Home Regulations Hub Corporate Sustainability Reporting Directive (CSRD)

Corporate Sustainability Reporting Directive (CSRD)

Home Regulations Hub Corporate Sustainability Reporting Directive (CSRD)

In 2023, the Corporate Sustainability Reporting Directive (CSRD) was introduced which governs the requirements for sustainability reporting in the EU. The new law marks a significant step up from the existing and relatively limited EU sustainability reporting requirements.

The law will bring sustainability reporting much closer to the discipline and fidelity of financial reporting. The CSRD will significantly impact the data that in-scope organisations need to publish, how that data is collected, and the processes needed to meet the additional requirements of the legislation. The law also required the creation of new European Sustainability Reporting Standards (ESRS) that define the content companies are required to report on.

The CSRD expands the number of companies with activities in the EU to which mandatory sustainability reporting requirements apply. It will inevitably also affect companies based outside the EU, either directly or indirectly through competition and the value chain.

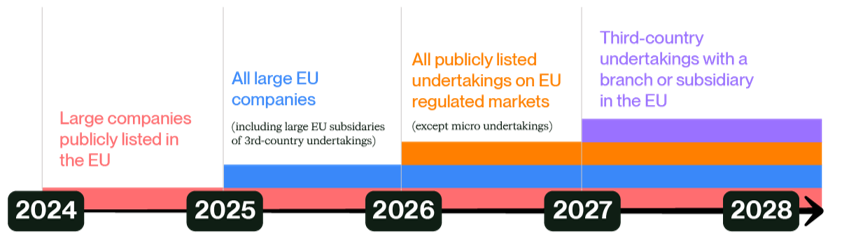

On the 10th of November 2022, the European Parliament voted ‘YES’ to the Corporate Sustainability Reporting Directive (CSRD) proposal. Companies are expected to comply with the bill, starting with the largest listed companies in 2024, other large companies in 2025, and listed small and medium enterprises (SMEs) in 2026. The CSRD is part of the broader ‘European Green Deal’ program that so far has delivered legislation including the EU Taxonomy Regulation and the Sustainable Finance Disclosure Regulation.

On the 31st of July 2023, the European Commission (EC) adopted the first package of European Sustainability Reporting Standards, including cross-cutting ESRS 1 and ESRS 2, and standards across environmental, social and governance topics. For large EU Public Interest Entities and those already reporting under the Non-Financial Reporting Directive (NFRD), the countdown is now on to report against CSRD for financial years starting on or after the 1st January 2025.

The CSRD outlines the following areas to be covered in an organisation’s mandatory sustainability reporting:

• Business model and strategy

• Sustainability governance and use of sustainability experts

• Sustainability policy

• Sustainability-related incentives

• Due diligence

• Value chain data

• Impacts, risks and opportunities

• Actions, metrics and targets to manage sustainability matters

The ESRS further define the contents and metrics organisations will use to report. The European Commission adopted the first set of ESRS standards in the summer of 2023, and sector-specific standards are now expected in June 2026. In January 2024, new Exposure Drafts of EFRAGs SME reporting standards were released and will be under consultation until May 2024.

Importantly, companies are required to report in accordance with the double-materiality principle, meaning that sustainability information should consider both the impacts caused by the organisation and the risks and opportunities incurred. This assessment requires the consideration of relevant “sustainability matters” including environmental, social and governance factors.

When it comes to reporting, organisations must provide “information necessary to understand the undertaking’s impacts on sustainability matters, and information necessary to understand how sustainability matters affect the undertaking’s development, performance and position.”

We expect many organisations inside and outside the EU to be affected directly or indirectly.

The legislation directly applies to companies specified by the CSRD (see table). The CSRD requires companies to report on their value chain, so suppliers to CSRD-reporting organisations should expect increased requests and requirements for information.

| Reporting per CSRD | Explanation | When? |

| Large companies subject to NFRD and some large non-EU listed companies | Large EU companies subject to NFRDLarge (non-EU) listed companies with more than 500 employeesNon-EU parent undertakings of large groups listed in the EU | Report in 2025, using 2024 data |

| Other large EU companies | Any company meeting two of the following criteria in the EU: Balance sheet total: 20 M EURNet turnover: 40 M EUREmployees: 250+Large EU subsidiaries of a non-EU groupEU parent undertakings of large groups | Report in 2026, using 2025 data |

| Listed small and medium-sized EU enterprises (SMEs) | Any company publicly listed in the EU, except micro undertakings, defined as meeting two or more of the following criteria: Balance sheet total: 450,000 EURNet turnover: 900 000 EUR10 employees | Report in 2027, using 2026 data |

| Non-EU companies | Non-EU companies that generate a net turnover of 150 M EUR in the EU with at least one large or listed subsidiary in the EU or one branch in the EU with more than 40 M EUR in net turnover.Undertakings established outside the EU, but with significant activity – minimum EUR 150M turnover in each of the two previous fiscal years – on the EU territory through either a subsidiary or a branch. In the case of a subsidiary, it concerns either large or publicly listed undertakings; micro-undertakings are exempt. A branch with a turnover of more than 40 M. | Report in 2029, using 2028 data |

Where assessment of material issues has previously been driven by stakeholder views, EFRAG encourages the use of data where possible to identify evidence-based impacts, risks and opportunities for an organisation. That said, the views and interests of stakeholders are still fundamental to the identification, assessment and management of material issues.

