Two of Anthesis’ mandatory reporting experts, Ben Tuxworth and Graeme Hadley, reflect on what we have learned 15 months into the implementation of the Corporate Sustainability Reporting Directive (CSRD) and how the process can be used to extract value.

For us, the direction of travel is clear: mandatory reporting regulations like CSRD will help in establishing a more robust baseline through sustainability reporting and disclosure. But it should also provide a more credible evidence base for effective sustainability strategy. As regulations such as CSRD bite, we are focused on helping clients extract value beyond compliance – using the process to support better choices about priorities and action.

15 months on from the CSRD entering into force, what have we learned?

The value chain map holds the key to opportunities

Where does a value chain begin and end?

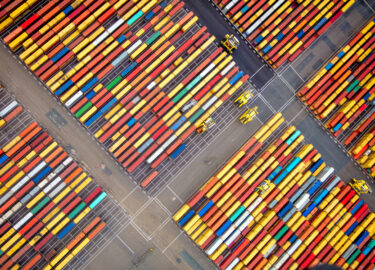

Drawing boundaries around different stages in the value chain and mapping the company’s influence across these stages is forcing organisations to assess a broader scope of impacts, risks and opportunities. This is unlocking broader strategic considerations such as the resilience of existing value chains and the ability to shift in an agile way to secure access to key resources. In the long term, this may provide a view of how these value chains can be flexed to mitigate emerging geo-political, environmental, and social risks, and how these can be pivoted to more circular and resilient business models.

Setting thresholds is tough, but it makes prioritisation easier

The European Sustainability Reporting Standards (ESRS) forces companies to disclose the threshold they have set for the materiality of an impact, risk or opportunity. For many companies, this reveals the uncomfortable truth that many topics – not just the ones that made it to the top right-hand corner of their materiality matrix – are material in some way. But that doesn’t mean every topic must also be a top priority.

Setting thresholds now means using quantitative evidence and subject matter expertise to look individually at each impact, risk or opportunity. This should also mean there’s a more solid evidence base as to why a topic is material, and a better rationale for prioritisation and action. It will also support specific stakeholder groups such as investors to provide a more informed view on risk and opportunity. For example, a recent financial institution client identified ESRS E3 water and marine resources as a material opportunity and can now consider the development or expansion of financing products and solutions to support water security as part of new or updated asset classes.

Systemising data requirements is vital to integrating ESG and financial reporting

Just five years ago the proliferation of ESG rankers and raters and reporting frameworks meant consistency, transparency and repeatability of data collection was challenging. With regulation such as CSRD playing a growing role in determining data requirements, and the promise of interoperability between key frameworks such as GRI, CSRD and ISSB, a landscape where data disclosures that are robust and comparable is in sight.

As these disclosures become higher quality, communicating performance in a more integrated way should be the norm, helping you discover and act upon the interlinkage between commercial and sustainability performance.

A methodical process and compliance transparency doesn’t replace creative storytelling

As the social and environmental impacts of business pile up, against a backdrop of wars, climate chaos and social unrest, corporate claims are under growing scrutiny from consumers, campaigners and lawmakers. The ESG backlash and greenwashing lawsuits are leading some companies to question their sustainability ambitions: if we can’t say anything, why do anything? Paradoxically, mandatory reporting processes offer a way out of this dilemma, providing a solid evidence base and platform for communications. With the right evidence, companies can identify what really matters and why, make the right claims, and back those claims up with meaningful action. Communicating more of this kind of action – and less of the vague, virtue-signalling claims of the past will be critical in the years ahead.

We can help

Anthesis supports organisations to navigate the sustainability reporting requirements and forge a path ahead. With an industry-leading subject matter expert team and ESG data management system, we help clients to leverage regulatory standards to move the dial on material disclosures and create compelling, brand-aligned stories.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.