Contents

- Transparent performance reporting for exit readiness

- Operational strategies for margin expansion

- Revenue growth amplification

- Supply chain optimisation

- Capital structure optimisation

- Beyond the investment team

Share this article

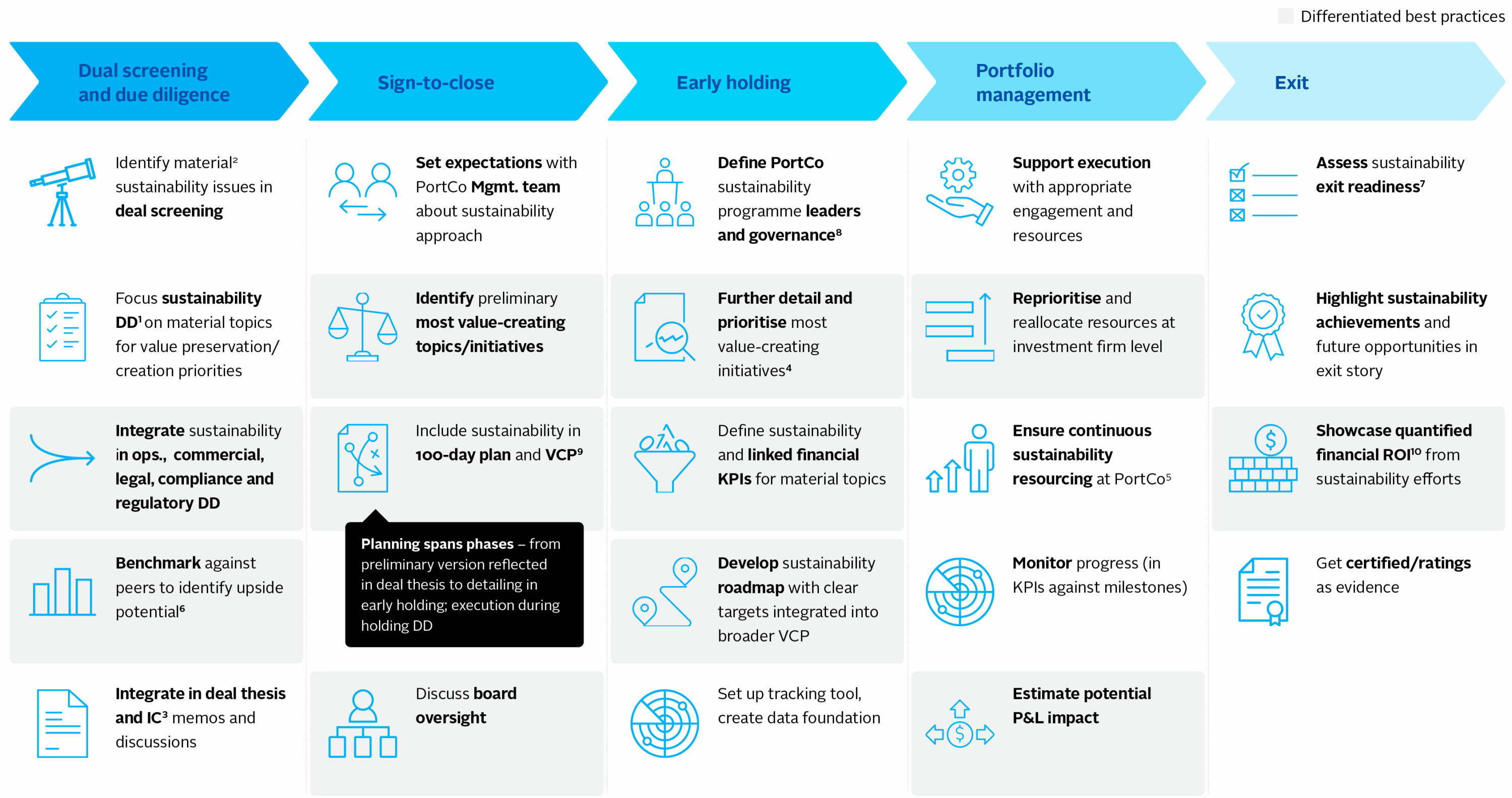

The new PRI Sustainability Value Creation framework is designed to support investors in embedding and leveraging sustainability to drive financial outcomes.

Building on this, investment teams shouldn’t treat sustainability value creation levers differently from levers that focus on proven strategies like:

- Operational efficiencies

- Performance reporting

- Capital structure optimisation

- Talent management

- Digital transformation.

ESG should be thought of as an integrated strategy that enhances the core business plan and supports long-term, strategic growth.

Here’s why the integrated ESG approach matters

Not all management teams respond to initiatives labelled as ‘sustainability’ – even when growth drivers are clearly demonstrable. Unfortunately, it can be the case that key stakeholders disengage at the mention of ESG.

This article explores how sustainability directly enhances value generation strategies, creating a powerful synergy between sustainability and financial performance. Instead of treating ESG factors as separate considerations, successful investors use them to serve as operational enablers that amplify conventional PE value creation levers.

Transparent performance reporting for exit readiness

The strategic imperative

Communicating strong performance and business value to the market and potential investors is high on the agenda of all management and sell-side teams.

ESG reporting frameworks are increasingly being used to:

- Showcase sustainability performance

- Demonstrate compliance with ESG investing criteria

- Quantify value creation during exit readiness

- According to the PRI, portfolio companies that embed sustainability can achieve a 6–7% multiple uplift at exit.

This uplift is only realised if ESG progress is clearly communicated to investors. For example, through investment memorandums and reports. Done well, this reporting provides tangible proof of value creation that complements traditional financial metrics.

