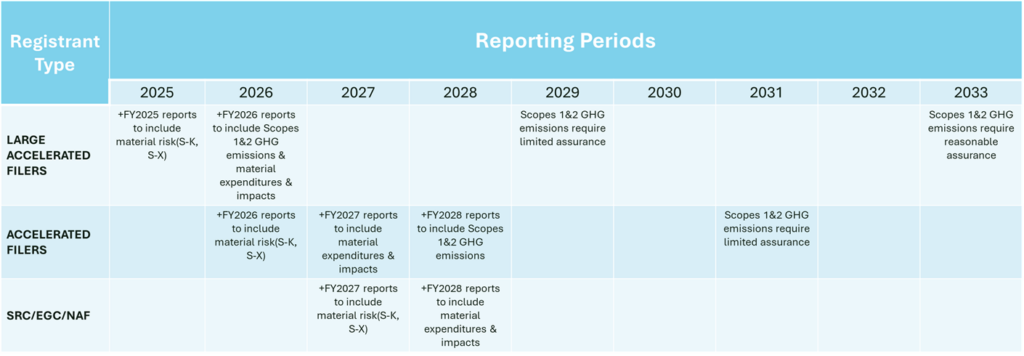

The first year of reports with GHG emissions metrics are due according to the following schedule →

2. Federal reporting requirements for GHG emissions are not new

The SEC’s rule is the second federal US requirement for mandatory reporting and disclosure of GHG emissions. Since 2010 GHG emissions reporting has been required by the US Environmental Protection Agency (EPA) for primary GHG emissions from major emitters such as fuel and industrial gas suppliers under their Mandatory Reporting Rule (MRR). Forty-one categories are included in EPA’s GHG reporting requirement (GHGRP) applying to direct emissions by specific process or industry type. There is no emissions reduction requirement associated with the EPA reporting program. About 8,000 industrial facilities reported in 2020 to the USEPA’s GHG Reporting Program, with nine sectors dominating the reported direct GHG emissions (power plants, oil & gas, non-fluorinated/fluorinated chemicals, refineries, minerals, waste metals, paper and electronics manufacturing).

In 2006, California, adopted mandatory reporting and set up a Cap-and-Trade program. GHG emissions for over 800 facilities were reported to the Air Resources Board in CY 2020. California has now mandated new disclosure requirements for GHG emissions and climate-related financial risks, which are covered in more detail in ‘California’s Climate Bills are a Path to Better Strategy’.

3. Current corporate GHG reporting is voluntary

Beyond the existing mandatory GHG reporting under the US EPA’s MRR and state requirements, corporate GHG reporting is voluntary, either disclosed in annual sustainability reports, or through a number of platforms. Companies reporting GHG voluntarily on GHG platforms include nearly 300 organisations on The Climate Registry and over 1,300 of companies disclosed on the CDP (Carbon Disclosure Project), for example. With the new SEC rules, it covers GHG reporting in order to:

- Provide for mandatory reporting and a consistent reporting structure

- Cover an entire company rather than a single facility (as the EPA MRR does now)

- Include companywide GHG emissions allocated to scopes 1, 2 and 3

- Require third-party independent assurance

4. The SEC’s GHG reporting requirement is aligned to the GHG Protocol

The disclosures of GHG are similar to those that many companies already provide based on broadly accepted disclosure frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the GHG Protocol. The SEC’s Rules on GHG disclosure cover Scope 1 and 2 (if material).

- Scope 1 direct GHG emissions from operations that are owned or controlled by a registrant.

- Scope 2 indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a registrant.

- Scope 3 indirect value chain emissions not otherwise included in a registrant’s Scope 1 or 2 emissions, which occur in the upstream and downstream activities of a registrant’s value chain:

- Upstream emission examples include emissions attributable to purchased goods and services, the transportation and distribution of goods, or employee business travel and commuting.

- Downstream emission examples include the use of the registrant’s products, transportation, and distribution of products (for example, to the registrant’s customers), end of life treatment of sold products, or investments made by the registrant.

- The rules would provide a safe harbour for liability from Scope 3 emissions disclosure and an exemption from the Scope 3 emissions disclosure requirement for smaller reporting companies (SRCs).

The SEC rules clarify GHG reporting in an attempt to provide a consistent reporting structure

5. No climate policy is included in the SEC rules

The rules focus on the disclosure of carbon emissions and climate risk (physical and financial) and do not include any federal climate policy or objectives such as a GHG emissions reduction goal. Company-wide GHG emissions reduction targets are to be disclosed to the SEC.

6. Why is it important?

Many investors are concerned about the potential impacts of climate-related risks on businesses. As a result, investors are seeking more information about the effects of climate-related risks on a company’s business to inform their investment decision-making, including GHG inventories. Investors also have expressed a need for more consistent, comparable, and reliable information about how a registrant has addressed climate-related risks when conducting its operations and developing its business strategy and financial plan. The rules are intended to enhance and standardize climate-related disclosures to address these investor needs. The SEC rules clarify GHG reporting in attempt to provide a consistent reporting structure. The SEC rules will require a more rigorous GHG monitoring and disclosure process, e.g. GHG inventories need to be documented and auditable, with required 3rd party verification.

7. What about new companies (registrants) who are planning to be publicly listed?

According to the SEC rules, by limiting the assurance requirements to accelerated filers and large accelerated filers, a new registrant would not be required to provide assurance until it has been subject to the requirements of specific sections of the Exchange Act.

Helpful Resources:

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.