While there is no prescribed approach for stakeholder engagement as part of CSRD, there is an expectation for companies to engage with stakeholders that may be affected by their activities – from workers across operations and the value chain, to communities and consumers. Views and interests of these groups should be collected on an ongoing basis through due diligence practices, with findings pulled into the materiality process where relevant.

To get started, those responsible for compiling their CSRD report should look to engage the following groups:

The CSRD also prescribes format and process requirements for sustainability reporting. One important requirement is that the reporting shall take place in the management report of the organisation. Another significant change is that the reported information will need to undergo assurance, starting with limited assurance and later to a reasonable assurance standard. These assurance standards are to be developed by the European Commission by 2026 and 2028, respectively.

The introduction of the CSRD arguably marks the most significant change to date in corporate sustainability reporting, and we are here for you to help with the transition. Anthesis offers solutions that give you the information and learning you need, help you to analyse your needs for change, and support you in implementing that change.

Our approach is two-fold: first, to prepare your organisation for compliance, focusing on internal understanding and the essentials of reporting. Secondly, perhaps more important, we empower your organisation for long-term success, uncovering the value and opportunities for your business, beyond regulatory requirements.

The introduction of the CSRD arguably marks the most significant change to date in corporate sustainability reporting, and we are here for you to help with the transition. Anthesis offers solutions that give you the information and learning you need, help you to analyse your needs for change, and support you in implementing that change.

Frame

1) Set the context: A range of regulations may apply based on your business context, and each carries it own timelines and requirements

Analytics

2) Understand what matters: Most current ESG regulations require analysis and reporting based on a type of materiality, up to and including CSRD-compliant double materiality.

3) Identify gaps: Each regulation contains functional and content metrics, requiring in-depth, current state gap analysis.

Solutions

4) Plan for change: Closing compliance gaps typically means program, governance, and / or disclosure changes on a specific timeline, requiring a custom roadmap and stakeholder alignment.

Implementation

5) Build capabilities: Depending on the regulation, you may need to implement expert-supported projects, such as developing a climate transition plan, to meet your compliance obligations.

6) Report with confidence: Each regulation has specific requirements for assuring and reporting your data, and the higher stakes of financial reporting mean current voluntary reporting should be designed for consistency.

The Corporate Sustainability Reporting Directive (CSRD) is the new EU legislation requiring both large and small companies to report on their environmental and social impact activities. It’s being directed by the EU in a bid to help cash flow towards sustainable activities.

In 2021, the European Commission adopted the Sustainable Finance Package, bringing with it one of the proposed measures, CSRD. With CSRD, for the first time the European Commission has defined a common reporting framework for non-financial data. Ultimately, it supports stakeholders to evaluate the non-financial performance of organisations. In the long run, it aims to encourage in-scope companies to develop more responsible approaches to business conduct.

As part of the EU Green Deal, the regulation has been developed in response to the challenge that, according to the European Commission, “reports often omit information that investors and other stakeholders think is important”.

CSRD aims to address this challenge, providing a standard reporting framework for businesses to tie their non-financial reporting to.

Currently, around 11,600 companies are required to report sustainability information through the Non-Financial Reporting Directive. However, the introduction of the CSRD means around 49,000 companies in the EU will now have to report non-financial information.

The CSRD applies to all large companies that are established in an EU member state or are governed by EU law, including those who already fall under the NFRD. These companies would include both large and SME public interest entities.

It also applies to all European stock exchange-listed companies (except micro companies) and global businesses that have operations (subject to thresholds) / listed securities on a regulated market in Europe.

The directive defines a large company as one that meets at least two out of three criteria:

Yes. Organisations will be required to follow a double materiality process. In short, this means assessing sustainability risks and opportunities affecting the company, as well as its impact on society and the environment.

With the sustainability reporting landscape evolving rapidly, reporting trends are likely to lean towards double materiality in the future, so understanding the impacts from both sides will be vital for accurate reporting.

The CSRD was formally introduced on 1st January 2024. The first cohort required to report are companies already subject to NFRD. They will need to comply with the amended rules, reporting in 2025 for the 2024 financial year.

Other large companies not subject to the NFRD must start reporting from 1st January 2026 on the financial year 2025.

SMEs will not start reporting until 1st January 2027 on the 2026 financial year. However, SMEs are granted the option to voluntarily opt-out until 2028.

For non-European companies that have branches or subsidiaries based in the EU, the new requirements apply from 1st January 2029 for financial year 2028. These companies will have a net turnover of more than €150 million in the EU at consolidated level, and have at least one subsidiary (large or listed) or branch (net turnover of more than €40 million) in the EU.

The CSRD requires companies to report on their value chain, so suppliers to CSRD-reporting organisations should expect increased requests and requirements for information.

Watch our experts explain the CSRD and how it will affect you and your organisation.

Topics covered included:

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.