Exit readiness support

Anthesis can support your portfolio companies with exit readiness and strengthen their position through vendor due diligence services. Read our recommendations: Positioning Private Equity assets to maximise exit value through ESG.

Our teams support private equity firms in reporting on ESG and sustainability, both at the firm and fund levels, highlighting responsible investment practices, case studies, and reporting on portfolio data.

Learn more in our guide: Best practices for Private Equity ESG reporting.

Operational strategies for margin expansion

Direct cost savings through ESG

Sustainability initiatives can deliver direct cost savings that enhance traditional margin expansion efforts.

The PRI has estimated that sustainability-linked value creationcan lead to a 6% cost optimisation and accelerate margin expansion and reduce volatility in returns, through:

Key sustainability-linked operational levers should be integrated into margin expansion thinking and result in reduced energy costs of production, reduced transportation costs, and reduced waste disposal costs. These environmental improvements create immediate bottom-line impact without requiring trade-offs with financial performance.

The bottom line

Our global team is continuously supporting companies to identify operational cost-saving opportunities. We apply robust engineering solutions to drive cost optimisation and solve climate problems within the industrial/manufacturing and built environments.

Explore our Decarbonisation & Energy Transition and Environmental Management Services.

Revenue growth amplification

Value-based pricing & market expansion

Credible and well-substantiated sustainability claims boost traditional revenue growth strategies, such as value-based pricing and market expansion. Product certification or product development creates substantial competitive advantages, with sustainable consumer goods commanding a 28% price premium and achieving 55% higher market share growth compared to conventional alternatives.

This directly supports PE firms’ organic growth objectives while expanding addressable markets.

Building loyalty and trust

In both B2C and B2B contexts, robust ESG practices:

- Show how ESG credentials become essential for winning new business and retaining existing clients.

- Enhance customer trust and reduce reputational risk while building long-term customer loyalty

- Enable companies to increasingly prioritise sustainability criteria in product and supplier selection

Making a green claim?

Our LCA specialists and Green Claims experts support clients across global markets to achieve price premiums for sustainable products and services while navigating any reputational and legal risks by demonstrating accurate claims.

Explore our Sustainable Products & Circularity services and read our Green Claims Whitepaper.

Supply chain optimisation

Addressing cost pressures

Cost pressures remain a top concern for many organisations, with recent research showing that 83% of procurement professionals identify inflationary pressures and rising commodity prices as their primary external challenge.

Integrating traditional supply chain management

Typical supply chain management programmes aim to reduce sourcing costs and volatility while mitigating operational risks that could impact cash flows. Sustainable supply chain interventions are no different and should be considered an integral part of supply chain optimisation for any business. Initiatives such as improved transparency, knowing your baseline, risk management, and supplier engagement are all sustainability value levers that create more predictable cost structures and reduce volatility in financial performance.

Capital structure optimisation

Unlocking lower cost capital

Reducing the cost of debt and improving access to funding are core components of capital structure optimisation. Sustainability-linked finance (such as Sustainability Linked Loans, or debt financing with sustainability ratchets baked in) is becoming a critical tool for investors to funnel capital towards the transition to net zero by influencing more sustainable practices, such as emissions reduction or target setting.

PE firms should consider and support portfolio companies to unlock access to capital while lowering debt costs through sustainability-linked financing mechanisms.

How Anthesis can help

We assist lenders and borrowers seeking to offer or raise funds through ESG or sustainability-linked loans and bonds, including baselining the borrowers current ESG performance, KPI (Sustainable Performance Targets) selection, and annual performance verification in line with LMA, LSTA, APLMA ,and related guidance.

Explore our ESG Credit & Debt Services and case study on developing the UK retail sector’s first sustainability-linked supply chain finance product with Tesco.

Beyond the investment team

Investor relations teams should also be aware of the integration of ESG with mainstream private equity value levers and how these vary significantly by geography, reflecting different market conditions and stakeholder expectations. According to PRI’s research, the regional variations are defined as follows:

- Europe: European investors emphasise customer-focused ESG initiatives that drive revenue growth, particularly sustainable product offerings responding to strong consumer demand for environmental responsibility.

- North America: North American investors prioritise risk management and cost-linked ESG drivers, focusing on operational efficiency and trust-building initiatives while facing challenges in demonstrating clear financial linkages.

- Asia-Pacific: APAC investors concentrate on social initiatives, particularly employee engagement and health and safety programs that drive both revenue and cost benefits.

- Africa: African investors emphasise community engagement and environmental cost-efficiency measures that support local economic development while reducing operational costs.

This integrated thinking helps frame ESG considerations as enhancing rather than existing alongside, or as a competing priority, to mainstream strategic growth drivers and value creation activities. ESG creates compound value through operational excellence, strategic positioning, and financial optimisation, working in concert with ambitious leadership teams.

The strategic framework

This integrated thinking helps frame ESG considerations as enhancing rather than existing alongside, or as a competing priority, to mainstream strategic growth drivers and value creation activities.

ESG creates compound value through operational excellence, strategic positioning, and financial optimisation, working in concert with ambitious leadership teams.

Anthesis has the global expertise and capability to support your portfolio across a wide range of strategic growth levers through embedding ESG. Our team of experienced ESG strategists has worked with companies of all sizes and sectors to develop ESG strategies that are designed to be embedded into the overall business operations and seamlessly embraced by their key stakeholders.

Whether you’re looking to embed ESG strategy across your entire portfolio or optimise specific value creation levers, we can support your team in turning sustainability into measurable financial outcomes.

Contact Us

Speak with our experts and discover how we can support you in creating impactful, purpose-driven communications for your brand.